The growth of Islamic mutual funds in Bangladesh is being restricted by the lack of Shariah compliant investable assets including a separate Islamic money market, experts tell IFN Investor.

“The mutual fund industry in Bangladesh is still in the nascent stage and there is a lack of awareness on the investment options in Shariah-based mutual funds. A significant number of Shariah-minded investors are unaware about the opportunities to be gained from Shariah compliant capital market investment through mutual funds.

“Compared to conventional mutual funds, Shariah funds usually have a notably smaller pool of investable assets. Furthermore, the absence of an Islamic money market and a limited number of Islamic debt instruments make it harder to diversify the investment portfolio and result in concentration risk,” says Dr Mufti Yousuf Sultan, the founder and CEO of, Adl Advisory.

This concentration of exposure is reflected in the fact that almost half of total investments made by Shariah funds are concentrated in only 10 large-cap equities.

Chart 1: Sector-wise investment allocation of Shariah funds in Bangladesh

Additionally, regulations set by the Bangladesh Securities and Exchange Commission can sometimes be stringent and complex, posing hurdles for fund managers. For example, various investment exposure limits imposed by the regulator make the investment scope narrower. The appointment of a Shariah advisory board, screening process and due diligence result in higher operating costs for fund managers that translate into higher expense ratios for investors and ultimately, in comparatively lower return potential compared with conventional mutual funds.

Presently, there are 18 Shariah compliant mutual funds in Bangladesh, consisting of 14 open-end mutual funds and four closed-end mutual funds, eight of which were launched over the last five years, according to EBL Securities. The assets under management (AuM) of Shariah mutual funds in Bangladesh reached BDT7,644 million (US$69.8 million) as of the 30th September 2023.

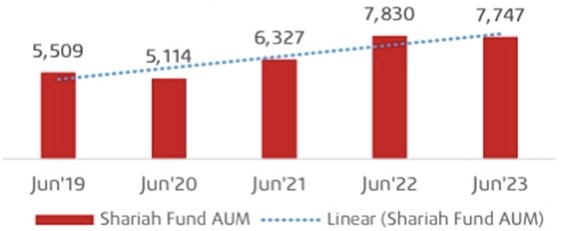

2023 proved to be a challenging year for Islamic mutual funds: due to rising interest rates and a shaky capital market performance, the total AuM of local Shariah funds grew by only 2.2% year-on-year (y-o-y) in July 2022 until June 2023. The last five years’ average annual return of the Shariah mutual funds in Bangladesh was 6.4%, according to IDLC Asset Management.

Chart 2: Shariah fund AuM size and growth in Bangladesh (y-o-y)

However, analysts note that conventional funds are also not immune to such challenges.

“Struggles aren’t specific to Islamic mutual funds. There are some hurdles for mutual funds such as reputation dents due to what happened with earlier closed-end funds and occasional non-compliant incidents. There is also room for improvement in policymaking which can result in higher taxation for investors,” points out Mustavi Khan, the senior investment analyst at Edge Research and Consulting. “The fact that regulatory caps are higher for industries and singular stock exposure is also salient here.”

The incident in question is mutual fund misappropriation by a top executive at asset management company Universal Financial Solutions in 2022.

Way forward

Efforts should be made to diversify the range of Shariah compliant investment options available to Islamic mutual funds. This can include introducing more Shariah compliant financial instruments, such as Sukuk, Islamic equity funds and Islamic REITs.

“Money market Shariah funds typically invest in Sukuk, or Islamic certificates that are like conventional bonds. As the Sukuk bond market is gaining pace in Bangladesh, Shariah funds will also be able to garner [a] diversification benefit from them. In future, the introduction of Islamic pension funds can pave a new way for financially securing retired life for Shariah-minded investors and become part of the Islamic financial sector. With increased awareness about the available investment scopes in Shariah funds, it is expected that more investments will start to flow into these funds in future,” concludes Yousuf.