- Shariah stocks withstood global tariff shocks better at 2025 lows

- Downside protection a welcome for Muslims desiring faith-based investing

- Defensive nature may hold Islamic equities in good stead despite volatility

Overview

The year 2025 so far has seen the stock market landscape marked by major volatility – though equities adhering to the tenets of Islamic finance have withstood global shocks better than their conventional peers.

Most risk assets were hit hard between February and early April 2025, reacting to US-triggered global tariff squabbles, recession fears amped by the first quarterly decline in US GDP since 2022 and uneasy ceasefires in Ukraine and Gaza.

On the 5th April 2025, at its low so far for the year, the S&P 500 was down almost 18% from its 2024 close, nearing the 20% drop that would define a bear market.

Faring slightly better was the S&P Global BMI Shariah Index which at its comparative low on 7th April 2025, was down nearly 16% from its 2024 finish.

Year-to-date, both these indices are down by about 4%.

The casual observer studying the relative performances of the two indices may not distinguish much between Islamic stocks and the broader US equity market.

But for Muslims not wanting to live off interest-generating income and determined to avoid speculation in business wherever possible, better downside protection for Shariah compliant stocks – however small – might be welcome.

“We need to be comfortable that we are in a position where we can invest, deliver returns and beat the benchmark,” Leslie Yap, country head of Nomura Asset Management (Malaysia), and manager of the Nomura Global Shariah Sustainable Equity Fund told IFN Investor in late March 2025, as the sell-off across equity markets began to peak.

In times of undue volatility, the strict screening in Shariah could also serve for better downside protection than ESG models.

An example would be the exclusion of major interest-earning banks like JPMorgan Chase, Bank of America and Wells Fargo from the financial subset of Shariah stocks – a move that would have benefited Muslim investors when share prices of these institutions plunged in March 2025.

Investment opportunity

The core principles of Shariah compliant investing lead to a distinct composition of listed companies that strive to stay off the Haram path as well as avoid elements like Riba, Maysir and Gharar. Industries typically sought by Islamic investors include:

- Technology and fintech

- Healthcare and pharmaceuticals

- Real estate and infrastructure

- Halal consumer goods and food

- Renewable energy and sustainability

- Manufacturing of permissible goods

- Agriculture

- Shipping and logistics

Market size

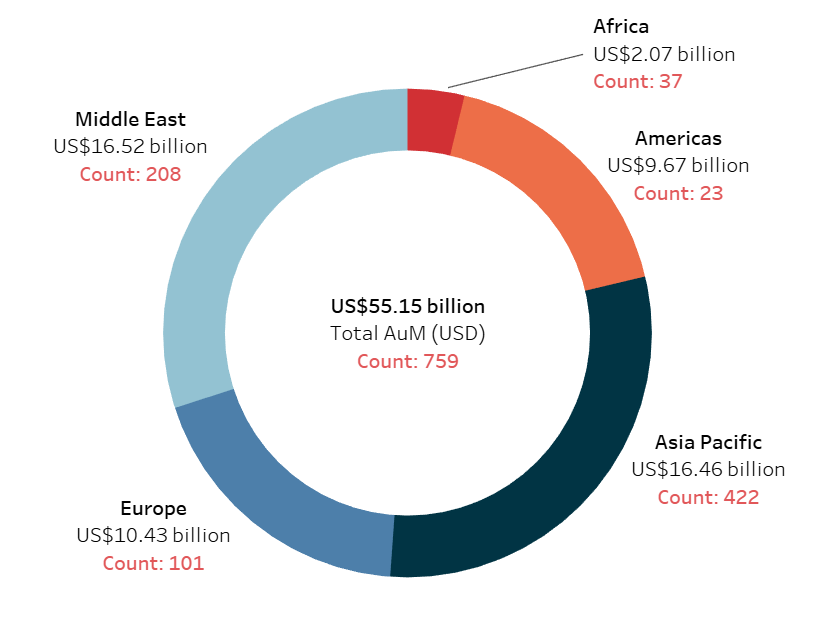

The highest number of Islamic equity funds are in Asia Pacific while the Middle East houses the largest combined assets for these, according to the IFN Investor Funds Database.

Asia Pacific has 422 Shariah compliant funds with combined assets under management (AuM) of US$16.46 billion.

The outsize fund presence in the region is due to the role played by countries such as Malaysia, which has for decades positioned itself as a global hub for Islamic finance, and Indonesia – which currently has the world’s largest Muslim-majority population.

The Middle East has less than half of Asia Pacific’s Islamic fund count, at 208. But its AuM is higher, at US$16.52 billion.

Europe is ranked third for both fund count and AuM, with 101 funds holding a combined US$10.43 billion. The UK, Luxembourg and Ireland Shariah markets – are helped by demand for ethical and socially responsible investing, globalization and interconnectedness, development of Islamic financial infrastructure as well as fintech and innovation.

Africa is fourth and the Americas fifth for fund count, with 37 and 23 funds, respectively. But in terms of asset size, the two switch, with the Americas having an AuM of US$9.67 billion and Africa US$2.07 billion.

Shariah investing, especially in North America, is helped by rising awareness and acceptance of ethical investing, fintech and digitalization increasing regulatory accommodation and growing institutional interest.

In terms of sheer AuM growth, Africa witnessed the biggest percentage rise in value for Islamic equity funds in Q1 2025, with a 23.69% growth from Q4 2024.

The Middle East was next with a 20.21% rise, followed by Asia Pacific, with 8.11%. The Americas and Europe experienced AuM contractions instead in the same period, of 10.56% and 11.8%, respectively.

Chart 1: Islamic equity funds by region, fund count and AuM

Table 1: Regional Islamic equity funds by value growth

| Region | Value |

| Africa | Up by 23.69% from US$1.67 billion to US$2.07 billion |

| Middle East | Up by 20.21% from US$13.74 billion to US$16.52 billion |

| Asia Pacific | Up by 8.11% from US$15.24 billion to US$16.47 billion |

| Americas | Down by 10.56% from US$10.81 billion to US$9.67 billion |

| Europe | Down by 11.8% from US$11.83 billion to US$10.43 billion |

Fund performance

Turkiye’s Allbatross Portfoy was the best global Islamic equity manager in Q1 2025, with a three-month return of 33.94% on its Allbatross Portfolio Participation Stock (TL) Fund, according to the IFN Investor Funds Database.

The stock-intensive Allbatross Portfoy fund had at least 80% of its total value invested in partnership shares of companies continuously traded on Borsa Istanbul and included in the indices approved for Shariah compliance, Allbatross Portfoy said.

QNB Finans Portfoy, also of Turkiye, came in second, with a three-month gain of 30.28% on its QNB Finance Portfolio Gold Participation Exchange Investment Fund.

Lunate Capital of UAE was ranked third after a three-month return of 27.29% for its Chimera S&P China HK Shariah ETF-Income fund.

HSBC Asset Management had the single largest AuM in the world for a Shariah fund, with its Islamic Global Equity Index Fund running at US$3.53 billion.

Table 2: Top Islamic equity funds by AuM as at the end of Q1 2025

| Fund name | Fund manager | Fund type | AuM (US$ billion) |

| HSBC LICITS Common Contractual Fund – Islamic Global Equity Index Fund- Class A2CGBP | HSBC Asset Management | Growth | 3.53 |

| Amana Growth Institutional Fund | Saturna Capital | Growth | 2.39 |

| Amana Growth Investor Fund | Saturna Capital | Growth | 2.16 |

| Albilad CSOP MSCI Hong Kong China Equity ETF | Albilad Capital | ETF | 1.23 |

| SP Funds S&P 500 Sharia Industry Exclusions ETF | ShariaPortfolio | ETF | 1.09 |

Table 3: Top Islamic equity funds by three months return at the end of Q1 2025

| Fund name | Fund manager | Three-months return (%) |

| Allbatross Portfolio Participation Stock (TL) Fund (Stock Intensive Fund) | Allbatross Portfoy | 33.94 |

| QNB Finance Portfolio Gold Participation Exchange Investment Fund | QNB Finans Portfoy | 30.28 |

| Chimera S&P China HK Shariah ETF – Income | Lunate Capital | 27.29 |

| Faisal Islamic Fund | Hermes Fund Management (EFG Holdings) | 20.17 |

| SAB Invest China and India Equity Freestyle Fund | SAB Invest | 13.45 |

Outlook

The performance of Shariah compliant equities will likely remain under close scrutiny, particularly if prevailing market headwinds persist due to tariff pressures driven by the Trump presidency. Still, the defensive characteristics of these investments could continue to offer a relative advantage.

It is crucial for investors to understand the specific sectoral exposures and geographical diversification in Islamic rules-based investing, as these factors will ultimately decide returns.

The potential for further outperformance hinges on the continuation of market trends that favor the inherent constraints and ethical considerations of Islamic finance.

As global economic uncertainties linger, Shariah compliant equities present a compelling investment opportunity for those seeking a potentially more resilient approach to the market.