- One of the world’s top Islamic finance hubs that paved the way for Europe

- Luxembourg’s Shariah market benefits from cross-border distribution, light regulation

- Lack of domestic Islamic banking and few local Sukuk issuance are challenges

Overview

Luxembourg became one of the world’s top five Shariah fund hubs through a hybrid of products, regulations and environment that made it a non-Muslim haven for Islamic capital.

The state became a so-called sovereign Grand Duchy in 1890. But it was not until 1978 that the Islamic Banking System Holdings of Luxembourg was established, paving the start of Shariah financing in Europe.

From there, rapid product diversification – from Shariah compliant equities to Sukuk and other fixed income instruments including real estate – along with supportive rules transformed Luxembourg into a European powerhouse for Muslim investments.

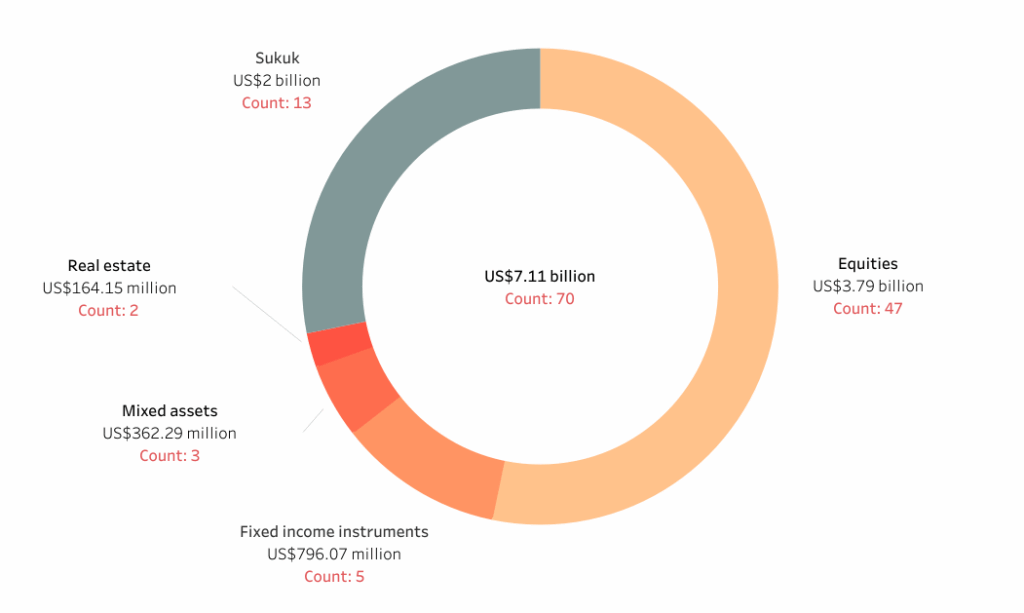

The IFN Investor Funds Database tracks a total of 70 Shariah funds in Luxembourg with combined assets under management (AuM) of US$7.11 billion.

That translates to an average holding of nearly US$102 million per fund – almost double the US$55 million average for an Islamic fund in Malaysia, the world’s top Shariah hub with a total of 594 funds and an AuM of US$33.04 billion at the end of 2024.

Investment opportunity

The Shariah landscape in Luxembourg primarily revolves around UCITS — undertakings for collective investment in transferable securities — which benefit from fund passporting for cross-border distribution in Europe and beyond.

Under this arrangement, global fund managers can base their Islamic funds in Luxembourg and distribute them widely across Europe and beyond.

The Luxembourg Stock Exchange plays a crucial role for product placement, serving as a primary listing venue for equities and other securities, including Sukuk from various global issuers, especially those in the Middle East and Asia.

The country’s expertise in alternative investments, particularly real estate and private equity, also presents avenues for Shariah compliant structuring.

Opportunities exist as well for those seeking exposure to ethically screened portfolios aligned with ESG principles, which naturally resonate with Islamic finance tenets.

Equity funds reign in Luxembourg’s Islamic market, with the IFN Investor Funds Database tracking 47 of them holding a joint AuM of US$3.79 billion.

Sukuk funds come next, with 13 valued at a total of US$2 billion. Other fixed income instruments follow, with five funds holding a combined US$796.07 million.

Mixed asset Shariah funds which combine multiple strategies including real estate, jointly hold US$362.29 million. The AuM in real estate-only funds stand at US$164.15 million.

Chart 1: Luxembourg domiciled Islamic funds by asset class and AuM as of Q1 2025

Regulatory environment

Luxembourg’s regulatory framework for Islamic finance is characterized by its adaptability rather than a distinct, separate set of Shariah laws. Shariah compliant investment funds and products are primarily regulated under the general Luxembourg legal framework for investment funds.

This flexible approach means that Shariah compliance is integrated through specific structural features within these vehicles, such as the appointment of Shariah advisory boards to validate fund structures and investment policies.

While there is no standing Shariah authority, the state encourages industry benchmarks like ‘best practice guidelines’ for Islamic investment funds drafted by the Association of the Luxembourg Fund Industry.

The Commission de Surveillance du Secteur Financier, Luxembourg’s financial regulator, also appears to possess considerable experience in authorizing and supervising Islamic finance structures.

Clear guidelines from authorities on the tax treatment of Islamic finance products including Sukuk Murabahah and Ijarah, further enhance certainty for market participants.

The flexibility in regulation is welcomed by investors seeking the ‘best of both worlds’ – i.e. a familiar, robust framework for markets that fosters confidence without the burden of overregulation.

Despite this, a 2023 audit by Luxembourg authorities found shortcomings in the Shariah fund screening for money laundering and terrorism financing. This raised concerns about under regulation; whether enforcers had been too lenient with rules to let dealmaking thrive.

Fund performance

Franklin Templeton’s Global Sukuk Fund is Luxembourg’s largest Islamic asset manager, with an AuM of US$820.76 million. It invests principally in fixed- and floating-rate Shariah compliant securities – including non-investment grade securities – that comprise Sukuk Murabahah and Wakalah placements as well as other short-term instruments issued by government and corporate entities in developed and developing countries.

Table 1: Top five largest Luxembourg funds

| Rank | Fund | Manager | AuM (US$ million) |

| 1 | Franklin Global Sukuk Fund – A | Franklin Templeton | 820.76 |

| 2 | SEDCO CAPITAL GLOBAL UCITS – SC US Equities Passive Fund – Class D USD | Sedco Capital | 737.11 |

| 3 | HSBC Islamic Global Equity Index Fund – Class IC | HSBC Asset Management | 720.26 |

| 4 | AZ Multi Asset AZ Islamic – MAMG Global Sukuk A-ME (USD ACC) | Azimut Investment | 614 |

| 5 | HSBC Islamic Global Equity Index Fund – Class IC GBP | HSBC Asset Management | 562.62 |

The top performing Shariah funds in Luxembourg are all run by Sedco Capital and are structured as UCITS benefiting from cross-border distribution in Europe and beyond.

Among them, the outlier is the SC China Equity Fund, which posted an annual return of 25.51% for the year ended the 31st March 2025. It invests in equities that profit largely from operations in China, Hong Kong or Macau. Returns are benchmarked against the Dow Jones Islamic China LowCap Total Return Index.

Table 2: Top performing Luxembourg funds by one-year return

| Rank | Fund name | Fund manager | One-year return (%) |

| 1 | Sedco Capital Global UCITS – SC China Equity Fund – Class R | Sedco Capital | 25.51 |

| 2 | Sedco Capital Global UCITS – SC China Equity Fund – Class D | Sedco Capital | 24.7 |

| 3 | Sedco Capital Global UCITS – SC US Equities Passive Fund – Class D USD | Sedco Capital | 14.14 |

| 4 | Sedco Capital Global UCITS – SC US Equities Passive Fund – Class R USD | Sedco Capital | 13.99 |

| 5 | Sedco Capital Global UCITS – SC Global Emerging Markets Equities Passive Fund – Class D | Sedco Capital | 11.85 |

Outlook

The outlook for Luxembourg’s Shariah market remains positive, driven by its established infrastructure and continued regulatory support for Islamic finance.

However, challenges persist as the lack of a strong domestic Islamic banking presence or widespread local Sukuk issuance, as noted by Fitch Ratings, indicates that Luxembourg’s domestic Shariah market remains comparatively underdeveloped despite its standing as a strong fund domicile and listing center.

Expansion into Takaful could also bolster Luxembourg’s overall market presence.

Efforts to reconcile with global Islamic standards even as it maintains a flexible regulatory approach will be another key to sharpening Luxembourg’s competitive edge and standing as a hub for Shariah capital.