- Mixed assets weather rocky start to 2025, offering defense to Shariah investors

- Outlook for balance of year “cautiously optimistic” due to uncertain global trends

- The ability of fund managers to dynamically tweak asset allocations will be key

Overview

Investments adhering to Islamic law, which blend equities, fixed income and property, have largely weathered the turbulent start to 2025, offering a haven for investors seeking ethical exposure and diversification.

The S&P Global BMI Shariah Index’s year-to-date returns of -0.98% as of May 14th 2025 fell behind that of the S&P 500’s 0.3%.

But at its low for the year, the Shariah index was down just around 16% versus the 18% on the S&P, which neared bear market territory after an investor flight triggered by US tariff wars.

Within the Islamic equity universe, technology and healthcare sectors generally outperformed, while energy and materials experienced greater price swings.

Commodities, led by precious metals and agricultural components, provided hedging against market downturns in other Islamic investments. Gold futures are up more than 20% on the New York Mercantile Exchange, hitting a record high of just over US$3,500 an ounce.

Sukuk and Shariah compliant Islamic real estate as well as REITs, completed the picture for Muslim investors in a volatile first quarter.

The FTSE Sukuk Index, tracking the global performance of Sukuk, has generally provided more stable returns compared to equities.

However, rising global interest rates have exerted some pressure on Sukuk prices, particularly those with longer maturities. Demand for high-quality Sukuk remains robust, supported by strong investor appetite in the GCC region and increasing international interest.

Whatever the case, the global Sukuk market is expected to continue growing, with S&P Global Ratings forecasting total Islamic bond issuance at between US$190 billion and US$200 billion in 2025, after the US$193.4 billion in 2024 and US$197.8 billion in 2023.

Shariah REITs demonstrated a defensive nature, starting the year positively before experiencing swings.

According to Manulife, Shariah REIT markets in India, Mexico, Netherlands, the Philippines, Saudi Arabia, Singapore, Thailand and the UK outperformed, while Australia, Japan, New Zealand and Turkiye underperformed.

The varied outcome in Islamic real estate was due to regional market dynamics. Rising interest rates and concerns about commercial property valuations created headwinds in some markets, while strong rental demand and economic growth contributed to gains in others.

Market presence

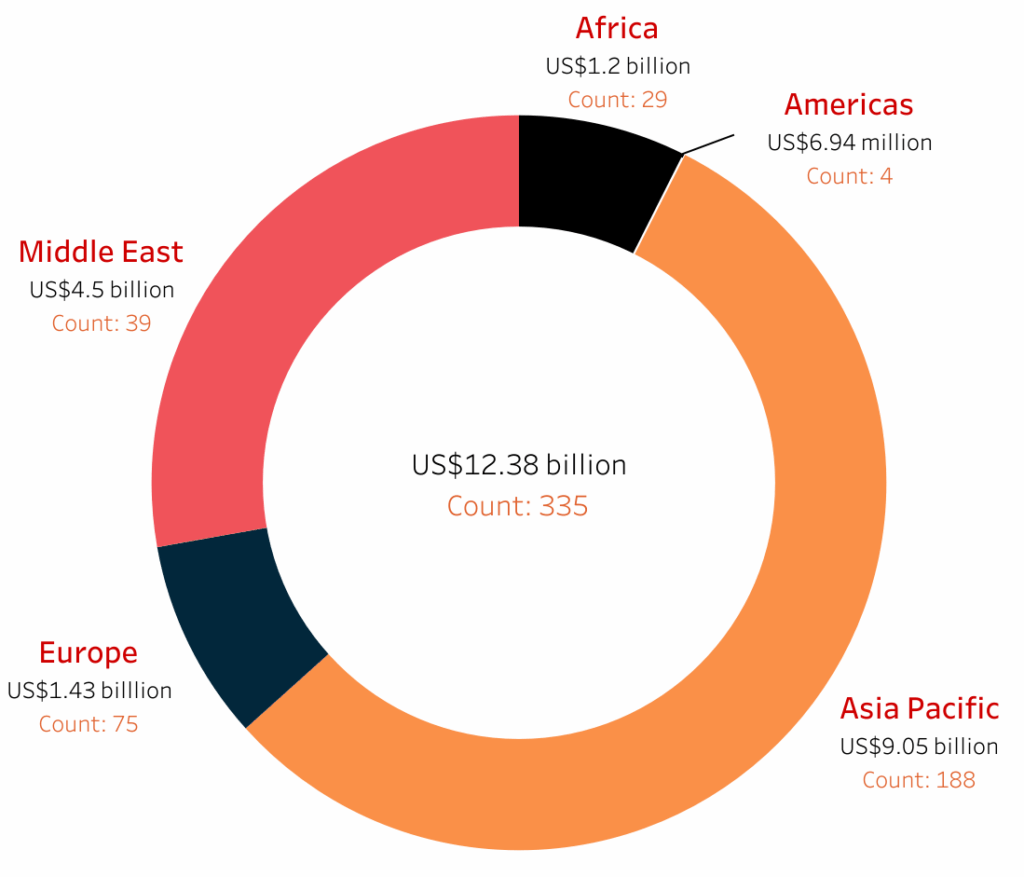

The largest concentration of Islamic mixed assets was in the Asia Pacific region, with the IFN Investor Funds Database tracking 188 such fund managers with a total US$9.05 billion in assets under management (AuM).

Europe had the second largest count of mixed asset Islamic funds at 75, though its combined AuM of US$1.43 billion trailed that of the Middle East, which has a combined AuM of US$4.5 billion from 39 such funds.

Chart 1: Islamic mixed assets funds by location, fund count and AuM

Asia Pacific also saw the biggest quarter-on-quarter growth for mixed assets in Q1 2025, with AuM rising 118.64%, according to the IFN Investor Funds Database.

Africa came in second, with an 85.87% growth. Europe took the third spot with a 54.91% gain, while the Middle East was fourth with a 28.08% expansion.

Table 1: Regional Islamic mixed assets funds by value growth from Q4 2024 to Q1 2025

| Region | Value |

| Asia Pacific | Up by 118.64% from US$4.05 billion to US$8.85 billion |

| Africa | Up by 85.87% from US$0.65 billion to US$1.2 billion |

| Europe | Up by 54.91% from US$0.93 billion to US$1.43 billion |

| Middle East | Up by 28.08% from US$3.51 billion to US$4.5 billion |

Fund performance

Malaysian Public Bank’s Public Mutual is the single largest mixed asset fund tracked by the IFN Investor Funds Database, with an AuM of US$5.15 billion.

The growth-type fund invests in qualified ESG stocks – where up to 30% of its net asset value may be invested in foreign markets that include China, Singapore, Hong Kong, Thailand, South Korea, Indonesia, Taiwan and the US.

Saudi Arabia’s Al Rajhi Capital had the second largest mixed asset fund, with US$2.05 billion in AuM for its Al Rajhi Growth Fund.

Takafulink Dana Ekuiti, another Malaysian-run fund, took the third spot for AuM. Run under the Prudential-BSN Takaful brand, comprising the Malaysian unit of US Insurer Prudential and the Takaful arm of local bank BSN, the fund had an AuM of US$637.72 million.

Table 2: Top Islamic mixed assets funds by AuM

| Fund | Manager | Type | AuM (US$ million) |

| Public Islamic Asia Tactical Allocation Fund | Public Mutual | Growth | 5,149.7 |

| Al Rajhi Growth Fund | Al Rajhi Capital | Growth | 2,046.58 |

| Takafulink Dana Ekuiti | Prudential BSN Takaful | Income | 637.72 |

| Lapfund Amal Fund | Lapfund | Retirement | 509.65 |

| Al Rajhi Monthly Distribution Fund | Al Rajhi Capital | Income | 454.54 |

Turkiye’s Allbatross Portfoy was the best performing mixed asset fund, with a return of 11.61% on its Allbatross Portfolio Short-Term Participation Free (TL) Fund for the three months ended 31st March 2025. Allbatross Portfoy described it as a short-term maturity fund that underwent rebalancing every 25 to 90 days.

The Al-Ameen Islamic Aggressive Income Plan-I, belonging to Pakistan’s UBL Funds, was second best with a three-month return of 10.99%.

Turkiye’s Garanti Portfoy was just a little behind the Al-Ameen fund, with a three-month return of 10.75% to take the third spot.

Table 3: Top Islamic mixed assets funds by three months return

| Fund | Manager | Type | Three months return (%) |

| Allbatross Portfolio Short-Term Participation Free (TL) Fund | Allbatross Portfoy | Others | 11.61 |

| Al-Ameen Islamic Aggressive Income Plan-I | UBL Funds | I-Income | 10.99 |

| Garanti Portfolio Participation Free (TL) Fund | Garanti Portfoy | I-Income | 10.75 |

| AXA Life And Retirement Initial Participation Retirement Investment Fund | AXA Hayat ve Emeklilik | Retirement | 10.69 |

| Turkiye Life And Retirement Oks Conservative Participation Variable Retirement Investment Fund | Turkiye Hayat Ve Emeklilik | Retirement | 10.28 |

Outlook

The prognosis for Shariah compliant mixed assets in 2025 is cautiously optimistic.

The diversification benefits inherent in these portfolios are expected to continue to appeal to investors seeking to navigate ongoing market uncertainty. The growth of Islamic finance globally and increasing awareness of ethical investing principles also provide a supportive long-term backdrop.

However, investors will need to closely monitor global macroeconomic trends, interest rate movements and geopolitical risks, which could impact the performance of the underlying asset classes.

The ability of fund managers to dynamically adjust asset allocations within Shariah compliant guidelines will also be crucial in delivering consistent returns.