Key Highlights:

- Saudi Arabia leads with the largest Islamic money market funds by AuM

- Asia Pacific experienced an AuM growth of 24.69% by the end of Q2 2024

- Eight Islamic money market funds were launched in the first half of 2024

Overview

Global money markets, including in the Shariah sector, were on tenterhooks during the second quarter of 2024 due to mixed signals from the US Federal Reserve (US Fed) on when it would implement the much-anticipated interest rate cuts that most economies reference against.

Being short-term instruments, typically maturing with a year’s period, this uncertainty led to extra cautious trades in the overall money market – as there was a risk of the US Fed’s action impacting returns for this otherwise low-risk investment.

As was seen with the IFN Investor Funds Database, tracking the average returns of 213 Islamic money market funds from both Q1 2024 and Q2 2024, there was a mild reduction in average annual returns from 7.64% to 7.16%.

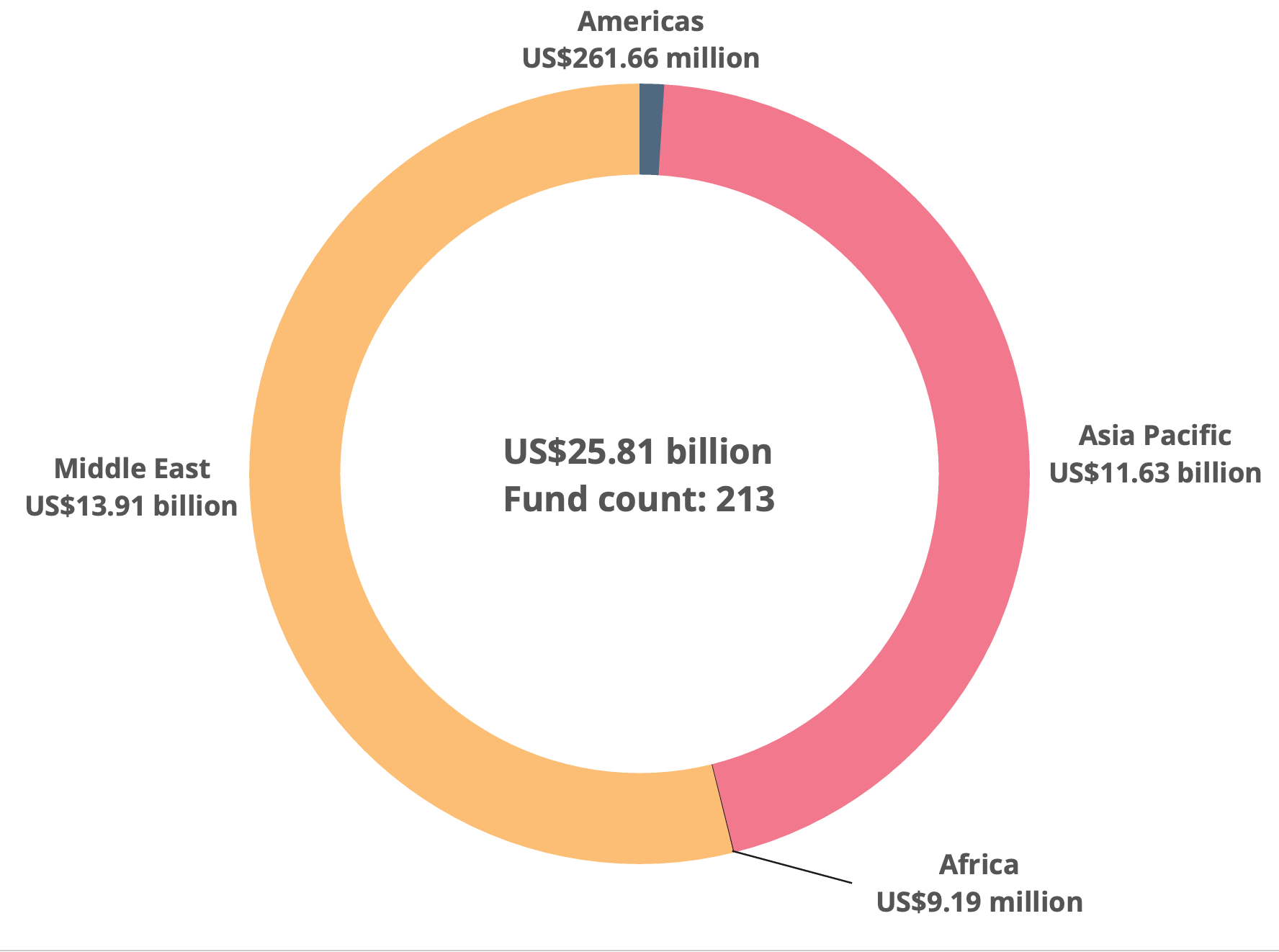

Chart 1: Islamic money market funds AuM by region (Q2 2024)

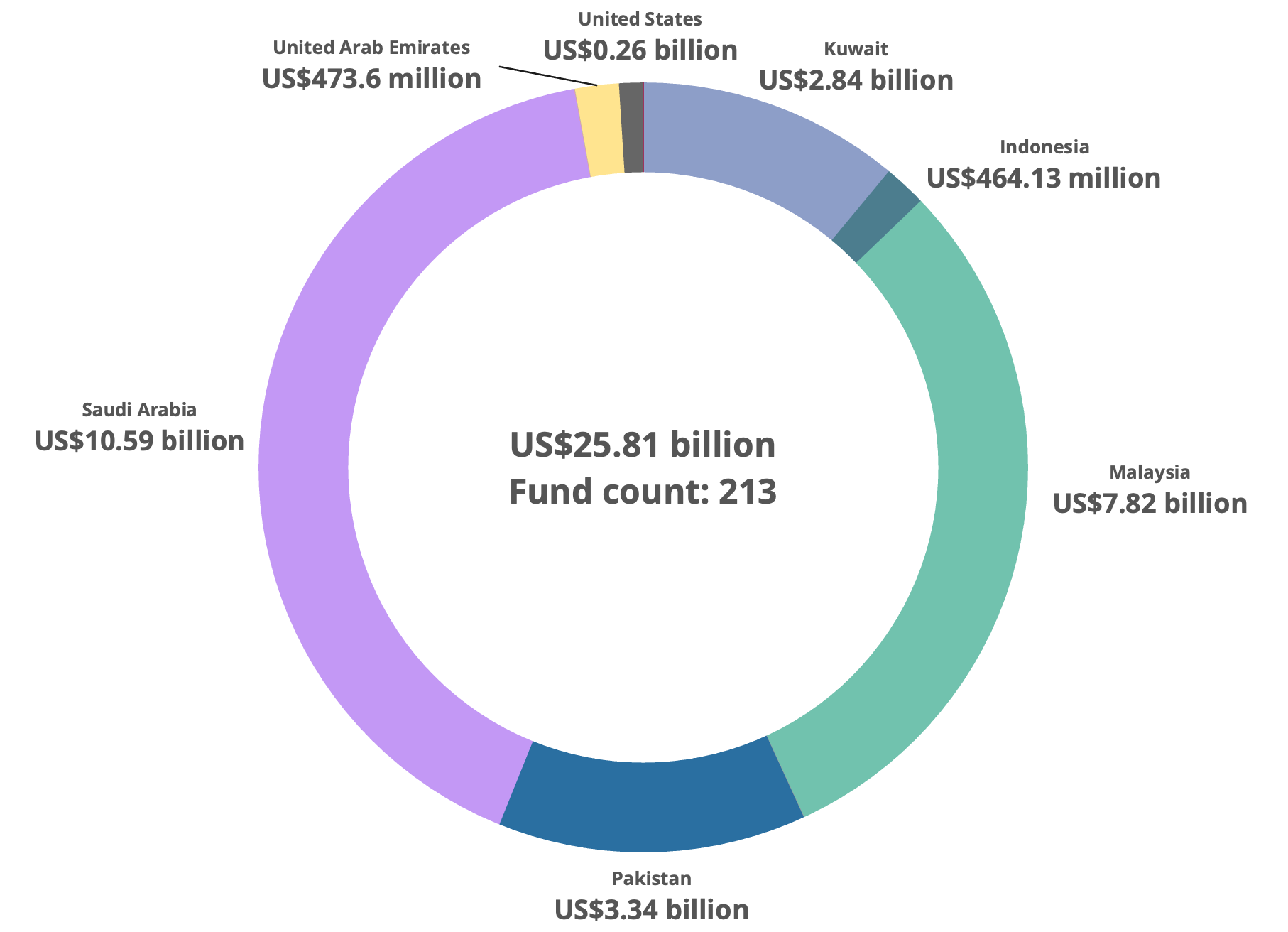

Chart 2: Islamic money market top seven nations by fund AuM

Saudi Arabia continues to lead the Islamic money market in terms of total assets under management (AuM), with US$10.59 billion across 30 funds. Malaysia follows with 58 funds, handling US$7.82 billion. Pakistan ranks third, with the AuM tally of US$3.34 billion.

When viewed from the perspective of a country having the greatest number of funds, Pakistan takes the lead at 60 funds, followed by Malaysia.

Table 1: Largest Islamic money market funds as at the end of Q2 2024

| Fund | Fund manager | AuM (US$ billion) |

| AHAM Aiiman Money Market Fund | AHAM Capital Asset Management | 3.13 |

| SNB Capital Al Sunbullah SAR | SNB Capital | 2.61 |

| SNB Capital Saudi Riyal Trade Fund | SNB Capital | 2.32 |

| Watani KD Money Market Fund II | NBK Wealth | 1.37 |

| Alpha Murabaha Fund | Alpha Capital | 1.15 |

AuM growth

While the Islamic money market in the Asia Pacific experienced healthy growth in AuM during Q2 2024, the Middle East saw a dip in overall performance.

- Middle East: Down by 4.39% from US$14.54 billion to US$13.91 billion.

- Asia Pacific: Up by 24.69% from US$9.33 billion to US$11.63 billion.

- Americas: Up by 1.33% from US$258.22 million to US$261.66 million.

* Q1 2024 comparison data for Europe and Africa not available.

ROI analysis (Three-month returns)

Table 2: Top performing Islamic money market funds by region in Q2 2024

| Region | Fund | Fund manager | Three-month returns (%) |

| Africa | 27four Best View Shariah Global Fund | 27 Four Investment Managers | -1.90% |

| Americas | Azzad Wise Capital Fund | Azzad Asset Management | 0.83% |

| Asia Pacific | Mahaana Islamic Cash Fund | Mahaana | 20.79% |

| Middle East | GIB Murabaha Fund – Class B | GIB Capital | 6.57% |

* Data on Europe not available

New players and products

According to the IFN Investor Funds Database, four Islamic money market funds were launched in the second quarter of 2024. Three of these funds – Meezan Paaidaar Munafa Plan IX, X, and XII – were introduced by Al Meezan Investment Management, collectively accumulating an AuM of US$15.83 million. Additionally, Mandiri Manajemen Investasi launched the Mandiri Pasar Uang Syariah fund, which had an AuM of US$12.4 million as of the 30th June 2024.

In total, eight Islamic money market funds were launched in the first half of 2024, with the largest being the Al Rajhi Awaeed Fund, boasting an AuM of US$768.15 million.

Table 3: Top 3 Islamic money market funds launched in H1 2024

| Fund manager | Fund name | Country | AuM (US$ million) |

| Al Rajhi Capital | Al Rajhi Awaeed Fund | Saudi Arabia | 768.15 |

| Mandiri Manajemen Investasi | Mandiri Pasar Uang Syariah (Kelas C) | Indonesia | 12.4 |

| Al Meezan Investment Management | Meezan Paaidaar Munafa Plan X | Pakistan | 10.1 |

Outlook

It was only in Q3 2020 that, on the 18th September 2024, did the US Fed announced a rate cut of 50 basis points – higher than the expectations of many analysts.

It isn’t clear if the US Fed may consider another interest rate cut in 2024, but the market sentiment is that the global economy should remain stable in the latter half of this year, supported by favorable labor market conditions and easing inflation.

Additionally, the monetary policy adjustments by advanced economies in emulating the US Fed’s rate cut would likely to further enhance growth in the short to medium term. Global trade growth is expected to continue its recovery, driven by a resurgence in technological advancements.

Even so, the impact on money markets would not be well reflected as the US Fed rate cut came at the tail end of Q3 2024. But with some sense of stability established, the outlook for the Islamic money market in 2024 is optimistic, fuelled by a rising demand for Shariah compliant investments, stronger regulatory support, and a more stable economic environment.

Increasing awareness among both retail and institutional investors is expected to drive growth, while supportive regulations will enhance confidence and encourage market participation. Furthermore, innovations in product offerings, along with a growing emphasis on sustainability and responsible investing, are likely to draw in more investors. Collectively, these factors contribute to a promising landscape for the development of Islamic money markets in the upcoming year.