(Updated with comments by Maldives Finance Minister Dr Mohamed Shafeeq)

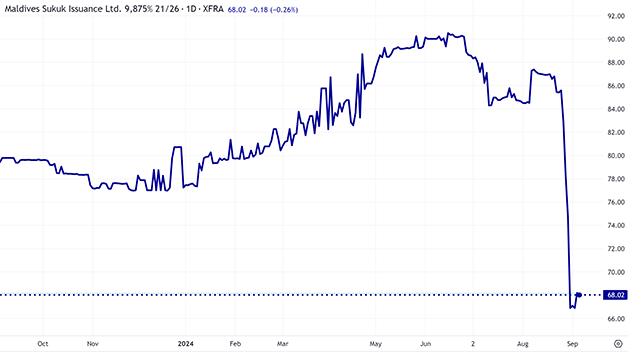

Fearing the Maldives may be the cause of the first ever sovereign-issued Sukuk default, traders all over have been dumping the US$500 million Islamic debt as many lack confidence in the 10.5% annual coupon rate being paid.

The selloff was triggered by the second downgrade by Fitch Rating on the 29th August 2024 – warning of the Maldivian government reserves having fallen dangerously low and potentially being unable to meet the upcoming 8th October 2024 coupon payment of US$25 million due on the Sukuk.

Chart 1: The Maldives Sukuk price trend

Source: www.boerse-frankfurt.de

While most economic analyses point towards the Maldives hoping to be rescued by a white knight with a fat wallet – like China, India or any GCC nation – some insiders feel this looming Sukuk default threat is the long-overdue spur needed to drive reform for the Indian Ocean island-nation’s economy.

The main issue is the huge national budget deficit, which has chalked up a sovereign debt of over US$8 billion for the Maldives – as domestic spending far outpaces tax income inflow for the local government.

Though luxury tourism may be the face of the Maldives to the world, the actual flow of tax revenues to the government from vacation resorts had so far been minimal – due to the bulk of sales recorded outside these islands, an official, who declined to be named, explained to IFN Investor.

Should the Sukuk default and the IMF has to step in to bolster the Maldivian economy, most of the tourism tax earnings would finally flow into the government coffers, said the official.

Also, with very little local resources – except for what comes from the sea – almost everything needed is imported into the Maldives. Ironically, the Maldivian export of yellowfin and skipjack tuna gets zero incentives when sold to Europe – which classifies the Maldives as a fully-developed nation.

The official noted that the EU calculates the presumed tourism revenue against the estimated 520,000 population in the Maldives to produce a high GDP per capita ratio – and hence the developed nation status, despite very little of that cash actually flowing into the local economy.

As domestic political will is lacking to ensure a bigger chunk of tourism dollars flows into the Maldives – rather than going mainly to foreign owner-operators of luxury resorts – an informed source said the Sukuk default could be inevitable as soon as the US$50 million coupon payments become due in 2025.

But other proposals have been made to the President Mohamed Muizzu-led government of this Muslim-populated nation – which some balk at as being contrary to Islamic principles.

Already uneasy at the sale of alcohol and pork being allowed at foreign-owned resorts, but barred in guesthouses operated by locals, the Muslim government has so far fended off proposals to allow a casino to operate within the Maldives or welcome cruises – which practice even fewer restrictions.

The looming threat of the Sukuk default may finally cause these political barriers to bend enough to facilitate the issuance of concessions – similar to how Singapore ring-fences the operations of cruises and casinos – and save the Maldives from economic doom.

(Update) In a scathing interview published by the Maldivian newspaper Avas on Saturday the 7th September 2024, Maldives Finance Minister Dr Mohamed Shafeeq slammed “misinformation published by reputable local and international news agencies”.

While acknowledging the Maldives is currently facing difficulties in repaying its debts, the minister assured the US$25 million coupon payment will be paid by the 8th October 2024 deadline, adding that a further US$70 million had already been deposited in the Sovereign Development Fund to meet the next coupon obligations due in April and October 2025.

To address the US$250 million lump sum due in 2026, Mohamed said this debt will be refinanced via a loan repayable via instalments instead. Further, the Maldives is preparing to arrange a US$400 million currency swap facility through the Reserve Bank of India and sell a refinancing green bond.