- Favored offshore domicile for Sukuk and Islamic mutual funds

- Tax-favorable environment a key attraction

- A leading offshore jurisdiction for private equity funds

Overview

The Cayman Islands is an important hub for Islamic finance, leveraging on its status as a major global offshore financial center that has developed since the 1970s. This jurisdiction’s appeal stems from its legal framework, tax efficiency and professional infrastructure. Operating with a common law system based on English law, the Cayman Islands regulatory framework offers significant flexibility in the structuring of financial instruments – which spurred innovations to comply with Shariah principles like Sukuk issuances using Ijarah and Mudarabah transactions.

The absence of income tax, capital gains tax, profit tax or withholding taxes enshrined in the law makes it an attractive location for cross-border transactions as well as high net-worth individuals and family offices taking advantage of its favorable treatment for wealth management and investments – while also allowing for efficient asset protection and estate planning.

In the 2020s, ESG was a popular theme with sustainable Sukuk issuance in Islamic capital market and these issuances used SPVs formed in offshore centers like the Cayman Islands.

Regulatory framework

Applying a common law system to provide stability and familiarity for international transactions, the Cayman Islands Monetary Authority (CIMA) is the primary regulator overseeing financial services in the jurisdiction.

CIMA does not regulate Islamic banking products or insurance beyond general banking and insurance regulations but ensures compliance with broader financial standards such as anti-money laundering provisions.

The Mutual Funds Act and Private Funds Act govern investment funds in the Cayman Islands – but do not specifically address Islamic finance products, beyond requiring registration or licensing with CIMA.

There are no specific Shariah boards located in the Cayman Islands that issue Fatwas or oversee Islamic finance transactions directly within the jurisdiction.

Capital market

The Islamic capital market in the Cayman Islands operates under the Securities Investment Business Act, which regulates all securities investment activities, including broker-dealers and investment advisors.

There are approximately 28,000 registered funds on the Cayman Islands Stock Exchange (CSX), covering various asset classes such as hedge funds, private equity funds and Sukuk, according to CIMA.

Regulatory flexibility allows fund managers to structure various Shariah compliant investment vehicles – including equity funds, real estate investment trusts, Sukuk funds and private equity – in accordance with Shariah compliance.

The Cayman Islands is a leading offshore jurisdiction for private equity funds, facilitating the exempted limited partnership (ELP) – which continues to be the preferred vehicle for private equity fund structures that is recognized by most global and investor-friendly regulations.

With its ability to accommodate customized profit-sharing models, the ELP structure also offers strong asset protection – ensuring that investors’ personal assets remain separate from the partnership’s liabilities.

Asset management

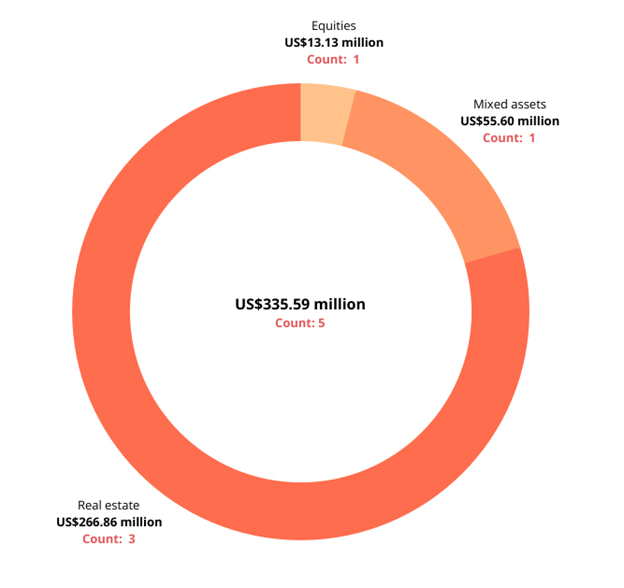

Most funds in the Cayman Islands are set up privately and do not publicly disclose performance statistics, limiting data monitoring for all Islamic funds.The IFN Investor Funds Database currently tracks five publicly-traded Shariah compliant funds domiciled in the Cayman Islands, with a total asset under management (AuM) of US$335.59 million as of the 30th December 2024, spread across various asset classes – primarily real estate.

Real estate funds lead in both number and total AuM, accounting for three funds valued at US$266.86 million, followed by mixed assets at US$55.6 million and equities at US$13.13 million.

Chart 1: Cayman Islands public Islamic funds

The BlueBox Islamic Global Technology Fund SPC, managed by BlueBox Asset Management, leads the performance ranking among Shariah compliant funds in the Cayman Islands with a year-to-date return of 14.2%, driven by strong gains in the global technology sector.

The Waha Islamic Income Fund, managed by Waha Capital, posted a 6% return, reflecting steady income-based performance. Meanwhile, Rasmala Holdings showed mixed results – both positive and negative returns.

Table 1: Performance of Islamic funds domiciled in Cayman Islands as at the end of 2024

| Fund name | Fund manager | Year-to-date returns (%) |

| BlueBox Islamic Global Technology Fund SPC | BlueBox Asset Management | 14.2% |

| Waha Islamic Income Fund | Waha Capital | 6% |

| Rasmala North American Real Estate Income Fund | Rasmala Holdings | 0.94% |

| Rasmala Long Income Fund | Rasmala Holdings | -1.32% |

| Rasmala European Real Estate Income Fund | Rasmala Holdings | -2.79% |

Outlook

There has been a recent increase in demand from Shariah compliant financial institutions based in the GCC to utilize offshore centers – such as Cayman Islands, Jersey and Luxembourg – to establish master Islamic investment platforms and to provide wealth management solutions and customized services to high net-worth individuals and family offices.

With continued innovative and consistent development of Shariah compliant offerings, offshore centers like the Cayman Islands are well-positioned to support this growth by offering efficient structures for Sukuk issuance and Islamic investment products.