Key Highlights

- Liquidity management challenges among Islamic banks and institutions persist

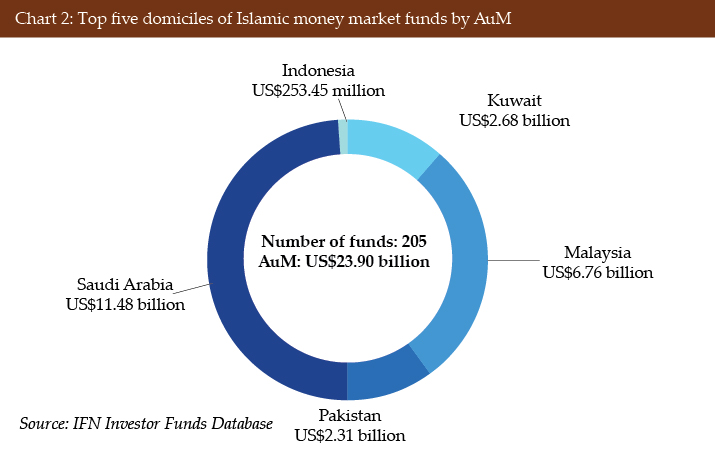

- Saudi Arabia hosts nearly 49% of global Islamic money market funds by AuM

- Four money market funds were launched in Q1 2024

- Regulatory support for Islamic liquidity management seen in Jordan and Bangladesh

Overview

Islamic banks can find it difficult to manage liquid reserves because of restrictions they encounter in accessing short-term money market instruments and/or interest-free borrowing from central banks. The development of Islamic liquidity management tools to overcome these hurdles also faces challenges on the global market front – due to varying interpretations of Shariah principles across jurisdictions. Another challenge faced for Islamic liquidity management is the lack of market players. Countries with fewer Islamic banks struggle to effectively manage liquidity issues, which ends up hindering the growth of Islamic finance. The short supply of Sukuk further impacts the development of liquidity management.

The performance of Islamic money market funds showed variability in the first quarter of 2024 (Q1 2024) compared to the previous quarter (Q4 2023). Islamic money market funds experienced a rise in assets under management (AuM) by US$365.73 million globally over consecutive quarters.

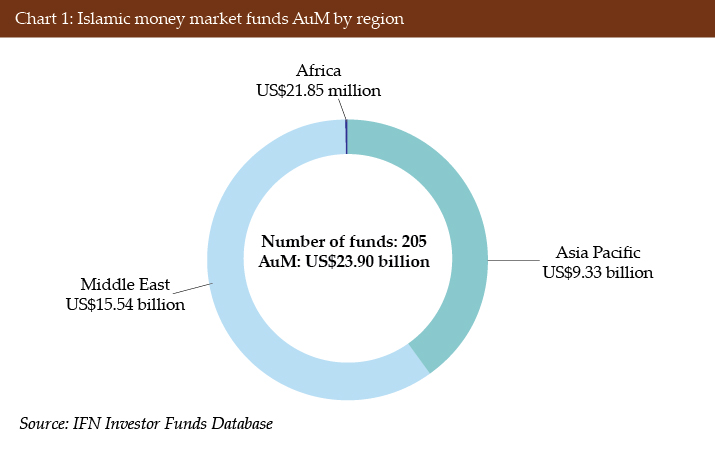

According to the IFN Investor Fund Database, there were a combined total of 205 Islamic money market funds across three regions in Q1 2024. The Middle East leads with the largest AuM totalling US$15.54 billion spread across 56 funds, followed by Asia Pacific with US$9.33 billion across 146 funds. Africa has three Islamic money market funds holding a total of US$21.85 million in AuM.

Saudi Arabia is the largest market for Islamic money market funds, with 45 funds and a collective AuM of US$11.48 billion, representing approximately 48% of the total Islamic money market AuM as at the end of Q1 2024.

Malaysia and Pakistan have comparable numbers of funds, at 56 and 59, respectively. However, Malaysia’s total AuM is US$6.76 billion, while Pakistan’s stands at US$2.31 billion.

Kuwait hosts eight funds with a combined AuM of US$2.68 billion. Indonesia ranks the lowest among these top five countries in terms of AuM, with US$253.45 million spread across 30 funds.

| Table 1: Largest Islamic money market funds as at the end of Q1 2024 | ||

| Fund | Fund Manager | AuM (US$ billion) |

| AHAM Aiiman Money Market Fund | AHAM Capital Asset Management | 3.19 |

| Riyad SAR Diversified Trade Fund | Riyad Capital | 2.03 |

| SNB Capital Saudi Riyal Trade Fund | SNB Capital | 1.93 |

| SNB Capital Al Sunbullah SAR | SNB Capital | 1.89 |

| Watani KD Money Market Fund II | NBK Wealth Capital | 1.37 |

| Source: IFN Investor Fund Database | ||

AuM growth

Islamic money market fund AuM in Asia Pacific and Africa increased during Q1 2024. Conversely, AuM in the Middle East declined by 0.49% in this same period.

• Africa: Up by 51.99% to US$19.09 million from US$12.56 million.

• Asia Pacific: Up by 4.75% to US$9.49 billion from US$9.06 billion.

• Middle East: Down by 0.48% to US$14.54 billion from US$14.61 billion.

ROI analysis (Three-month returns)

| Table 2: Top performing Islamic fixed income funds by region in Q1 2024 | |||

| Region | Fund | Fund manager | Three-month returns (%) |

| Africa | 27four Best View Shariah Global Fund | 27 Four Investment Managers | 10.87% |

| Asia Pacific | Pak-Qatar Daily Dividend Plan | Pak-Qatar Asset Management | 20.80% |

| Middle East | Miyar Saudi Equity Fund | Miyar Capital | 9.03% |

|

Source: IFN Investor Funds Database Data on America and Europe not available |

|||

New players and products

In 2023, a total of 26 Islamic money market funds were introduced worldwide.

Pakistan accounted for 17 of these launches, amassing a total AuM of US$116.01 million. Al Meezan Investment Management initiated six Paaidaar Munafa Plan funds with a combined AuM of US$58.2 million. The largest single fund launched in Pakistan was the Alfalah Islamic Money Market fund, valued at US$51.6 million.

Kuwait launched three money market funds, with the largest being the Boubyan KD Money Market Fund II, achieving a total AuM of US$867.6 million. Saudi Arabia introduced four Islamic money market funds, including offerings from Artal Capital, Dom Capital and GIB Capital.

Four Islamic money market funds were launched in Q1 2024. The largest among them was the Al Rajhi Awaeed Fund, which debuted with a value of US$315.8 million. In Pakistan, Faysal Asset Management and Al Habib Asset Management introduced two funds, accumulating a total AuM of US$2.86 million. Ahli Islamic Bank from Oman also launched a money market fund with a total AuM of US$5.19 million.

Regulatory development

Central Bank of Jordan introduced new Islamic money market tools in February 2024.They enable Islamic banks to access intraday and overnight liquidity as well as for periods up to one week, offering flexibility in both duration and amount. This policy seeks to channel funds toward emerging firms poised for growth, development, and expansion.

The Central Bank of Bangladesh in early 2023 introduced the Mudarabah Liquidity Support instrument, after launching the Islamic Banks Liquidity Facility at the end of 2022, to enhance liquidity management.

Outlook

In the short- to medium-term, the outlook for the Islamic money market is promising, with ongoing initiatives and support from central banks. Effective liquidity management is critical for financial players, who seek markets aligned with Shariah principles. The introduction of new regulatory frameworks aimed at enhancing transparency and data availability is seen as a positive development. These changes are expected to drive advancements and improve efficiencies within Islamic financial markets.

This report was produced by Aravinth Rajendran and Elliot Yip, financial data analysts at IFN Investor.