* Combined, the two islands rank fourth among Europe’s Shariah capital centers

* GCC wealth, seeking diversification, finds a receptive home in the Channel Islands

* Promising trajectory from Shariah sector’s 2024 growth, 2025 forecast

Overview

Off the rugged coast of France, the Channel Islands of Jersey and Guernsey, self-governing British Crown Dependencies, are steadily cultivating a niche in the burgeoning global landscape of Islamic finance.

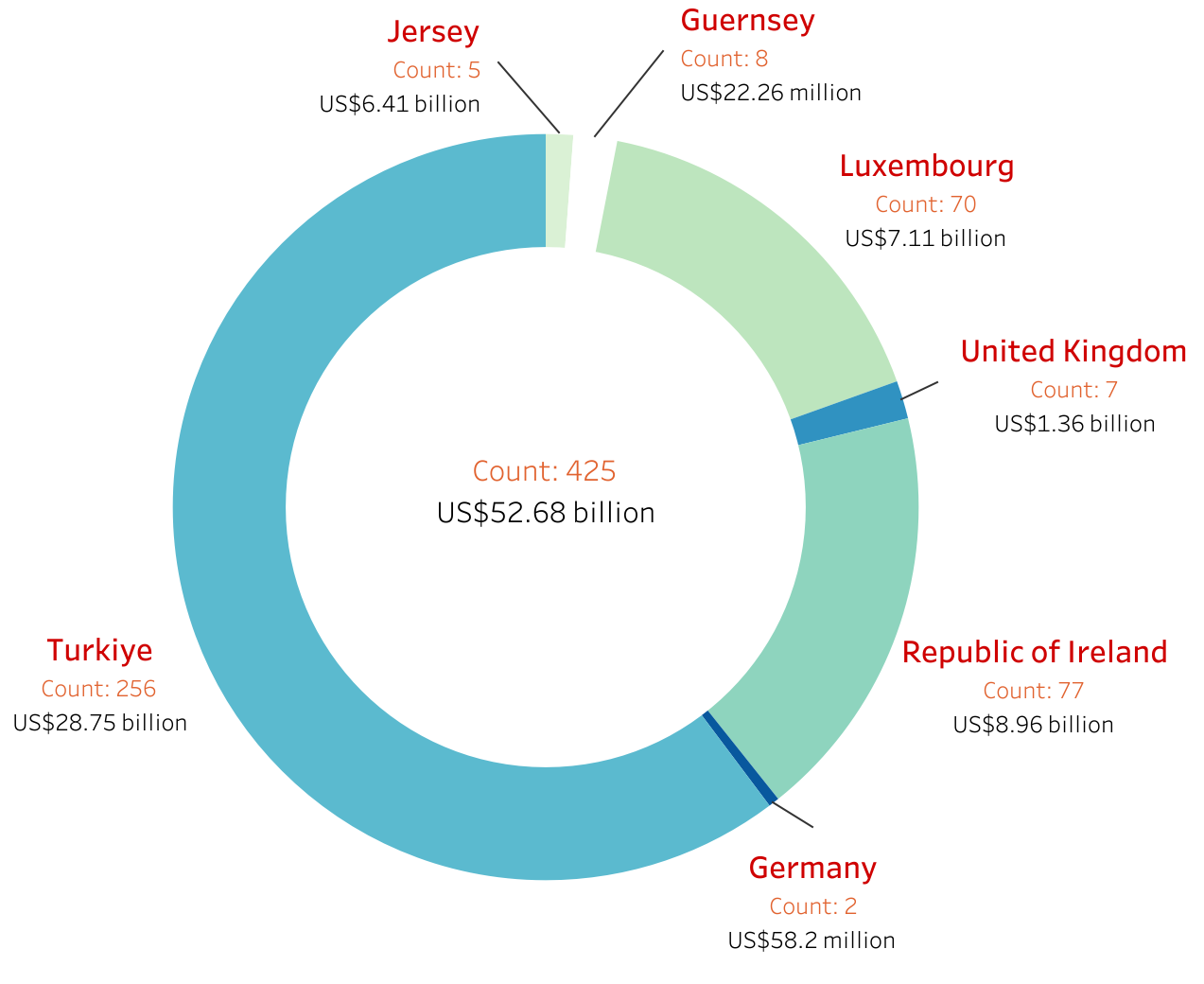

Jersey and Guernsey combined are ranked fourth for their draw of Islamic funds according to the IFN Investor Funds Database, after Turkiye, Ireland and Luxembourg which hold the respective top three positions.

Operating under English common law, the small archipelagos of the Channel Islands are increasingly recognized for their sophisticated infrastructure and legal frameworks that accommodate the intricate demands of Shariah compliant investments.

Though associated with traditional offshore banking too, their discreet yet effective approach on the Shariah front has forged strong ties with financial centers in the Middle East and Southeast Asia – destinations from which Islamic capital increasingly flow.

Investment opportunity

For investors seeking to deploy capital in accordance with Islamic principles, the Channel Islands offer a compelling, albeit perhaps less widely known, alternative to larger players like Luxembourg.

While Luxembourg boasts a greater number of established Islamic funds and a pan-European marketing passport, Jersey and Guernsey distinguish themselves with regulatory environments that are often perceived as more agile, potentially allowing for quicker and more cost-effective fund setups.

The momentum for the Bailiwicks of Jersey and Guernsey is propelled by a global Islamic finance industry that expanded 10.6% in 2024, according to S&P Global Ratings – which estimates total worldwide Shariah assets now at US$5 trillion, driven largely by banking assets and Sukuk.

Wealth from GCC, seeking diversification into alternative assets, finds a receptive home in the islands, which excel at structuring Shariah compliant vehicles – from the ethical bonds known as Sukuk to specialized fund structures designed for private equity.

The Channel Islands Securities Exchange, too, has been proactive, tailoring its rules to attract more Islamic listings.

Regulatory framework

The foundation of the Channel Islands’ appeal lies in their meticulously crafted regulatory environment. Built upon the principles of English common law, this framework offers a familiar and stable legal bedrock for international transactions.

A tax-neutral stance further enhances their attractiveness for cross-border Islamic finance. Crucially, local legal and financial service providers have developed deep expertise, navigating the nuanced requirements of Shariah law and integrating them seamlessly with conventional financial regulations.

This ensures that products like Murabahah and Ijarah can be structured and executed with both legal rigor and religious adherence. The financial regulatory bodies of Jersey and Guernsey maintain strict oversight, fostering an environment of trust and compliance.

Fund spread, performance

The IFN Investor Funds Database tracks US$6.41 billion worth of Shariah capital in Jersey operated by five funds and US$22.26 million in Guernsey belonging to eight funds.

Combined, the US$6.43 billion AuM puts the Channel Islands at the fourth spot for Islamic funds in Europe, after Turkiye’s US$28.75 billion from 256 funds, Ireland’s US$8.96 billion from 77 funds and Luxembourg’s US$7.11 billion from 70 funds.

Chart 1: Fund numbers and Islamic capital in Europe

IFN Investor Funds Database

WisdomTree Metal Securities’ US$5.59 billion WisdomTree Physical Gold fund is the largest Shariah asset manager in the Channel Islands.

It is also the highest returning fund with a one-year return of 37.86%.

Designed as a UCITS fund – undertakings for collective investment in transferable securities – WisdomTree Physical Gold provides access to physical gold and a return based on movements in the commodity’s price.

Table 1: Top five largest Channel Island Islamic funds

| Rank | Fund | Manager | Asset class | AuM (US$ million) |

| 1 | WisdomTree Physical Gold | WisdomTree Metal Securities | Commodities | 5,597.17 |

| 2 | Emirates Islamic Money Market Fund | Emirates NBD Asset Management | Money market | 615.79 |

| 3 | Emirates Global Sukuk Fund (Jersey) | Emirates NBD Asset Management | Sukuk | 111.51 |

| 4 | Emirates World Opportunities Fund (Jersey) | Emirates NBD Asset Management | Equities | 44.59 |

| 5 | Emirates Islamic Global Balanced Fund (Jersey) | Emirates NBD Asset Management | Mixed assets | 42.85 |

Table 2: Top preforming Channel Island funds by one-year return

| Rank | Fund | Manager | Asset class | One-year return (%) |

| 1 | WisdomTree Physical Gold | WisdomTree Metal Securities | Commodities | 37.86 |

| 2 | Emirates Islamic Global Balanced Fund (Jersey) | Emirates NBD Asset Management | Mixed assets | 4.95 |

| 3 | IIAB Sukuk & Murabahah Middle East and Africas Fund | Al Arabi Investment Group | Sukuk | 4.76 |

| 4 | Emirates Islamic Money Market Fund | Emirates NBD Asset Management | Money market | 4.69 |

| 5 | Emirates Global Sukuk Fund (Jersey) | Emirates NBD Asset Management | Sukuk | 4.28 |

Outlook

The trajectory for Islamic finance within the Channel Islands looks promising, with the Shariah sector’s robust asset growth in 2024 and the continued expansion forecast for 2025.

Combined, total AuM for all funds in Jersey and Guernsey rose to GBP327.3 billion (US$444.64 billion) by Q4 2024 from GBP322.7 billion (US$438.38 billion) in Q4 2023, official data showed.

While that does not break out the Shariah component, it underscores the stable and growing Islamic financial ecosystem of the islands.