Key Highlights

- Bullion prices continue to soar, up 45% since its lowest point after the COVID-19 pandemic.

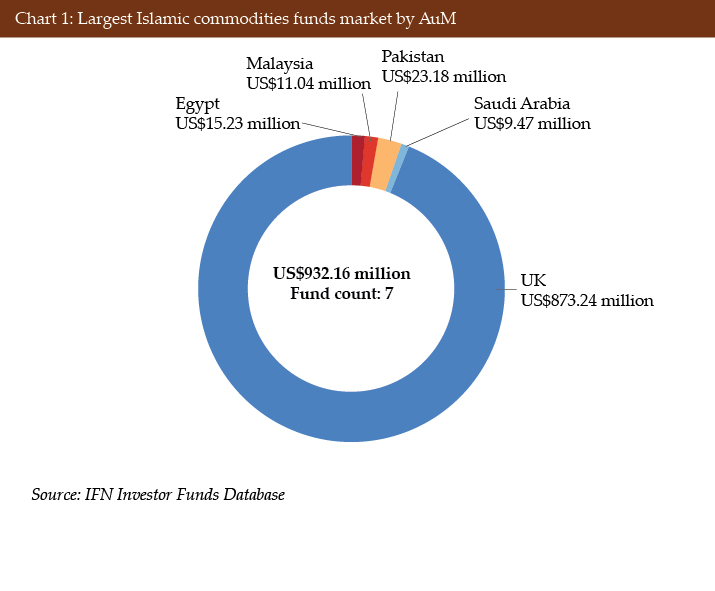

- UK has the largest Islamic gold fund and holds more than 90% the total global value.

- Asia shows the greatest percentage growth in the latest quarter.

Overview

Asia Pacific and Europe led growth in Islamic commodities funds in Q2 2024, with Asia Pacific and Europe contributing roughly US$8 million and US$160 million in value respectively. The Islamic commodities funds market value stood at US$932 million as of the 6th August 2024.

Generally, commodities investments as a whole are risky and – to an extent – speculative, where investors are expected to have some understanding on trading and a risky appetite to withstand the volatile nature of this market. IFN Investor database tracked seven commodities funds where metal – gold in particular – is the chosen primary commodity for mutual funds’ investments. A mutual fund with gold as the underlying asset exhibits special properties some investors may seek, such as the liquidity it provides. As seen in UK’s largest gold fund, the advantages include hedging against uncertainty and inflation, the intrinsic value it holds and the low price-trend correlation it has compared to other asset classes.

Clearly, the UK has the most investments in this asset class, all held by a singular fund of the The Royal Mint Responsibly Sourced Physical Gold ETC. This is an asset-backed fund launched in 2020 which tracks the underlying bullion’s price and offers investors investment exposure to the precious metal market. This particular investment also allows investors to withdraw their capital in physical gold.

Pakistan hosts two funds with total assets under management (AuM) of US$23.18 million, held by Meezan Gold Fund and Meezan Tahaffuz Pension Fund. Malaysia carries the TradePlus Shariah Gold Tracker ETF by AHAM capital, Saudi Arabia hosts the Yaqeen Gold Fund and Albilad Gold ETF, and Azimut from Egypt with its AZ-Gold Fund. All these funds invest in gold.

AuM growth

In Q2 2024, Islamic commodities funds in Asia Pacific experienced the greatest growth in AuM at 30.4%, followed by Europe with a 22.18% increase. The values of Islamic commodities funds in the Middle East and Africa region fell by 18.47% and 28.99% respectively.

- Asia Pacific: Up by 30.4% from US$26.24 million to US$34.22 million.

- Europe: Up by 22.18% from US$714.7 million to US$873.24 million.

- Middle East: Down by 18.47% from US$11.62 million to US$9.47 million.

- Africa: Down by 28.99% from US$ 21.44 million to US$15.23 million.

The Americas do not have any Islamic commodities funds at the time of writing.

Table 1: Top performing Islamic commodities funds by region in Q2 2024

| Region | Fund | Fund manager | Three-month returns (%) |

| Asia Pacific | Meezan Gold Fund | Al Meezan Investment Management | 8.47 |

| Europe | The Royal Mint Responsibly Sourced Physical Gold ETC | HANetf Management Limited | 5.17 |

| Middle East | Albilad Gold ETF | Albilad Capital | 9.87 |

Source: IFN Investor Funds Database

Regulatory development

Commodities trading under Shariah principal rulings demands its own set of guidelines. Malaysia stood out as a great example with the establishment of Busa Suq al-Sila’(BSAS), a commodity trading platform dedicated to facilitate Islamic liquidity management. The BSAS project is a collaboration between Malaysia’s central bank, Securities Commission Malaysia and Bursa Malaysia, the Malaysian bourse.

The commodity Murabahah (CM) contract based on Tawarruq, a cost-plus sale of commodities on a deferred basis, is the most prevalent structure for commodities trading with the participation of four different parties. The structure meets the Shariah principle where all the commodities being traded must exist and the commodity ownership belongs to the seller.

CM is not without its challenges, as argued by Shariah scholars. The Majma’ Rabitah al-Alam al-Islami (Muslim World League) have announced that the modern Tawarruq resembles an interest-based dealing. The Tawarruq arrangement has since been reviewed by multiple scholarly bodies such as the Bank Negara Malaysia’s Shariah board, Kuwait Finance House and Dubai Islamic Bank – with each issuing their recommendations and views on the arrangement to maintain the permissibility of CM.