Malaysia’s Strategic Co-Investment Fund (CoSIF) initiative is opening up applications from the 2nd May 2025 to attract private investors via seven P2P and equity crowdfunding (ECF) platforms to support rising businesses in 21 identified economic sectors.

The ECF platforms are pitchIN; Mystartr; Leet Capital and Crowdo, while the P2P platforms are Funding Societies Malaysia, CapBay and B2B Finpal. All are registered with the Securities Commission Malaysia (SC) – where Leet Capital, Crowdo and B2B Finpal offer only conventional investing offers.

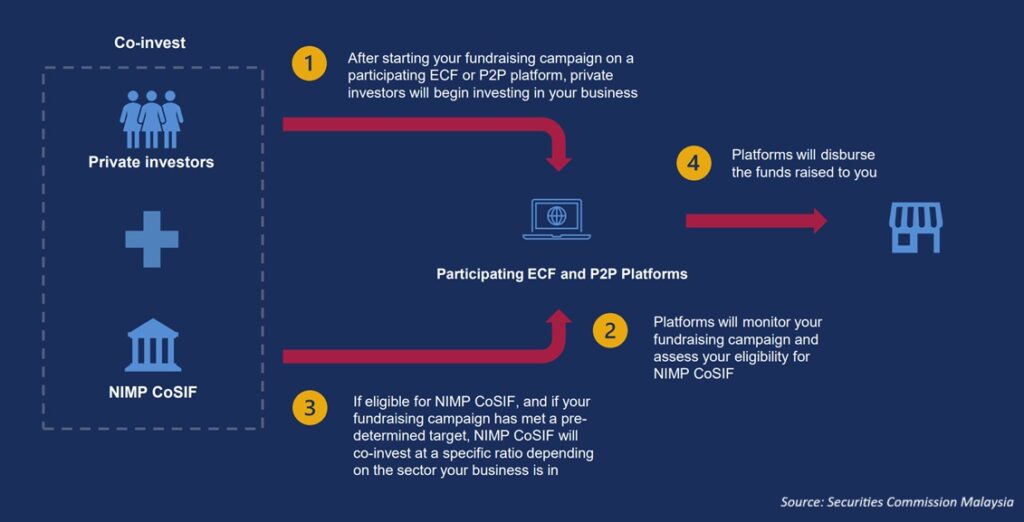

Applications for these investment opportunities – both Shariah compliant and conventional – will start only after the target businesses have already run fundraising campaigns on the respective platforms. Once an undisclosed fundraising target has been reached, the CoSIF portion may be implemented.

Chart 1: CoSIF investment process flow

To qualify for CoSIF, the firms must have a shareholders’ fund of over RM2.5 million (US$567,200) or engage 75 or more fulltime paid employees for manufacturing concerns. A firm not involved in manufacturing can seek exemptions from this criteria.

The CoSIF initiative is led by Malaysia’s Ministry of Investment, Trade and Industry while the fund is administered by the SC – with an initial allocation of RM131.5 million (US$29.82 million) to prioritize growth in 21 economic sectors given focus in the nation’s New Industrial Master Plan (NIMP) 2030.

NIMP 2030 focuses on easing capital market financing access for local SMEs and mid-tier companies. The total co-investment amount in any company, or a group of related companies, cannot exceed 10% of the total NIMP CoSIF funds.

In Malaysia’s five priority sectors – aerospace, chemical, electrical and electronics, pharmaceutical plus medical devices – the government to private co-investment ratio is set at 1:2, with a RM10 million (US$2.27 million) maximum for each campaign.

A similar co-investing principle will apply for what Malaysia separately identified as four new growth sectors of carbon capture, utilization and storage, electric vehicles plus renewable energy and advanced materials.

A lower co-investment ratio of 1:4 and a RM5 million (US$1.13 million) maximum for each campaign will apply for the following 16 economic sectors:

- Digital and information and communication technology,

- Automotive,

- Food processing,

- Global services and professional services,

- Halal,

- Machinery and equipment,

- Manufacturing related services,

- Metal,

- Mineral,

- Palm oil-based products,

- Petroleum products and petrochemicals,

- Rail,

- Rubber-based products,

- Shipbuilding and ship repair,

- Textile, apparel and footwear, plus

- Wood, paper and furniture.

Also read: Malaysia unveils new co-investment fund