Key Highlights

- 10.05% of global Islamic funds AuM is managed by the US.

- S&P Global Shariah indices are widely used in the Islamic financial market.

- The US hosts 21 Islamic funds whereas Canada houses 6 Islamic funds.

Overview

While recent years have seen a number of Islamic financing initiatives introduced in the northern American nations of Canada and the US, it still isn’t clear whether it is ethical or religious ethos that would be the bigger influence in driving this industry’s growth.

Measuring the potential demand for Islamic financial services in the US presents a challenge. The US Census Bureau does not include religious affiliations in its annual or decennial analyses, resulting in a lack of official statistics on the number of Muslim Americans. However, according to a Pew Research Center study, it is estimated that approximately 3.45 million Muslims reside in the US, comprising about 1.1% of the total US population.

Islamic finance in Canada may also not seem to be at the forefront of demand, with total Muslims at 1.5 million, or 4% of the total population, not yet a major consumer base. But, taking note of Islam as the second largest religion in the country, the private sector in Canada has produced a variety of Shariah compliant investments and solutions – which have resulted in increasing interest from both domestic and international investors.

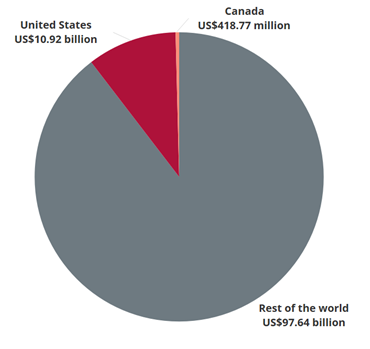

Consequently, the Islamic finance market in North America had shown substantial growth in recent years. The IFN Investor Fund Database reports a total of 21 Islamic funds in the US, with a total of US$10.92 billion as of the end of Q2 2024. This accounts for 10.05% of Islamic funds managed around the globe. To date, there are over 15 Islamic financial services that operate on an interest-free basis – which includes local community banks such as Devon Bank, the Bank of Whittier and LARIBA. There are no national Islamic finance institutions but rather they are operated on a state level.

Chart 1: Islamic funds market in the US and Canada

The size of Islamic finance market in Canada is comparably lower to the US. According to the IFN Investor Fund Database, as of Q2 2024, there are six Islamic funds in Canada totaling US$418.77 million. As Canada’s Muslim population grows, the country has seen the emergence of Islamic financial institutions like Bank Fair, Aya Financials, and the Royal Bank of Canada, all offering halal investment opportunities to the public.

Regulatory framework

In the US, unlike in many Islamic countries, there is no central authority overseeing the compliance of transactions or products with Shariah principles, nor regulating in the appointment of Shariah professionals or the composition of Shariah boards. Islamic financial institutions (IFIs) in the US are not mandated to establish their own Shariah supervisory boards; instead, they may collaborate with the Shariah Board of America or other scholars such as those from American Muslim Jurists Association. Some well-known Shariah advisory boards in the US include those associated with major Islamic banks and financial institutions operating in the country. The Federal Reserve of the US allows American financial institutions to provide Shariah compliant products in overseas markets, where such offerings are required or essential for the institution to remain competitive.

In 1997, the Office of the Comptroller of the Currency (OCC) approved Ijarah and Murabahah structures for home financing and retail financial products, citing their equivalence to conventional products. The New York State Banking Department also endorsed Ijarah in 1999, agreeing with OCC’s assessment that it parallels secured real estate lending. Murabahah was approved by OCC, recognizing banks as riskless principals. These structures have since gained federal and state approval. Musharakah is used by nonbank lenders due to its requirement to mimic debt transactions. Freddie Mac and Fannie Mae began purchasing Islamic mortgages in 2001 and 2003, supporting liquidity, with companies like LARIBA, Bank of Whittier, and Guidance Residential offering Ijarah and Murabahah home financing.

Similarly in Canada, there isn’t a specific regulatory body for Islamic finance. Instead, Islamic financial products and services are typically regulated under existing financial regulatory frameworks that oversee banking, insurance and securities. This means that institutions offering Islamic finance products in Canada must comply with the regulations set by the Office of the Superintendent of Financial Institutions (OSFI) for banks and federally regulated insurers, and provincial securities commissions for investment products. These entities ensure that financial products, whether conventional or Islamic, adhere to Canadian regulatory standards.

Some of the challenges faced in Canada regarding Islamic finance is the lack of knowledge around Shariah compliant products. Many years ago, the Royal Bank of Canada ventured into this movement of offering Shariah compliant products but the bank experienced lack of demand then. Now, market trends in Canada have shifted and most financial institutions are looking into incorporating Islamic finance into their offerings.

Investment market

Shariah compliant investing has experienced substantial growth in recent decades, fueled by increasing demand within the Islamic investment community for more sophisticated financial options. In the US, a well-established capital market features various Shariah compliant indices such as those from Dow Jones, FTSE and S&P Global. Due to the absence of specific legal or regulatory frameworks for Islamic finance in the US, these initiatives primarily stem from private sector endeavors. The US Shariah indices enjoy widespread recognition and are integral to numerous global investment funds.

In the US, Shariah compliant investment opportunities are accessible through licensed fintech firms and financial institutions offering specialized Islamic financial services. Leaders in this sector, like JP Morgan and Saturna Capital, provide Islamic products that are publicly tradable. Shariah compliant equities are actively traded on prominent US exchanges such as the New York Stock Exchange and Nasdaq.

Similarly, in Canada, Islamic financial products are typically traded on the Toronto Stock Exchange (TSX). Canada also boasts its Shariah compliant index known as the S&P/TSX 60 Shariah Index, comprising 60 large-cap stocks listed on the TSX. This index holds global recognition among Islamic finance professionals and investors, offering a transparent benchmark for Shariah compliant investing in Canadian equities.

Asset management

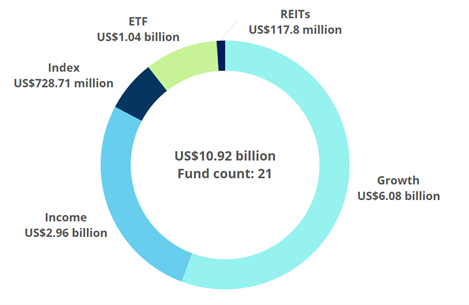

According to data from the IFN Investor Fund Database, the market for Islamic fund management in the US is valued at approximately $10.92 billion as of end of the second quarter of 2024. While the US may not lead in terms of the number of funds, it holds significant dominance in terms of AuM, accounting for 10.4% of the global AuM excluding Iranian funds. Growth funds represent the largest category in the US market with seven funds, followed by income funds and ETFs, each with six funds respectively. There is only one REIT and Index fund each.

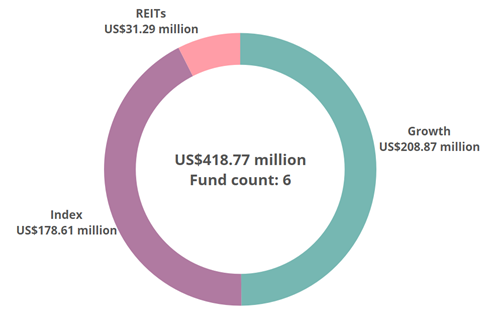

The Canadian Islamic fund market was valued at US$418.77 million as of the end of Q2 2024. The market comprises six funds, distributed across three different fund types: three growth funds amounting to US$206.87 million, two index funds totaling US$178.61 million, and one REIT fund valued at US$31.29 million.

Chart 2: Islamic fund breakdown by fund type in the US

Chart 3: Islamic fund breakdown by fund type in Canada

In 2024, GFH Partners, the real estate asset management division of GFH Financial Group based in Dubai, unveiled its seventh logistics and investment fund in the US. This fund, valued at US$300 million, encompasses a portfolio of 25 industrial assets.

Table 1: Top five performing Islamic funds in the US as of Q2 2024

| Fund | Fund manager | Three-month returns (%) |

| SP Funds S&P Global Technology ETF | ShariaPortfolio | 15.90% |

| Iman Fund | Allied Asset Advisors | 13.41% |

| SP Funds S&P 500 Sharia Industry Exclusions ETF | ShariaPortfolio | 11.04% |

| Wahed FTSE USA Shariah ETF | Wahed Invest | 4.74% |

| SP Funds S&P World ETF | ShariaPortfolio | 4.66% |

Source: IFN Investor Fund Database

Outlook

In recent years, there has been a notable shift from actively managed Shariah compliant mutual funds to passive index-based investing. Many of these Islamic index funds, which initially gained prominence in Islamic financial hubs like Malaysia and Saudi Arabia, have expanded their presence into North America and Europe. This expansion is evident as these funds are now listed on major trading platforms such as the New York Stock Exchange and the London Stock Exchange, underscoring the growing value and accessibility of Shariah compliant investment options. Islamic finance in the US and Canada is steadily growing. The Muslim community’s influence has led financial institutions to develop products that adhere to both state and federal regulations. Moreover, there is a growing interest in ethical investing across North America, accompanied by greater awareness of Islamic finance principles. This has created opportunities for the launch of new Shariah compliant funds in the region, leveraging established US-based Shariah indices like those from Dow Jones and S&P.