Key highlights

- Qatar’s Islamic assets increased yoy by 3.3% in 2023, reaching US$180 billion

- Infrastructural spending, especially on LNG, has slightly affected equities growth

- Central bank roadmap focuses on development of innovative Islamic financial products

Overview

Qatar is one of the wealthiest countries, primarily due to its substantial reserves of oil and natural gas. Holding more than 15% of the world’s proven natural gas reserves, this vast energy resource has fueled significant economic growth for Qatar and led to the amassing of considerable wealth for its population of over 2.9 million.

This nation experienced a remarkably rapid installation of modern infrastructure and a boost in tourism from hosting the FIFA 2022 World Cup tournament. Additionally, strategic hedging policies were implemented to ensure banking and financial stability, resulting in improved capitalization, liquidity and profitability for banks.

By 2023, the Qatari economy had returned to its usual growth trajectory, driven by prudent macroeconomic policies and substantial structural reforms aimed at addressing global crises and economic fluctuations. Notably, the expansion of the North Field projects generated a financial surplus and positively impacted the services, logistics, industry, and trade and finance sectors.

Islamic finance in Qatar is diverse, consisting of four main sectors: Islamic banks, Islamic finance companies, Takaful insurance companies and Islamic investment companies – providing Islamic products represented in Sukuk, Islamic investment funds and indices.

According to Bait Al-Mashura Financial Consulting 2023 report, Qatar’s Islamic finance assets increased by 3.3% year-on-year (yoy) from 2022, reaching QAR656 billion (US$176.3 billion) as at 31st December 2023.

Islamic banks were the primary contributors, with their holdings accounting for 87.6% of these assets. Sukuk followed with 11.1%, while Takaful insurance companies made up 0.7% of the total. Investment funds and other Islamic financial institutions contributed the remaining 0.6%.

Regulatory framework

Operating under the direct supervision of Qatar Central Bank (QCB), Islamic finance activities carried out by local institutions must adhere to regulations set within the Qatar Financial Centre (QFC) framework.

In 2012, the QCB introduced regulations that prohibited conventional banks from operating Islamic windows. This directive required conventional banks to discontinue all Islamic finance products and transfer any existing Islamic liabilities to Islamic banks.

In November 2023, the QCB unveiled its Third Financial Sector Strategic Plan 2024-2030. This plan is designed to reduce costs within the financial services sector, offer clear guidance, support the development of innovative Islamic financial products, and raise awareness of Islamic finance. It is built around four key strategic pillars: banking, insurance, digital financing, and capital markets.

Bait Al-Mashura Financial Consulting, licensed by the QCB, is the first officially-recognized entity to offer financial and investment advice, as well as legal audit services, to Qatar’s financial and banking sectors.

The QFC is set to introduce a digital asset framework to legally recognize digital assets and support the country’s digital economy strategy. This initiative responds to growing interest from technology firms and industry stakeholders.

The new framework will facilitate the tokenization of various real-world assets – such as securities, debt instruments, capital market products, sukuk and other asset classes. The QFC plans to complete and put into action this framework by the fourth quarter of 2024, with the goal of advancing Qatar’s digital economic strategy and strengthening the QFC’s position as a premier financial and business hub in the Middle East.

Capital investment markets

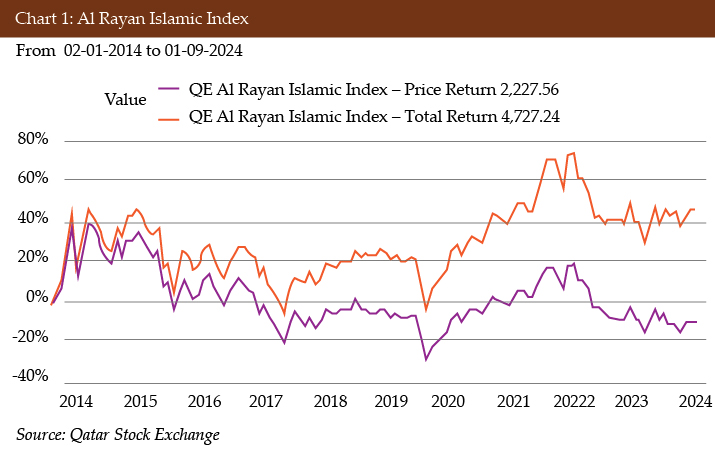

The Qatar Stock Exchange (QSE) introduced its first Islamic index, the QE Al Rayan Islamic Index, in 2013. This index monitors the trading liquidity and market capitalization of listed company shares on the QSE. It operates as a total return index, reflecting both price performance and the reinvestment of dividends from the shares of listed companies.

In 2023, the Al Rayan Islamic Index saw a rise of 3.76%, ending the year at 4,763.91 points, an increase of 172.45 points from 2022. The expansion of the Islamic stock market was highlighted by the listing of two companies on the QSE: Dukhan Bank and Damaan Islamic Insurance Company (Beema).

The chart below shows a comparison between the total return and the price return of the Al Rayan Islamic Index, highlighting how the overall performance of the index benefits from additional income sources.

Asset management

The IFN Investor Fund Database lists four equity funds based in Qatar with a total value of US$255.77 million. Among them, two are managed by Al Rayan Investment, an investment bank specializing in asset management and financial advisory services.

The Al Rayan GCC Fund, inaugurated on September 2009, stands as Qatar’s largest mutual fund and the world’s largest Shariah compliant GCC fund, with assets totaling US$109.35 million as of 30th June 2024. This fund adopts a medium-term value investment strategy, focusing on GCC-listed equities and fixed income instruments.

Alongside, the Al Rayan Qatar ETF, valued at US$119.08 million as of the same date and listed on the QSE, aims to mirror the performance of the leading Shariah compliant stocks in Qatar.

The Al Bait Al Mali Fund, another open-end investment fund, concentrates on Shariah compliant equities listed on the QSE, amounting to US$93.45 million in assets by 30th June 2024. Launched in September 2006, this fund marked Qatar’s pioneering Shariah compliant investment vehicle.

Lastly, the TFI Securities Fund, also Shariah compliant and open-end, is listed on the QSE with assets totaling US$6.27 million as at the same date.

Table 1: Islamic funds in Qatar as at Q2 2024

| Fund Name | Fund Manager | Fund Type | Asset Class | AuM USD (million) |

| Al Rayan GCC Fund | Al Rayan Investment | Growth | Equities | 109.35 |

| Al Rayan Qatar ETF | Al Rayan Investment | ETF | Equities | 119.08 |

| Al Bait Al Mali Fund | Qatar National Bank | Growth | Equities | 93.45 |

| TFI Securities Fund | Dukhan Bank | Growth | Equities | 6.27 |

Source: IFN Investor Funds Database

Outlook

Islamic finance in Qatar is experiencing rapid growth, with double-digit increases year-on-year. However, the focus on infrastructural spending has slightly affected equities, as cashflow shifts with Qatar’s plans of significant investments in expanding its liquefied natural gas (LNG) facilities. Qatar, a top global LNG exporter alongside Australia and the US, aims to boost its annual output from 77 million tons to 142 million tons by 2030 through a three-phase expansion.

Additionally, Qatar is constructing the world’s largest ethylene cracker and expanding its ammonia plant starting in 2025. These developments are expected to drive Qatar’s GDP growth by 50-60% by 2030, creating opportunities for medium-to-long-term investors to invest in Qatar equities, which are currently valued at multi-year lows.