Key Highlights

- The Financial Sector Conduct Authority and Prudential Authority oversee the Islamic regulatory landscape

- South Africa is a leader in the investment market across the African region, comprising a total of 36 Islamic investment funds

- Equity funds dominate as the largest asset class in South Africa

Overview

Known for its robust conventional financial services in Africa and its well-developed banking system and regulations, South Africa has a population exceeding 62 million, with 3% being Muslim. Despite this relatively small population, services related to Islamic finance have become significant over the past decade, with various initiatives gaining traction.

South Africa’s debut US$500 million debut Sukuk issuance in 2014, a first for the continent, was fully redeemed in 2020 and while this nation has also issued in the local rand currency, its impact is relatively muted. According to a recent S&P analysis report, “the complexities and evolving Islamic legal requirements related to Sukuk issuance, hamper the success of the instrument and make African sovereigns hesitant to use Sukuk to fund large infrastructure projects”.

Even so, there is a growing commitment to promoting Shariah compliant financial products. South Africa’s regulatory framework – alongside its diverse financial ecosystem – has facilitated the development of the Islamic asset industry, seeking to position it as an attractive option for both local and international investors.

Regulatory framework

In South Africa, the regulatory framework for Islamic finance is primarily overseen by the Financial Sector Conduct Authority (FSCA) and the Prudential Authority, both of which operate under the auspices of the South African Reserve Bank. These authorities are tasked with ensuring the stability, transparency and integrity of the financial sector, while also safeguarding consumer interests.

The South African investment framework provides a conducive environment for Shariah compliant funds. Key regulatory instruments include the Collective Investment Schemes Control Act, which governs the establishment of mutual funds, and the Banks Act, which regulates banking institutions.

There are no fixed regulations specific to Islamic finance. This jurisdiction lacks a centralized Shariah board at the national level. However, Islamic banks and institutions rely on the internal Shariah boards or independent advisory committees on the compliance of their operations. These boards consist of qualified scholars who provide guidance on Shariah compliant products and investment strategies.

Investment funds that are Shariah compliant in South Africa are subject to the same regulatory requirements as conventional funds, without specific provisions distinguishing them solely as Islamic. The focus remains on ensuring legal compliance and investor protection, with the FSCA emphasizing transparency and ethical conduct in financial dealings.

Investment market

South Africa offers a variety of Shariah compliant investment options that are readily accessible for public trading. Through the Johannesburg Stock Exchange (JSE), investors can access the equities market, the commodities market, REITs, ETFs, derivative market, structured products and more. The JSE has actively facilitated the listing of Shariah compliant securities, contributing to the overall growth of the Islamic assets sector.

Among the major players in South Africa providing mutual funds’ investments, six asset managers offer Islamic private retirement funds (PRFs), governed by Regulation 28 under the Pension Funds Act. The PRF aims to be highly transparent in terms of its source of money and the asset classes the funds are investing in, as well as promoting asset diversification. This greatly reduces risk and uncertainty which is encouraged in Shariah.

Asset management

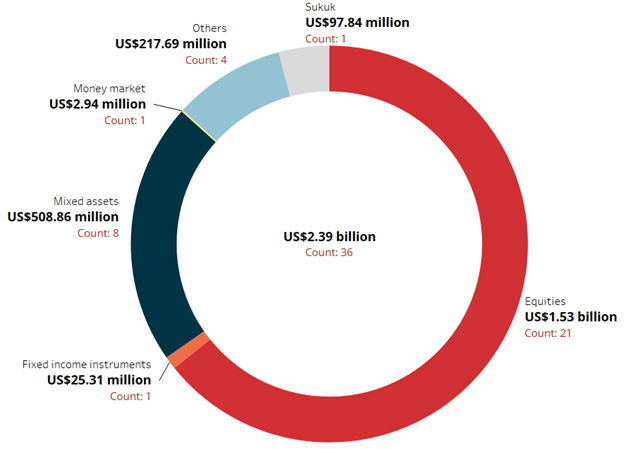

The IFN Investor Funds Database highlights South Africa as the leader in investment funds across the African region, surpassing Nigeria and Egypt. South Africa hosts a diverse array of 36 Islamic investment funds, encompassing growth, income and retirement funds. As of Q3 2024, the total assets under management (AuM) in South Africa amount to US$2.39 billion, representing 1.75% of the global Islamic funds market.

Equity funds dominate as the largest asset class in South Africa, comprising 21 funds totaling US$1.53 billion, which accounts for 58.33% of the total AuM. Mixed asset funds follow with eight funds totaling US$508.86 million. Additionally, there is a fund each for Sukuk, fixed income and the money market, with respective AuM of US$97.84 million, US$25.31 million, and US$2.94 million.

Chart 1: Islamic investment funds in South Africa by asset class

Source: IFN Investor Fund Database

Table 1: Largest Islamic funds in South Africa in Q3 2024

| Fund | Fund manager | AuM (US$ million) |

| Oasis Crescent Equity Fund | Oasis Crescent | 312.01 |

| Old Mutual Albaraka Balanced Fund | Old Mutual Unit Trust | 301.09 |

| Islamic Balanced Fund | Camissa Asset Management | 234.05 |

| Old Mutual Global Islamic Equity Portfolio | Old Mutual Unit Trust | 188.50 |

| Oasis Crescent Income Fund | Oasis Crescent | 176.11 |

Source: IFN Investor Funds Database

The five largest South African funds, with a combined value of US$1.12 billion, make up roughly 47% of all Islamic funds AuM combined in the nation. The fund managers are also the three largest, managing 86% of all Islamic funds AuM hosted within the nation.

On the 19th September 2024, Satrix, a provider of index tracking solutions, launched its inaugural Islamic ETF with offshore exposure, the Satrix MSCI World Islamic ETF. This ETF is to be listed on the JSE on the 22nd October 2024. It tracks the MSCI World Islamic Index, which measures the performance of large and mid-cap companies from 23 developed markets.

Outlook

Despite the strong Islamic investment foundation and landscape, the World Bank noted that high crime rates, electricity shortages and logistics bottlenecks continues to be a problem for South Africa. The organization was also bearish on the growth prospect for the year 2025 and the current forecast is for continuance of the already weak growth in 2024.

The country’s well-established financial institutions and regulatory bodies continue to foster an environment conducive to Islamic finance, enhancing its appeal to a broad range of investors globally. That said, the South African Islamic finance landscape’s growth could face continued headwinds if investor’s confidence cannot be enhanced – given that the government still has much to accomplish for the nation to provide uninterrupted basic needs and infrastructures.

In summary, South Africa’s Islamic finance regulatory framework is evolving, driven by a combination of strong oversight from regulatory authorities, the establishment of Shariah compliance mechanisms, and growing interest from both domestic and international investors. This environment positions South Africa as a burgeoning center for Islamic finance on the African continent, offering diverse investment opportunities tailored to ethical and responsible finance principles.

This report was produced by Aravinth Rajendran and Elliot Yip, financial data analysts at IFN Investor.