Launched on the 16th September 2024, the open-ended Cur8 USD Income Fund is aimed at individuals and corporations seeking a Shariah compliant, relatively low-risk investment option to lock away capital and receive semiannual returns.

Subscriptions are open only to certified high-net-worth individuals, including those classified as being professional or sophisticated investors, and institutions with net assets of at least GBP5 million (US$6.55 million).

Investment Manager Fahim Rahman told IFN Investor: “We have chosen to steer the fund toward consumer finance and working capital investment opportunities in US dollar-denominated growing economies.

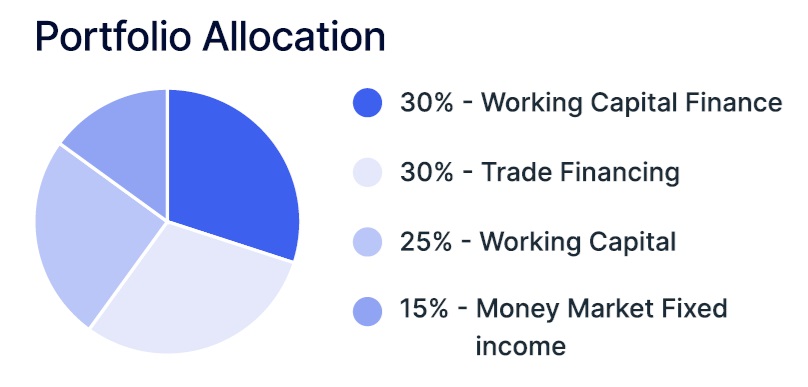

“These markets are ripe with growth potential, we have identified a significant gap in ethical, Shariah compliant financing for entrepreneurs and businesses. By concentrating on securitized consumer financing, working capital and trade finance investments, the fund aims to foster financial accessibility for individuals, businesses, and communities.”

The investment instrument is a Wakalah note (Shariah compliant financing note offering a fixed coupon) with a minimum US$5,000 (US$6,547) commitment, where profits are taxed as interest under UK laws.

“While the US market is a key focus, we are also partnering with entities in the UAE, CIS region and the UK. This approach helps diversify risk across multiple markets, all while operating in regions where the US dollar is a dominant currency.”

Explaining how each of the fund’s investment focus will be implemented, Fahim said the consumer financing portfolio will be in instalment-based purchases – working with experienced providers who have an existing loan book valued over US$100 million and net profits of US$8 million.

For working capital and trade finance, the fund aims to help businesses which experience short-term cash flow challenges while waiting for customer payments. Downside risk is protected by taking security over assets wherever possible, or putting in place guarantees.

“We offer advance payments secured by trade receivables and other physical collateral, such as inventory and real estate, to help bridge this gap. This provides businesses the liquidity they need to keep running smoothly. We also work closely with finance providers globally to offer them funding lines to issue these financings in their local jurisdictions.”

Fahim added that the fund will provide Shariah compliant bridge financing to a US-based entity where the management has previously built a loan book over GBP5 billion (US$6.55 billion) in value.

Income generation is the primary focus for the fund, with a minimum 8.5% targeted net return via half-yearly distributions. Any capital gains will be passed back through income distributions.

*Disclaimer: The opinions and viewpoints expressed in the Fund Profile do not constitute as a recommendation for any funds highlighted. The information presented is not investment advice and should not be treated as such.

| Cur8 USD Income Fund | |

| Fund manager | IFG.VC – operating commercially as Cur8 Capital |

| Launch date | 16th September 2024 |

| Asset class | Wakalah note for consumer financing, working capital and trade finance |

| Base currency | GBP |

| Initial investment | GBP5,000 (US$6,547) |

| Investment objective | Open-ended fund with regular income generation by investing in debt instruments compatible with Shariah guidelines |

| Benchmark | None |

| Risk profile | Low risk |

| Distribution | Half-yearly, redemption needs three-month notice |