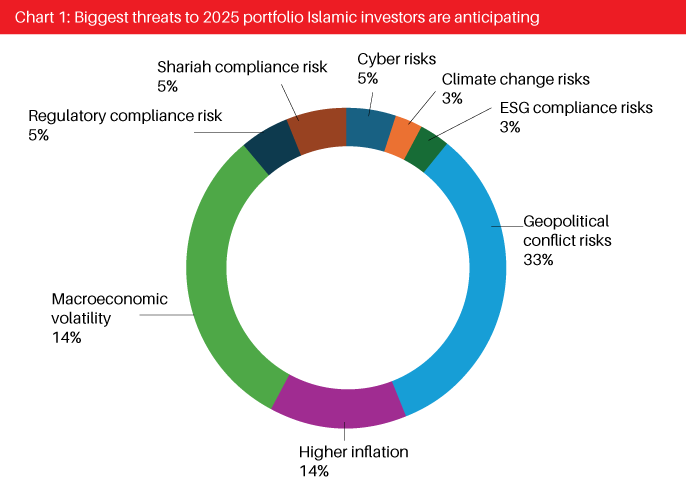

Deepening geopolitical tensions and macroeconomic volatilities have kept investors worried – triggering bouts of selling in stock markets.

With Donald Trump promising to hold his protectionist stance threatening trade tariffs as he steers the world’s largest economy, policymakers and investors are left in a state of flux as greater uncertainties hang, compelling central banks to reconsider their monetary easing policies as they try to delicately balance slowing economic growth and rising inflation.

Speaking to Islamic institutional investors from the GCC, the UK and Southeast Asia, IFN Investor learned that they have all adapted their investment strategies for a higher inflation and higher interest rate environment as they perceive geopolitical conflicts and macroeconomic volatility as the main threats to their portfolios in 2025

Eye of the storm

However, despite the pressures on the investment climate due to persistent and disruptive nationalism and protectionism across the world, Islamic investment managers are still fairly bullish on returns, believing they will be able to beat, or at the very least, price in, market risks so as to not compromise on returns – they expect their portfolios to perform better in 2025, or to deliver similar levels of profits seen in 2024.

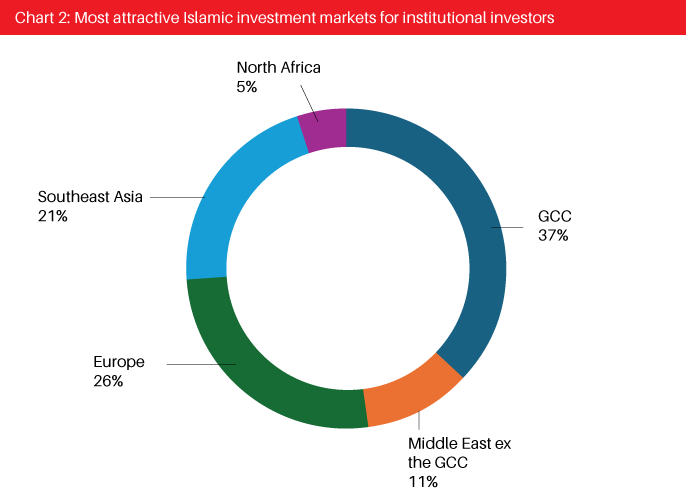

This could be explained by the fact that most of the asset managers interviewed expect the GCC to contribute the bulk of yield appreciation (See Chart 2). This is not only due to the diversity and availability of Shariah compliant avenues in the region, but the fact that the GCC has been largely insulated from tariff impact threats and uncertainty over external demand. The GCC has also shown to be resilient to regional geopolitics despite being close to conflicts of Israel and Iran.

Economists forecast the GCC economy to outperform the 2.5% global average (S&P Global) in 2025: the Institute of Chartered Accountants in England and Wales anticipates the region’s GDP to about double to 4%; First Abu Dhabi Bank expects it to hit 4.2% while the IMF puts the number at 4.7%.

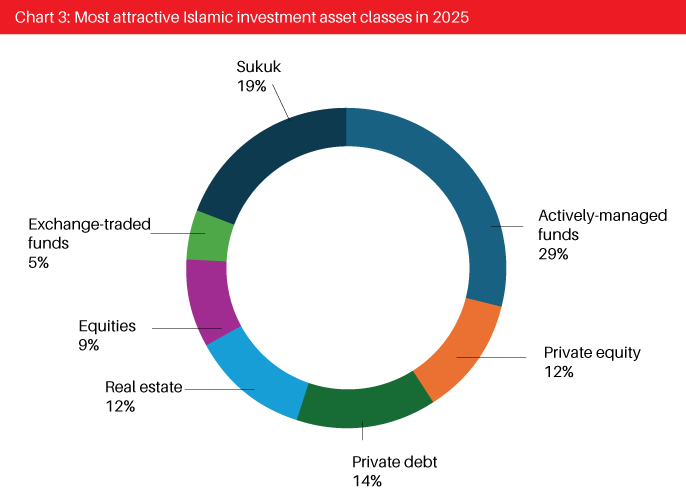

Such optimistic projections are anchored by the region’s economic reforms and robust diversification strategy to reduce its reliance on hydrocarbons, which has been attracting significant foreign direct investments. GCC countries – particularly Saudi Arabia and the UAE – are also ripe with Islamic private equity and Shariah compliant private credit opportunities – which are the top asset classes of interest for the investors we spoke to (See Chart 3).

While Europe may not fare as well as the GCC in terms of economic growth (the European Commission projects a lackluster 1.5% GDP expansion), the asset classes Islamic investors are keen on – such as real estate – in Europe are poised for strong performance this year.

The property market in the UK for example (an Islamic investor favorite), stands to potentially receive an injection of GCC monies in the coming year as London maintains its lure for residential and commercial property capital gains, while other cities such as Liverpool and Manchester also deliver favorable returns.

Given the enduring appeal of Sukuk and actively-managed funds to Islamic investors, it is unsurprising that Southeast Asia is in the top three most favored Islamic investment destination for investors, considering that the region is one of the most prolific Sukuk issuers and providers of Islamic funds.

Comfort in the familiar

It is interesting to note that despite the phenomenal rise of cryptocurrencies as an asset class among conventional investors, Islamic investors are taking a significantly more cautious approach. While some have expressed interest (or intrigue) in crypto assets, none would actually commit capital into digital currencies this year; instead, they are taking a wait-and-see approach.

This is understandable considering how cryptocurrencies still divide Shariah scholars due to their utility and highly speculative nature, despite key Islamic financial markets already regulating digital assets in one form or another. This discrepancy in risk appetite can be illustrated by the sheer difference in the number of Shariah compliant and conventional crypto funds. Out of nearly 900 crypto funds globally (managing about US$56 billion in assets, according to Crypto Fund Research), IFN Investor Fund Database confirmed that there are only three which have been certified Shariah compliant, and together they hold under US$17 million in assets.

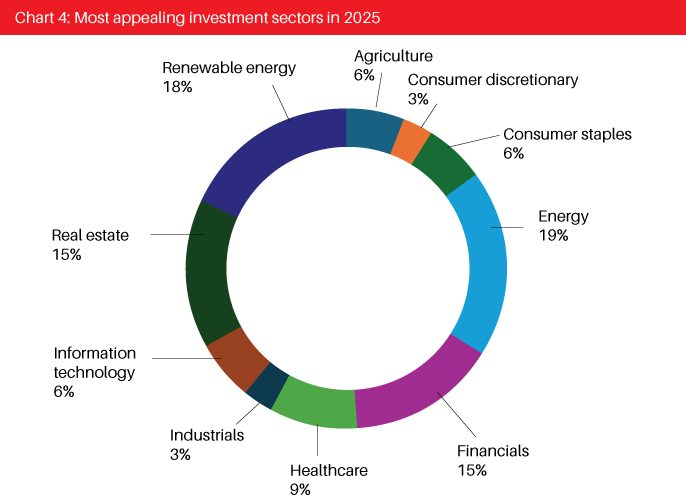

Keeping digital assets at arm’s length, our focus group instead prefers to park their money in tried-and-tested sectors such as energy including renewable energy and real estate (See Chart 4).

Investing in renewables is in line with the Islamic finance industry aligning itself with the wider ESG movement, despite heightening opposition against the latter as anti-ESG sentiment sweeps across the US and Europe.

One Islamic fund manager even noted that the sector needs to be better at integrating charitable-giving vehicles if we want to meaningfully grow the space.

Pursuing alpha

Islamic investors generally are not dissociating themselves from the ESG movement, despite their conventional peers – especially those in the West – being more careful with the ESG label (witnessed by the outflows from ESG-related funds).

Fueled partly by altruism and religious obligations, the majority of Islamic investors are nonetheless prioritizing alpha generation when it comes to sustainable investment.

“Finding an available investment compliant with three perspectives – Shariah, ESG and profits simultaneously, is the biggest challenge we face when it comes to Islamic investments,” shared one investor.

The pursuit of outperforming the market and to sustain “targeted returns and preserve invested capital” is at the top of the agenda with several noting that cost of Islamic products or deals are still an issue while citing the lack of diversity in products. A handful mentioned that educating their clients about Islamic financial instruments remains a priority as poor Shariah finance literacy continues to be a core challenge, particularly in non-traditional markets.

Yet, despite the systemic and macroeconomic challenges Islamic investor face, they are optimistic about the year ahead – most of the fund managers interviewed plan to roll out new products in 2025 – boding well for the growing sector, which currently boasts 2,494 funds and over US$456.56 billion in assets under management as of the end of 2024, according to IFN Investor Fund Database.