Malaysia’s Employees Provident Fund (EPF) declared a total payout of RM10.19 billion (US$2.28 billion) for the pension fund’s Shariah accountholders investments income in 2024, higher than the 2023 Shariah distribution of RM7.48 billion (US$1.68 billion).

Total conventional account payout was RM63.05 billion (US$14.13 billion) in 2024, up from 2023’s RM50.33 billion (US$11.28 billion).

Last year saw the first time that the Shariah income declaration of 6.3% matching that of the conventional pension contributions, after lagging behind since the Islamic option was introduced in 2017.

From an overall investments payout standpoint, the 2024 ratio of conventional to Shariah stood at 63.59% to 10.87% – roughly 6:1 – compared to the 2023 split of 58.97% to 8.02%, or more than 7:1, further cementing the growth of Shariah earnings at EPF.

With 2024 as the first year that the EPF fully separated its conventional and Shariah portfolios to manage these two funds independently, it has allowed each portfolio to optimize its returns through diversification, ensuring assets under the Islamic and conventional schemes are well distributed across distributed across asset classes, geographies, markets, and industries for sustainable returns.

CEO Ahmad Zulqarnain Onn said EPF was ranked as the world’s 13th largest pension fund and the fifth largest in Asia as at September 2024, when its assets valuation then stood at US$247 billion.

EPF did not disclose the split of its total investment asset holdings, which stood at RM1.25 trillion (US$280.06 billion) as at the 31st December 2024, up 10% from RM1.136 trillion (US$254.53 billion) in 2023.

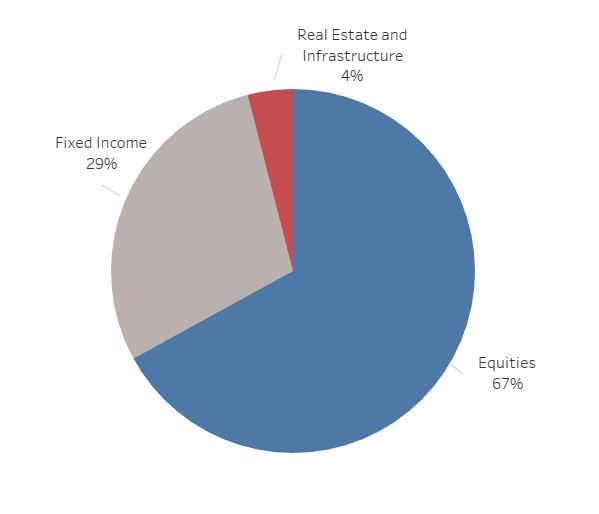

Chart 1: EPF 2024 investment income breakdown

At the end of 2024, 63% of EPF’s assets was invested domestically – which generated RM37.02 billion (US$8.3 billion), or 49.7% of total investment income. Global assets generated income of RM37.44 billion (US$8.39 billion), or 50.3%, of the total investment income recorded.

Ahmad said there should be no change to this domestic and global investments allocation split under EPF’s next three-investment cycle ending 2027.

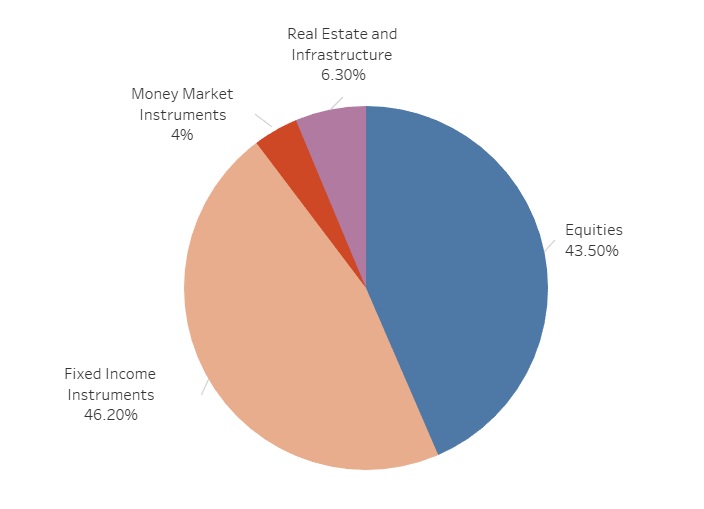

The breakdown of total EPF investments showed the biggest allocation of 46.2% was in fixed income instruments – mainly Malaysian government securities and equivalent, loans and bonds. Another 43.5% was in equities, 4% in money market instruments and 6.3% in real estate and infrastructure.

Chart 2: EPF 2024 investment allocation

Moving forward, Ahmad said EPF estimates around RM5 billion (US$1.12 billion) potentially flowing into the pension fund, once the government mandate is implemented to receive contributions from around two million foreign workers in Malaysia.

Ahmad further noted that only 60% of Malaysians are currently contributing to the EPF, hinting that the pool of available investible funds could potentially grow as more locals sign up. EPF’s membership now stands at 16.22 million at the end of 2024, adding 475,752 last year. But only 8.78 members are now actively contributing to the pension fund.