Key Highlights

- Global Islamic fund AuM stood at US$101.11 billion as at end of Q1 2024

- Malaysia holds the highest number of Islamic equity funds at 217

- In 2023, 38 new funds were launched with a total AuM of US$987.3 million

- Nomura Global Shariah Semiconductor Fund generated the highest return (33.66%) in Q1 2024

Overview

It has been a strong start to the year for global equities. In the first three months of 2024, the S&P Global BMI surged by 7.8% while the S&P 500 jumped by 10.6%, a new record high. Islamic indexes have also outperformed their conventional counterparts: The S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index beat their respective counterparts by 0.8 percentage points and 0.6 percentage points respectively. The S&P Global BMI Shariah Index has historically performed better than the conventional benchmark index nearly 75% of the time over the past 10 years.

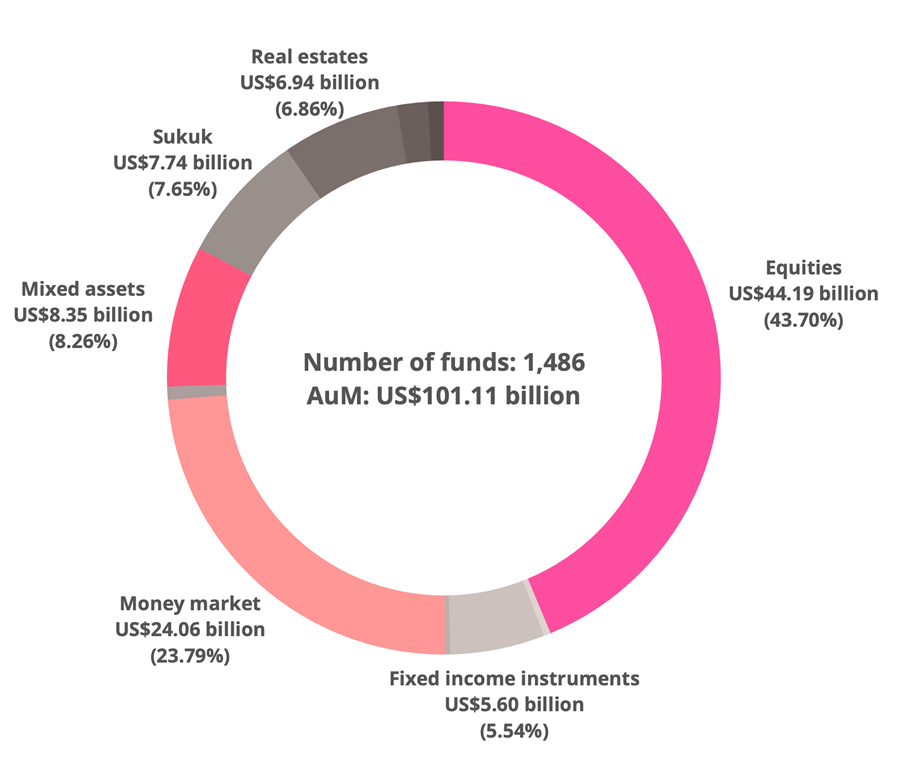

Islamic funds globally, excluding Iran, hold a value of US$101.11 billion. Almost half of Islamic fund assets worldwide is comprised of equity funds. Being the largest asset class at an AuM of US$44.19 billion (43.7%), the Islamic equity fund market is followed by money market funds (23.79%) and mixed assets market funds (8.26%).

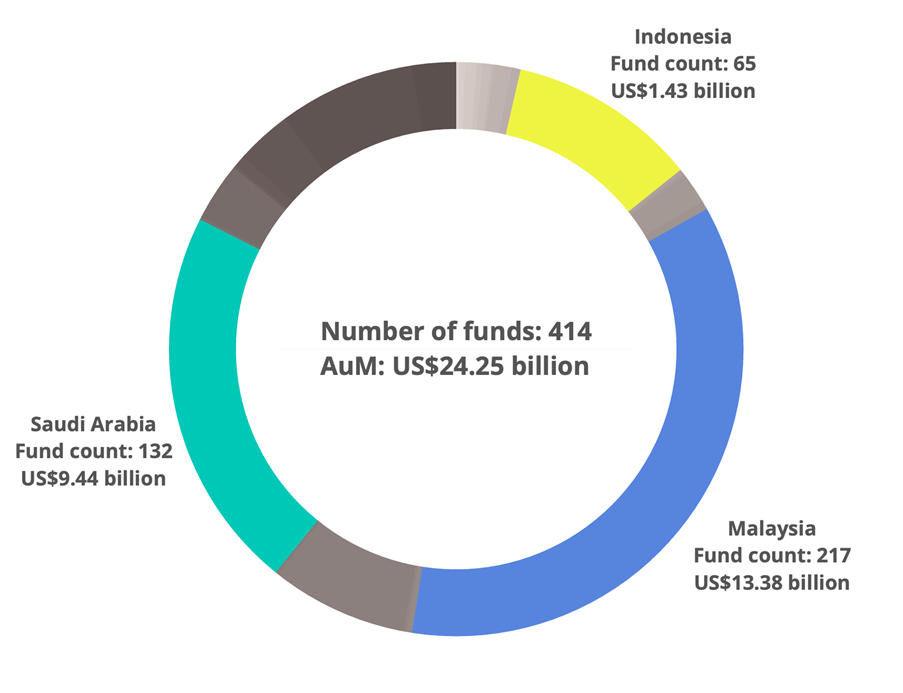

Malaysia houses the largest number of Islamic equity funds as at the end of Q1 2024, followed by Saudi Arabia and Indonesia. Malaysia has 217 equity funds with a total AuM of US$13.38 billion, Saudi Arabia manages 132 funds with total AuM of US$9.44 billion and Indonesia handles 65 funds of US$1.43 billion total AuM.

Source: IFN Investor

In Q1 2024, the number of Malaysian Islamic equity funds increased by eight, AuM rose by US$199.4 million (1.51%). The number Saudi Arabia’s equity fund reduced by two in the same quarter, however, AuM rose US$569.1 million (6.42%).

Source: IFN Investor

AuM growth

On a regional level, Islamic equity fund AuM in the Americas and Africa experienced double-digit growth in a span of three months from the beginning of 2024 until the end of March, while other regions grew modestly.

- Africa: 16.4% to US$1.07 billion from US$920 million

- Americas: 10.87% to US$9.37 billion from US$8.45 billion

- Middle East: 6.12% to US$10.39 billion from US$9.79 billion

- Europe: 4.07% to US$8.1 billion from US$7.8 billion

- Asia Pacific: 0.7% to US$15.24 billion from US$15.14 billion

ROI analysis (Three-month returns)

Table 1: Top performing Islamic equity funds in Q1 2024

| Region | Fund Manager | Fund | Three-month returns (%) |

| Asia Pacific | Nomura Asset Management Malaysia | Nomura Global Shariah Semiconductor Fund | 33.66 |

| Middle East | Alinma Investment | Alinma Saudi Equity Fund | 24.37 |

| Europe | Franklin Templeton | Franklin Templeton Technology Fund | 18.6 |

| Africa | Hermes Fund Management (EFG Holdings) | Faisal Islamic Fund | 22.33 |

| Americas | ShariaPortfolio | SP Funds S&P Global Technology ETF | 15.9 |

New players and products

Year 2023 witnessed 38 new Islamic equity funds launched, with total AuM amounting to US$987.3 million as of the 31st March 2024. Sixteen of such funds originated in the Middle East accounting for 75.8% (US$748.8 million) of total AuM, Europe accounts for another 12% (US$119 million) and Asia Pacific at 6.7% (US$65.73 million).

In March 2023, S&P Dow Jones Indices partnered with the Australia Securities Exchange (ASX) to introduce the first Australian Shariah compliant series of benchmarks to the market due to increase demand and expanding Muslim population in Australia. The S&P/ASX have replaced the globally recognized S&P Global BMI Shariah index for the Australian market.

Notable regulatory development

- China has tightened its guidelines on the stock market for new listings, requiring new companies to disclose their dividend policies, limiting shareholders from liquidating their position for underperforming companies, all amid the country’s poor recovery from the pandemic.

- Banks in the US also experienced greater regulatory intensity, as well as new regulations for artificial intelligence and machine learning.

- Regulatory bodies worldwide are pushing toward faster settlement time and realizes the advantages it poses, specifically for the US, India, Canada and Europe.

- The UK reformed its IPO regime, giving the Financial Conduct Authority more power to decide whether a prospectus is required for new public offerings.

This report was produced by Elliot Yip and Aravinth Rajendran, financial data analysts at IFN Investor.