ETF Bureau aims to expand its offerings of Shariah compliant exchange-traded funds (ETFs) while continuing to educate investors, particularly in the Middle East, about the benefits of the asset class, building on the success of its current Islamic ESG real estate investment trust (REIT) offering.

“We believe this is the future — the combination between technology with real estate,” CEO Mohammed Alswaidan shared with IFN Investor.

ETF Bureau is counting on the tri-filtered algorithm in its RITA ETF to pick an unrivaled combination of REITs for Shariah investors worldwide.

Officially known as the ETFB Green SRI REITs ETF, the New York Stock Exchange-Arca-listed RITA picks quality dwellings, office towers and other properties that run through filters for financial performance, Shariah compliance and green sustenance, Mohammed explained.

“We went to the real estate sector because we believe that real estate is the most beloved asset class among all investors and that real estate is safer than other asset classes.”

“Furthermore, there are very limited players in the Shariah compliant global REITs ETF market at the moment, so we would like to fill that gap.”

RITA has received Shariah approvals from multiple scholars across Saudi Arabia, the GCC and Malaysia, ensuring global acceptance from Islamic investors for the product.

Eliminate and replace

The ETF’s portfolio currently comprises 43 REITs diversified across eight developed countries, including the US, the UK, Japan and New Zealand. The number fluctuates quarterly based on the filtering process, Mohammed explained.

“Any REIT that has been changing positions from a performance perspective, Shariah perspective or green perspective, we exit that REIT within 90 days, or we capture a new REIT that has been listed within 90 days.”

The quarterly rebalancing ensures that RITA consistently holds REITs that meet all three demanding criteria, Mohammed stressed.

For instance, in the final quarter of 2024, the ETF had 51 REITs and prior to that, around 60. The current number, the CEO clarified, was not a reflection of demand but rather a testament of RITA’s commitment to quality.

“Our filters keep eliminating REITs that can’t meet the performance, Shariah and green standards that have been set, and we’re a completely passive manager who follows the system.”

“There are 950 REITs available in the market… We believe this [the 43] is the premium.”

Launched in December 2021, RITA tracks the performance of the FTSE EPRA Nareit Ideal Ratings Developed REITs Islamic Green Capped Index.

That is a collaborative benchmark comprising the FTSE, or UK’s Financial Times Stock Exchange 100 Index; the EPRA, or European Public Real Estate Association; the US Nareit, or National Association of Real Estate Investment Trusts; Shariah-based and SLAM, a green building rating system.

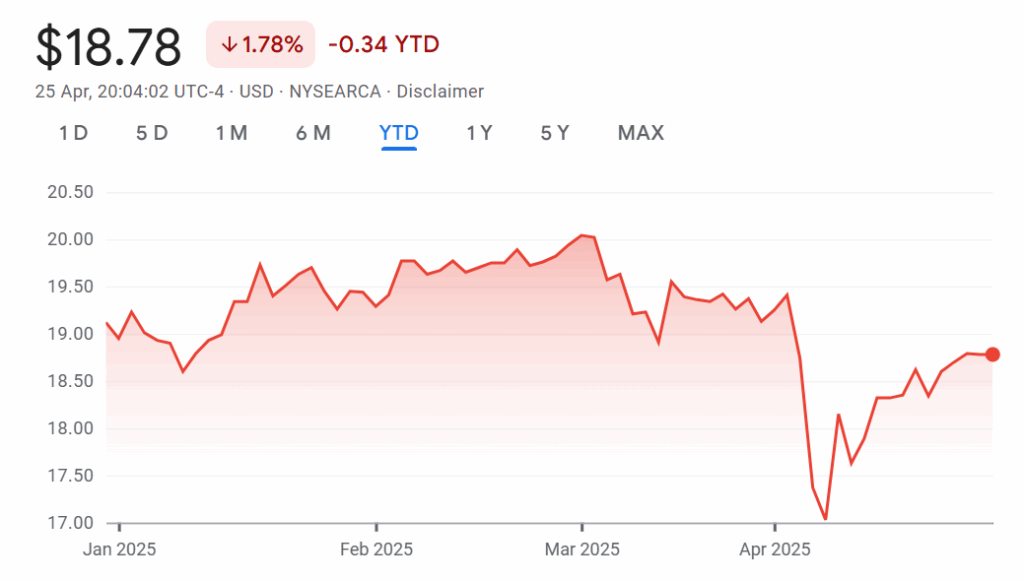

The ETF closed at US$18.78 on the 25th April 2025, down 1.78% year-to-date (YTD) but up 3.7% on a one-year basis.

Chart 1: ETFB Green SRI REITs ETF performance YTD

Chart 2: ETFB Green SRI REITs ETF one-year performance

Three-pronged filter

The core of RITA’s selection process lies in its three-pronged filtering mechanism that scours the global universe of tradable REITs.

The ETF’s algorithm narrows down the selection with a performance-first focus, where an initial filter identifies REITs with the strongest financial metrics, utilizing data from FTSE and the ETF Bureau’s internal analytics.

Next on is the Shariah filter that ensures strict adherence to Islamic finance principles, both from financial ratios and nature of business activities of REIT and its tenants.Any deviation from these principles could trigger an immediate removal.

Mohammed provided an example: “There was one REIT in 2023, where the performance was really good, and it also passed the green filter. The issue, however, was with the REIT manager, who instead of using cash in the account to buy or invest in buildings, locked it into bank deposits that earned an interest of 6-7%.

“That was in breach of the Shariah condition on Riba. So that REIT has been taken out from our pool.”

The third and distinguishing filter integrates ESG factors, in the search for “green” buildings and socially responsible tenants.

“The green filter is related to the buildings, and the ‘S’ in ESG is rated to the tenants, the companies who occupy these buildings,” Mohammed elaborated.

The criteria for green buildings, assessed using IdealRatings’ methodology involving over 490 factors, include aspects like energy efficiency — such as skylights, LED lighting and solar panels — as well as building certifications. Furthermore, the tenants occupying these buildings must meet a minimum “PP4 rated” standard, indicating a commitment to sound environmental and social practices.