• Nascent yet promising growth trajectory for ETFs within the Islamic finance world

• Europe dominates Shariah ETF market, followed by Americas and Middle East

• Industry players focused on liquidity, product innovation and diversity

Overview

In the vast and rapidly expanding world of ETFs, a quieter, yet increasingly significant corner is being carved out by Shariah compliant ETFs.

These funds, designed to align with Islamic ethical and legal principles, represent a small but growing segment of the global investment landscape. While the conventional ETF market commands trillions in assets, the AuM in Shariah ETFs tracked by the IFN Investor Funds Database expanded from US$3.25 billion in Q1 2024 to US$8.67 billion by Q1 2025.

This growth underscores the nascent yet promising trajectory within Islamic finance. The market’s relatively smaller scale compared to the multi-trillion dollar conventional ETF sector, however, presents both unique challenges and untapped opportunities.

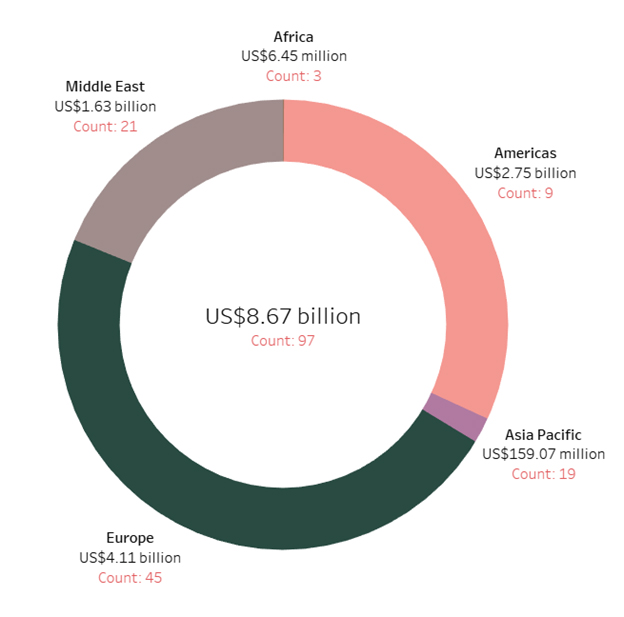

Europe accounts for the lion’s share of the global Shariah ETF market, with 45 funds holding US$4.11 billion in AuM, or 47% of total money invested in the space.

There are multiple drivers for Europe’s dominance here, among them being its early adopter and innovation hub status that led global asset managers with a strong European presence – such as BlackRock (iShares) and HSBC Asset Management – to pioneer the launch of Shariah compliant ETFs.

The Americas rank second with nine funds worth a total US$2.75 billion. These ETF funds are primarily in the US and Canada. Like their European peers, they are driven by unique factors such as large and growing Muslim populations, sophisticated financial market infrastructure, deep capital markets, ESG-consciousness and low entry barriers.

The Middle East has US$1.63 billion in Shariah ETF AuM, placing it at the third spot despite being the birthplace of Islamic finance. While there are 21 such funds tracked by the IFN Investor Funds Database, later adoption of ETFs and liquidity concerns has led to the Middle East trailing in this space.

Completing the global AuM picture for Shariah ETFs is the Asia Pacific with 19 funds worth US$159.07 million and Africa with three funds valued at US$6.45 million.

Chart 1: Global Shariah ETF AuM by region

Source: IFN Investor Funds Database

Investment Opportunity

Key components of Shariah ETFs typically lean heavily towards sectors deemed permissible under Islamic law – such as information technology, healthcare, industrials, energy and consumer staples.

This sectorial bias can influence performance relative to broader market indices. The demand for Halal assets is expanding beyond traditional Islamic geographies, with growing interest from ESG-conscious investors globally. Products like Shariah compliant gold-backed ETFs have also gained traction as safe-haven assets.

For individuals and institutions committed to Islamic finance principles, Shariah ETFs provide a unique pathway to participate in public markets without compromising their values by rigorously screening out companies involved in activities deemed impermissible such as those deriving significant revenue from alcohol, tobacco, gambling or interest-based financial services.

The development of Sukuk ETFs, or Shariah compliant bond ETFs, also offers an ethical alternative for fixed-income investors.

Regulatory Framework

The governance of Shariah ETFs is multifaceted, involving both conventional financial regulations and specific Islamic compliance oversight. A dedicated Shariah supervisory board or adviser is typically mandated for each fund to ensure adherence to Islamic principles, from initial screening of assets to ongoing purification of impermissible income.

This dual layer of oversight can contribute to higher operational costs compared to conventional ETFs. While jurisdictions such as Malaysia and the GCC have been at the forefront of developing Islamic finance frameworks, harmonization of Shariah standards across global markets remains an ongoing endeavor, presenting challenges for cross-border listings and investor clarity.

In essence, the regulatory landscape is evolving, with Shariah advisory boards playing a crucial role in ensuring ongoing compliance with Islamic law. This involves rigorous screening processes, both qualitative (industry exclusions) and quantitative (financial ratios like debt to assets).

While mature markets have established regulatory frameworks, Islamic ETFs listed in emerging markets may face developing legal infrastructure and varied regulatory interpretations. Organizations like AAOIFI provide standards that guide the structure and operation of these funds, though universal adoption across all jurisdictions remains a work in progress.

Challenges include achieving consensus among Shariah scholars and the added cost associated with compliance and purification mechanisms.

Asset outlay, fund performance

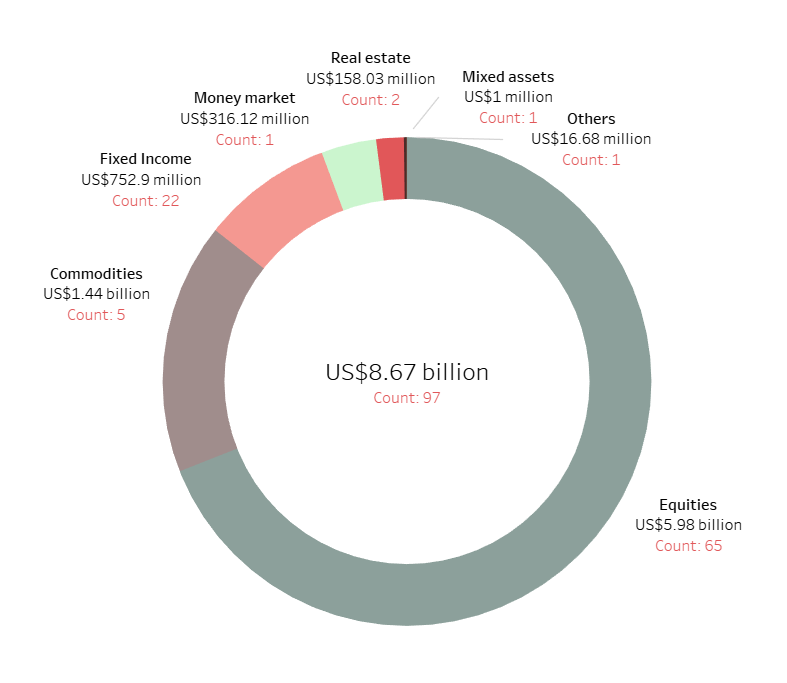

Equities were the asset of choice for global Shariah ETF managers, with 65 funds worth US$5.98 billion, from the total 97 in the space valued at US$8.67 billion.

Commodity ETFs, particularly those backed by precious metals assets, were the second most popular, accounting for five funds with a combined AuM of US$1.44 billion.

Other asset classes in order of fund value were fixed income (22 funds, US$752.9 million); money market (one fund, US$316.12 million); real estate (two funds, US$158.03) and mixed assets (one fund, US$1 million).

Chart 2: Shariah ETF AuM by asset class

Source: IFN Investor Funds Database

Saudi-based Albilad Capital runs the largest Shariah ETF as tracked by the IFN Investor Funds Database, with its Albilad CSOP MSCI Hong Kong China Equity ETF having an AuM of US$1.23 billion.

Florida-based ShariaPortfolio is the Shariah ETF manager with the second largest assets in the space, held in the US$1.09 billion equities-focused SP Funds S&P 500 Sharia Industry Exclusions ETF.

Other Shariah ETF managers and their funds in the order of asset value are Ziraat Portfoy’s Ziraat Portfolio Gold Participation Exchange Investment Fund (US$1.05 billion); Invesco Capital Management’s equities-focused Invesco Dow Jones Islamic Global Developed Markets UCITS ETF (US$837.14) and iShares (BlackRock)’s iShares MSCI World Islamic UCITS ETF (US$633.81).

Table 1: Shariah ETF funds by size

| Rank | Fund name | Fund manager | Asset class | AuM (US$ million) |

| 1 | Albilad CSOP MSCI Hong Kong China Equity ETF | Albilad Capital | Equities | 1,225.95 |

| 2 | SP Funds S&P 500 Sharia Industry Exclusions ETF | ShariaPortfolio | Equities | 1,087 |

| 3 | Ziraat Portfolio Gold Participation Exchange Investment Fund | Ziraat Portfoy | Commodities | 1,052.56 |

| 4 | Invesco Dow Jones Islamic Global Developed Markets UCITS ETF | Invesco Capital Management | Equities | 837.14 |

| 5 | iShares MSCI World Islamic UCITS ETF | iShares (BlackRock) | Equities | 633.81 |

Source: IFN Investor Funds Database

The top performing Shariah ETF fund was Lunate Capital’s equities-focused Chimera S&P China HK Shariah ETF, which returned 27.29% during the three months to 31st March 2025. The ETF is designed to mimic the performance of the S&P Hong Kong-Listed Shariah Liquid 35/20 Capped Index that allows it a single access point to the Hong Kong equity markets.

Azimut Portfoy’s Azimut Portfolio Precious Metals Participation Fund was the second-best performing fund with a 26.49% return.

Other high performers were Albilad Capital’s Albilad Gold ETF (16.43%); Lunate Capital’s Chimera S&P Kuwait Shariah ETF (10.93%) and QNB Finans Portfoy’s Silver Participation Exchange Traded Fund (9.73%).

Table 2: Shariah ETF funds by performance

| Rank | Fund | Manager | Asset class | Three-month returns (%) |

| 1 | Chimera S&P China HK Shariah ETF – Income | Lunate Capital | Equities | 27.29 |

| 2 | Azimut Portfolio Precious Metals Participation Fund | Azimut Portfoy | Commodities | 26.49 |

| 3 | Albilad Gold ETF | Albilad Capital | Commodities | 16.43 |

| 4 | Chimera S&P Kuwait Shariah ETF – Income | Lunate Capital | Equities | 10.93 |

| 5 | Silver Participation Exchange Traded Fund | QNB Finans Portfoy | Commodities | 9.73 |

Source: IFN Investor Funds Database

Outlook

The trajectory for Shariah ETFs appears promising. As global awareness of Islamic finance grows and demand for ethical investment options intensify, the market for Shariah compliant ETFs is expected to mature.

Key drivers include the demographic growth of the global Muslim population and a broader societal shift towards values-based investing. To foster further expansion, industry players are focusing on increasing liquidity, developing more innovative and diverse product structures and enhancing investor education to demystify Shariah compliant investing.

While challenges like narrower investment universes and relatively higher costs compared to their conventional counterparts persist, the long-term vision is one of continued integration and growth within the broader financial ecosystem.