Key highlights

- Global Islamic fixed income market remained largely steady in Q4 2024 from a year ago

- Islamic fixed income fund yields may be tempered on interest rate cuts

- Potential catalyst with new demand from pension and retirement schemes

Overview

The performance of Islamic fixed income funds around the world is largely interlinked with new Sukuk issuances and redemptions of those instruments, combined with prevailing interest rates. As 2024 proved to be a year of uncertainty over the US Federal Reserve (US Fed)’s interest rate actions, this clouded the overall Sukuk market.

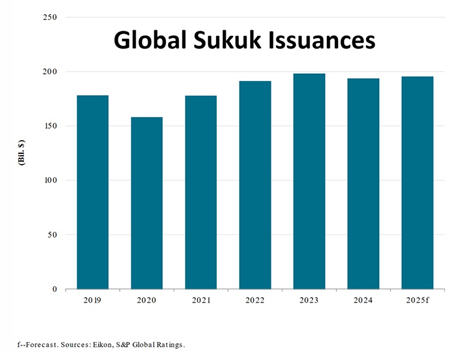

As a result, global Islamic fixed income funds finished the final quarter of 2024 little changed from Q4 2023 – a trend tracked by the IFN Investors Fund Database that paralleled S&P Global’s figures which showed total Sukuk issuance of US$193.4 billion at the end of 2024 being slightly down from US$197.8 billion a year earlier.

When the US Fed finally announced a 50bps rate cut on the 18th September 2024, followed by another two 25bps slashes in November and December 2024, the knock-on effect many expected would be new Sukuk issuances taking advantage of lower repayment costs – resulting in lower fixed income yields.

However, another wrinkle with the proposed AAOIFI Shariah Standard 62 – potentially requiring stricter asset-backing rules for new Sukuk issuances – plus the US Fed then signaling interest rates may be on hold again on inflation concerns may have dampened the Sukuk space.

Chart 1: Global Sukuk issuances 2019 – 2025f

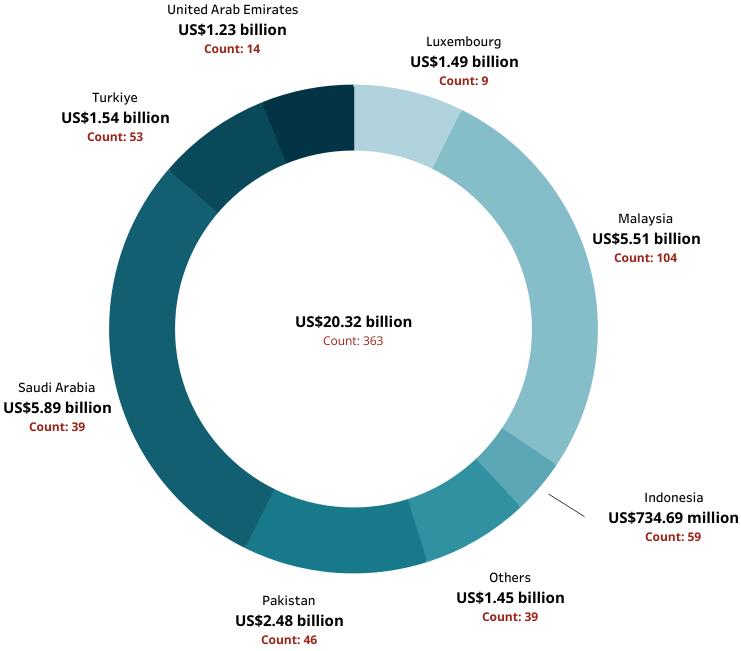

The IFN Investor Funds Database reports the Islamic fixed income and Sukuk funds market concluded Q4 2024 with total assets under management (AuM) of US$20.32 billion, marking a slight increase of 6.98% from the previous quarter.

The global landscape comprises 363 funds, with Saudi Arabia leading AuM at US$5.89 billion across 39 funds. However, Malaysia tops the list by the number of funds with 104, collectively managing US$5.51 billion.

Chart 2: Largest Islamic fixed income funds market by AuM

AuM growth

Europe led the AuM growth with a 21.49% rise, supported by the launch of a new fund. Asia Pacific followed with a 10.48% rise. America, Africa and the Middle East recorded slower growth for the quarter.

Table 1: Regional AuM overview as at the end of Q4 2024 (q-o-q)

| Europe | Up by 21.49% from US$3 billion to US$3.64 billion |

| Asia Pacific | Up by 10.48% from US$8.02 billion to US$8.86 billion |

| Africa | Up by 4.13% from US$152.61 million to US$158.91 million |

| Americas | Up by 2.7% from US$481 million to US$494.01 million |

| Middle East | Down by 2.39% from US$7.36 billion to US$7.18 billion |

Table 2: Top performing Islamic fixed income funds by region as at the end of Q4 2024

| Region | Fund name | Fund manager | Three-month returns |

| Asia Pacific | ABL Islamic Sovereign Plan-I | ABL Asset Management | 23.57% |

| Europe | Turkiye Life and Retirement Oks Balanced Participation Variable Retirement Investment Fund | Turkiye Hayat Ve Emeklilik | 19.67% |

| Middle East | Batik Liquidity Fund | Saudi Kuwaiti Finance House | 5.49% |

| Africa | 27four Shariah Income Fund | 27 Four Investment Managers | 1.94% |

| Americas | Amana Participation Investor Fund | Saturna Capital | -0.87% |

ABL Islamic Sovereign Plan-I emerged as Asia Pacific’s top-performing Islamic fixed income fund in Q4 2024, delivering 23.57% three-month returns and outperforming the PKISRV six-month benchmark rates. This performance stemmed from its strategic allocation of over 60% assets to Shariah compliant government securities, particularly ‘AAA/A+’-rated Sukuk.

While the fund maintains a moderate risk profile and a majority sovereign-backed portfolio, the nominal returns should be weighed against Pakistan’s elevated inflationary context amid its economic recovery.

New players and products

The IFN Investor Funds Database recorded two new Islamic fixed income funds launched in Q4 2024.

The SPDR JP Morgan Saudi Arabia Aggregate UCITS ETF tracks US dollar-denominated sovereign and quasi-sovereign instruments, along with SAR-denominated government Sukuk from Saudi Arabia. By focusing on stable returns through strong credit ratings – mainly ‘A’-rated securities – it provides an appealing balance of risk management and yield potential. By the end of 2024, it managed US$243.34 million in assets with a moderate yield to maturity of approximately 5.41%. The fund is positioned as an attractive entry point into emerging Middle Eastern financial markets, while balancing a diversified fixed income portfolio.

The ARM Sharia-Compliant Fixed Income Fund, launched in Q4 2024, is a NGN-denominated open-ended mutual fund investing exclusively in Shariah compliant fixed income instruments like sovereign and corporate-issued Sukuk, Mudarabah and Murabahah contracts. The fund employs active portfolio strategies to generate steady income streams, with current AuM at almost US$500,000.

Outlook

Looking into 2025, the Islamic fixed income market performance is poised for steady AuM growth as funds still have Sukuk with higher payouts until these expire. This AuM rise will however be tempered by replacements with lower yielding newly-issued Sukuk.

New Sukuk issuance, which is key fuel for fixed income funds, will continue to manifest a robust pipeline as demand for Shariah compliant financing is expected to remain strong to fund domestic infrastructural developments within the GCC regions and other emerging Islamic nations.

Another catalyst will be the potential increase in demand from pension and retirement schemes for these fixed income fund units, given that a number of jurisdictions are beginning to consider offering ethical investment options for retirement schemes’ members.