Key Highlights

- Global Sukuk issuance total value increased by 0.66% in the first half of 2024.

- Saudi Arabia hosts the largest concentration of fixed income funds by AuM at US$6.65 billion.

- Fifteen Islamic fixed income funds were introduced in the H1 2024.

- Regulatory advancements concerning Sukuk have been noted in the Philippines, Pakistan, and the UAE.

Overview

Islamic fixed funds’ performance was mixed during Q2 2024, with Asia Pacific and the Americas leading growth.

Sukuk are a significant portion of constituents within a fixed income fund portfolio. S&P Global Ratings reported that global Sukuk issuance totaled US$91.9 billion in the first half of the year, marking a slight (0.66%) increase from the same period in the previous year’s US$91.3 billion

Saudi Arabia, the UAE, Malaysia, Oman and Kuwait were the primary drivers for Sukuk issuances. It is notable that key Islamic nations in Africa were absent from this momentum.

Of this total, US$32.7 billion was denominated in the US dollar. Dollar Sukuk issuance saw a significant 23.8% rise by the 30th June 2024, up from US$26.4 billion in the same period a year ago.

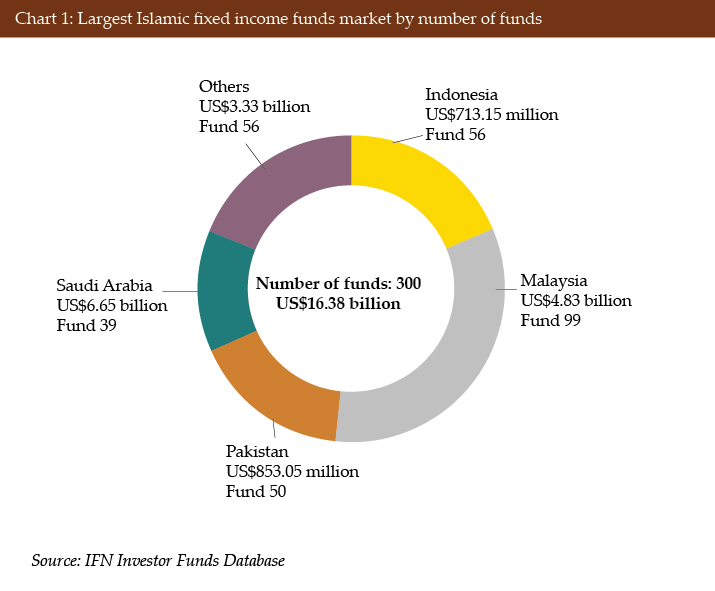

As of 30th June 2024, the IFN Investor Funds Database documented 300 Islamic fixed income funds globally with a total assets under management (AuM) of US$16.38 billion. Malaysia leads by number of funds, totaling 99, valued at US$4.83 billion. This marks an increase of nine funds from the previous quarter.

Following Malaysia, Indonesia hosts 56 funds valued at US$713.15 million, indicating a rise of 15 funds. Pakistan ranks third with 50 funds valued at US$853.05 million, reflecting an increase of three funds. Saudi Arabia houses 39 funds valued at US$6.65 billion, showing a decrease of one fund compared to the previous quarter.

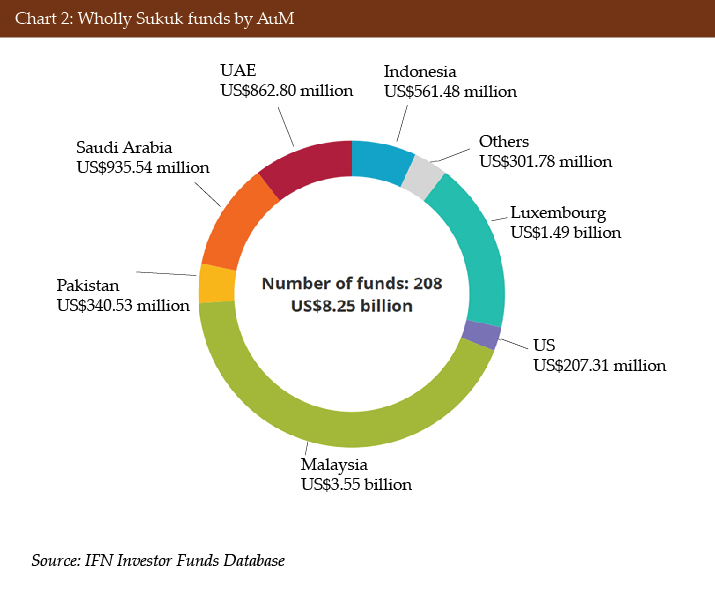

As of the 30th June 2024, the IFN Investor Funds Database recorded a global total of 208 Sukuk funds. Malaysia leads with the highest number, totaling 81 funds valued at US$3.55 billion. Luxembourg follows with seven funds valued at US$1.49 billion. Saudi Arabia ranks third with 21 funds totaling US$935.54 million. The UAE is home to nine funds valued at US$862.8 million. Indonesia hosts 45 funds with assets under management totaling US$561.58 million. Pakistan has 17 Sukuk funds valued at US$340.53 million. The US accounts for one fund with total AuM of US$207.31 million.

AuM growth

In the second quarter of 2024, Islamic fixed income funds in Asia Pacific experienced the highest surge in AuM growth with a total rise of 14.79%, followed by the Americas with a 6.58% increase and lastly Europe which was up 2.34%. Islamic fixed income funds in the Middle East and Africa region experienced a drop in AuM, down 6.26% and 8.25% respectively.

- Asia Pacific: Up by 14.79% to US$6.47 billion from US$5.64 billion.

- Americas: Up by 6.58% to US$409.62 million from US$384.33 million.

- Europe: Up by 2.34% to US$1.57 billion from US$1.53 billion.

- Middle East: Down by 6.26% to US$7.72 billion from US$8.24 billion.

- Africa: Down by 8.25% to US$146.22 million from US$159.32 million.

Table 1: Top performing Islamic fixed income funds by region in Q2 2024

| Region | Fund | Fund manager | Three-month returns (%) |

| Asia Pacific | PRUlink Syariah Extra Capital Fund | Prudential Indonesia | 79.67 |

| Americas | Amana Participation Institutional Fund | Saturna Capital | 0.68 |

| Europe | Azimut Portfolio Lease Certificate Sukuk Participation Fund | Azimut Portfoy | 10.13 |

| Middle East | AlJazira Saudi Riyal Murabaha Fund | Aljazira Capital | 5.29 |

| Africa | Lotus Halal Fixed Income Fund | Lotus Capital | 3.83 |

New players and products

In 2023, a total of 37 Islamic fixed income funds had been launched worldwide. The largest number of these funds debuted in Pakistan, amassing a combined AuM of US$137.37 million. Malaysia followed with eight funds, totaling US$95.61 million, while Indonesia introduced seven funds with a collective AuM of US$14.31 million. Saudi Arabia contributed three funds valued at US$32.95 million. Additionally, individual launches included Australia, Nigeria and the UK, each with one fund totaling US$3.65 million, US$177,903 and US$36.6 million, respectively.

According to the IFN Investor Funds Database, 15 new Islamic fixed income funds have been launched from the start of 2024 until 30th June 2024. Of these, 12 were launched in Q1 2024.

In Q2 2024, three additional funds were launched, two of which originated from NBP Fund Management in Pakistan: the NBP Islamic Fixed Term Munafa Plan-III and Plan-VI. Together, these two funds have accumulated AuM of US$13.87 million as of 30th June 2024.

The third fund was launched by Lion Global Investors: the Lion-BIBDS Islamic Enhanced Liquidity Fund, domiciled in Singapore, in partnership with Bank Islam Brunei Darussalam. This fund holds an AuM of US$20.3 million as of 30th June 2024 and is the asset manager’s inaugural Shariah compliant fund.

In Q3 2024, Lunate Capital launched its tenth sub-fund, Chimera JPMorgan Global Sukuk ETF, fund on the 8th July 2024, which tracks the performance of the JPMorgan Global IG Sukuk Index. This fund was launched with an AuM of US$3.82 million.

Regulatory development

The Bureau of Internal Revenue of the Philippine Department of Finance issued new regulations for equal Sukuk tax treatments as part of its capital market reforms. Final withholding tax applies at redemption if the Sukuk is maturing within five years on a sliding scale – with 20% if three years or fewer remains, 12% for up to four years and capped at 5% in the fifth year. Longer term Sukuk will attract no tax. A flat 25% final withholding tax applies to all foreign individuals and entities.

Pakistan introduced new tax rates on Sukuk investments under the Finance Bill 2024. According to the bill, associations and retail investors will face a 10% tax rate on returns below PKR1 million (US$3,581), which increases to 12.5% for returns exceeding this amount. Institutional investors and corporate entities will be subject to a flat tax rate of 25%.

The UAE Securities and Commodities Authority reiterated its support for special purpose vehicles, a key regulatory feature attracting foreign investors and businesses to the Emirates. This initiative aims to enhance the regulatory framework for securitization and Sukuk, while also promoting growth in the investment funds sector within the UAE.

Recent concerns were triggered by AAOIFI Shariah Standard No 62, currently in exposure draft form till the end of July 2024, which requires Sukuk to be asset-backed, rather than asset-based. This could be problematic as the vast majority of all Sukuk issued currently are the latter type and there could be an impact on Sukuk issuance and associated fixed income fund performances.

Top 10 fixed income instruments funds by AuM

| Rank | Fund name | Fund manager | AuM US$ (millions) |

| 1 | Riyad SAR Diversified Trade Fund | Riyad Capital | 1617.00 |

| 2 | SNB Capital Diversified Saudi Riyal Fund | SNB Capital | 1,397.45 |

| 3 | Aiiman Income Extra Fund | Aiiman Asset Management | 851.32 |

| 4 | Albilad SAR Murabaha Fund | Albilad Capital | 839.25 |

| 5 | Riyad SAR Trade Fund | Riyad Capital | 535.46 |

| 6 | AlJazira Saudi Riyal Murabaha Fund | Aljazira Capital | 358.51 |

| 7 | Alistithmar Capital SAR Murabaha Fund | Alistithmar Capital | 201.12 |

| 8 | Amana Participation Institutional Fund | Saturna Capital | 173.29 |

| 9 | SNB Capital International Trade Fund | SNB Capital | 164.55 |

| 10 | Principal e-Cash Fund | Principal Asset Management | 149.50 |

Top 10 Sukuk funds by AuM

| Rank | Fund name | Fund manager | AuM US$ (millions) |

| 1 | AZ Islamic – MAMG Global Sukuk (USD) | Azimut Investment | 697.77 |

| 2 | Franklin Global Sukuk Fund – A | Franklin Templeton | 681.73 |

| 3 | Emirates Global Sukuk Fund (Luxembourg) | Emirates NBD Asset Management | 408.12 |

| 4 | AHAM Aiiman ESG Income Plus Fund | AHAM Capital Asset Management | 403.14 |

| 5 | Principal Islamic Institutional Sukuk Fund | Principal Asset Management | 395.44 |

| 6 | SC Global Sukuk Fund Class D USD | Sedco Capital | 367.97 |

| 7 | Public Islamic Infrastructure Bond Fund | Public Mutual | 237.35 |

| 8 | Principal Islamic Lifetime Sukuk Fund | Principal Asset Management | 225.59 |

| 9 | ASN Sukuk | Amanah Saham Nasional | 211.79 |

| 10 | SP Funds Dow Jones Global Sukuk ETF | ShariaPortfolio | 207.31 |