Fitch Rating has forecast that total assets under management (AuM) within Saudi Arabia will cross the US$300 billion mark “within a couple of years”, stating inflows as at the end of H1 2024 saw total AuM rise 13.5% year-on-year (y-o-y) to over US$250 billion.

While the bulk of the AuM is held by locals – with 63% at Saudi bank-affiliated asset managers and 20.5% with other local managers as at the end of 2023 – foreign players could see their 12.5% share rising as the government is wooing them to shift their regional headquarters into Saudi Arabia. The Fitch report noted that “five of the 95 domestic asset managers (make) up 64% of industry AuM”.

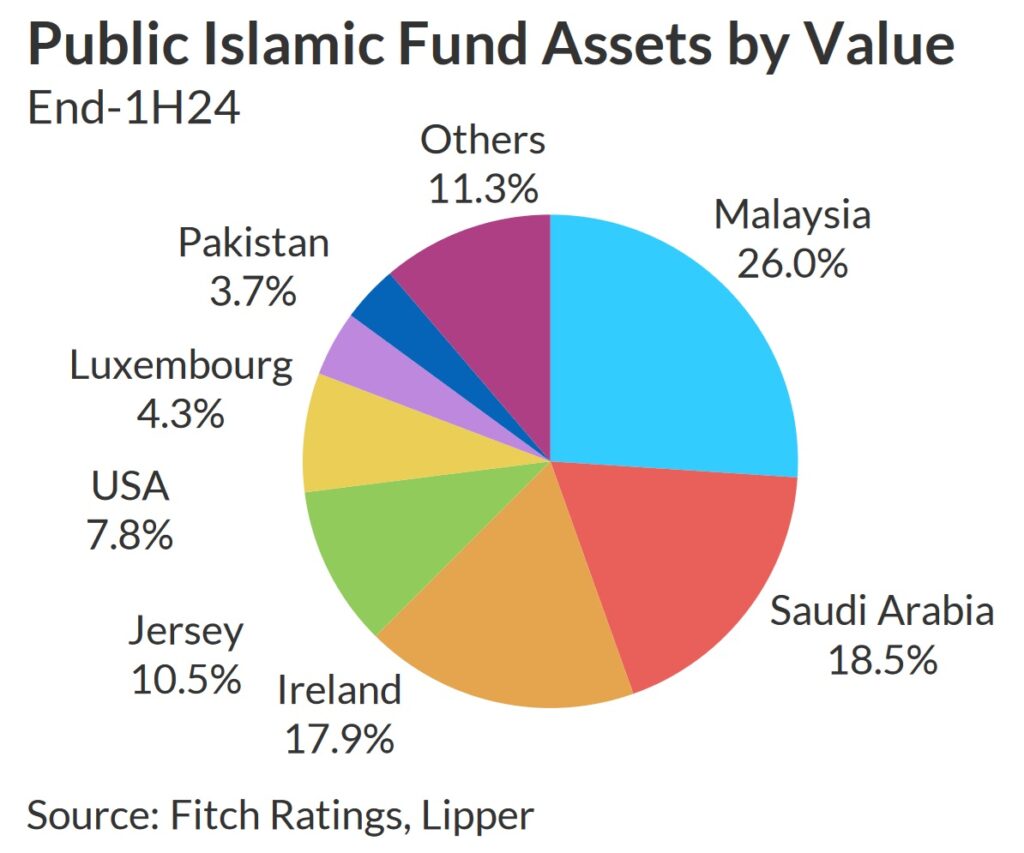

Around 95% of the mutual funds in Saudi Arabia are Shariah compliant as of Q3 2024 – with strong demand from both retail and institutional investors, Fitch reported. “Many asset managers also can only offer Islamic products.”

Tadawul is the GCC’s largest stock exchange and world’s 10th-largest, of 80 exchanges globally tracked by Fitch, as at the end of H1 2024.

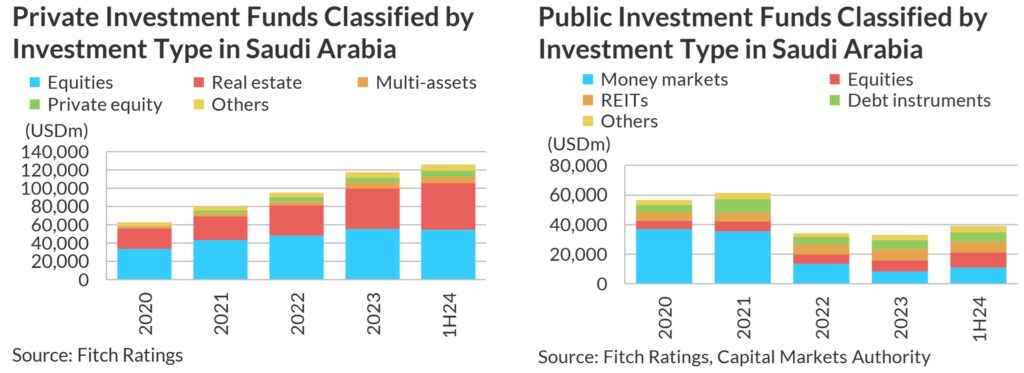

Private funds total AuM was more than triple the value of total public funds AuM.

“Real estate has the largest share of private funds by fund count (44%). The private funds’ AuM doubled since 2020 and was up 18.5% y-o-y to US$126 billion, with 43% in equities and 40.5% in real estate.

“Public funds’ AuM grew by 19.7% y-o-y to US$39.1 billion, with 28% in money markets, 25.6% in equities, 18.7% in REITs and 16% in debt instruments. About 86% of public funds are in domestic assets.”