As international sanctions continue to keep Iran largely isolated from global inflationary pressures, the biggest influence on its internal economic landscape is the annual pricing review issued by the central government, Navid Asset Management Company Managing Director Mojtaba Shafipoor told IFN Investor.

Explaining this annual pricing review is watched eagerly by domestic investors seeking to quickly capitalize on potential gains in the equity and commodity markets, Shafipoor said: “The government announces every year that it has tried to keep the average increases below 20%. But the impact felt on the ground once the price hikes filter down is often closer to 40%.”

According to World Bank statistics, the latest available annual inflation figures for Iran are 43.5% in 2022 and 43.4% in 2021.

Shafipoor said the government price review process usually begins in December and indicative figures are made public by end-March. But these figures are still subject to drastic changes when the final declarations are made sometime in May.

Following the declarations, Shafipoor said there would be scrambling in market trades as investors try to calculate how soon the price hike impacts would be felt and factored. Investment portfolio adjustments happen rapidly over the subsequent months to chart gains via arbitraging.

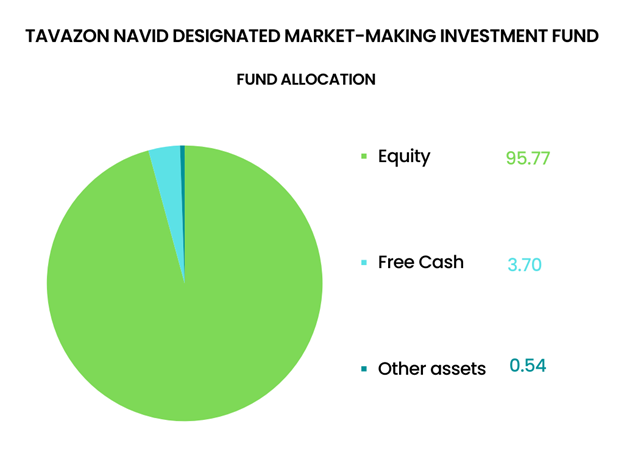

For the firm’s Shariah compliant flagship Tavazon Navid Designated Market-Making Investment Fund — which invests in mixed assets of equities and market commodities — Shafipoor said there could be swift shifting of funds into commodities like sugar, as the price impact could be reflected slower along the supply chain, or tapping into efficiencies of listed companies.

Navigating such strategies has enabled value appreciations that have resulted in this flagship fund charting valuation growth of almost 200% in the past two years. The IFN Investor Funds Database shows its assets under management (AuM) at IRR1.02 trillion (US$24.25 million) as at the 7th May 2024.

Chart 1: Tavazon Navid Designated Market-Making Investment Fund’s net asset value trend

Being nimble with investments has proven to be a viable strategy for Navid, which began as a financial entity offering loans some two decades earlier before expanding its scope into asset management and investing in markets.

Chart 2: Tavazon Navid Designated Market-Making Investment Fund’s fund allocation

The firm operates two other funds — as at the 7th May 2024, the IFN Investor Funds Database shows the Navid Equity Mutual Investment Fund having AuM of IRR247.19 billion (US$5.86 million) while Sobat Navid Investment Fund has AuM of IRR380.91 billion (US$9.02 million).

Currency conversions from the Iranian riyal to the US dollar is based on the official Iran Central Bank rate of IRR42,000 being equal to US$1 on the 7th May 2024, rather than the higher unofficial market exchange rate.

Shafipoor said Navid is now among the top 20 fund managers in Iran, with the institutional-to-retail investors split being around 70:30 by total value of investments made. The firm sees itself as remaining within this ranking as it mainly serves the private sector rather than public bodies.

Despite international sanctions, Shafipoor said there has been interest from foreign investors in recent years wanting to tap gains in Iranian capital markets — including from Sweden, Kuwait, the UAE, Iraq and Syria.

With such investments highly regulated, Shafipoor said these investors are clearly looking at long-term gains as they are not allowed to repatriate earnings out of Iran currently.

The opinions and viewpoints expressed in the report do not constitute as a recommendation for any funds highlighted. The information presented is not investment advice and should not be treated as such.

This report was produced by IFN Investor editor Francis Nantha & data analyst Arash Malekfard