Key Highlights

- Currently has 10 public Shariah funds tracked by IFN Investor

- No Shariah compliant finance regulatory structure, nor visible government support

- With Europe’s second-largest Muslim population, potential is enormous

Overview

Germany has a significantly small Islamic finance sector relative to its stature as Europe’s largest economy.

While the Deutsche Bundesbank – the country’s central bank – puts the 2024 GDP at EUR4.3 trillion (US$4.68 trillion), Germany has few Shariah compliant funds – with only 10 tracked by the IFN Investor Funds Database and having total assets under management (AuM) of less than US$150 million at the end of 2024.

Germany has no Islamic finance policies to grow the industry and the government has not indicated that it will develop specific legal frameworks to support the sector.

On the corporate front, discussion or activity on Shariah-led financial initiatives have been largely muted despite the potential its growing Muslim population holds – Germany has approximately 5.5 million Muslims (according to a 2020 study by the Federal Office for Migration and Refugees), the second most in Europe after France’s 5.72 million and ahead of the UK’s 4.13 million.

Despite Islam being the second-largest religion in Germany, officially there is only one Islamic bank – KT Bank; the 2018-established Islamic digital bank, insha, shuttered its operations in 2023, and sporadic Islamic financial services are offered by a handful of Islamic fintech start-ups.

Regulatory network

BaFin, or Bundesanstalt für Finanzdienstleistungsaufsicht, enforces all financial regulation in Germany, reporting to the finance ministry. BaFin supervises asset management companies and investment funds under the German investment code known as Kapitalanlagegesetzbuch, or KAGB.

The central bank, Deutsche Bundesbank, serves as the eyes and ears of BaFin, providing input to decision-making by the primary regulator

Islamic capital

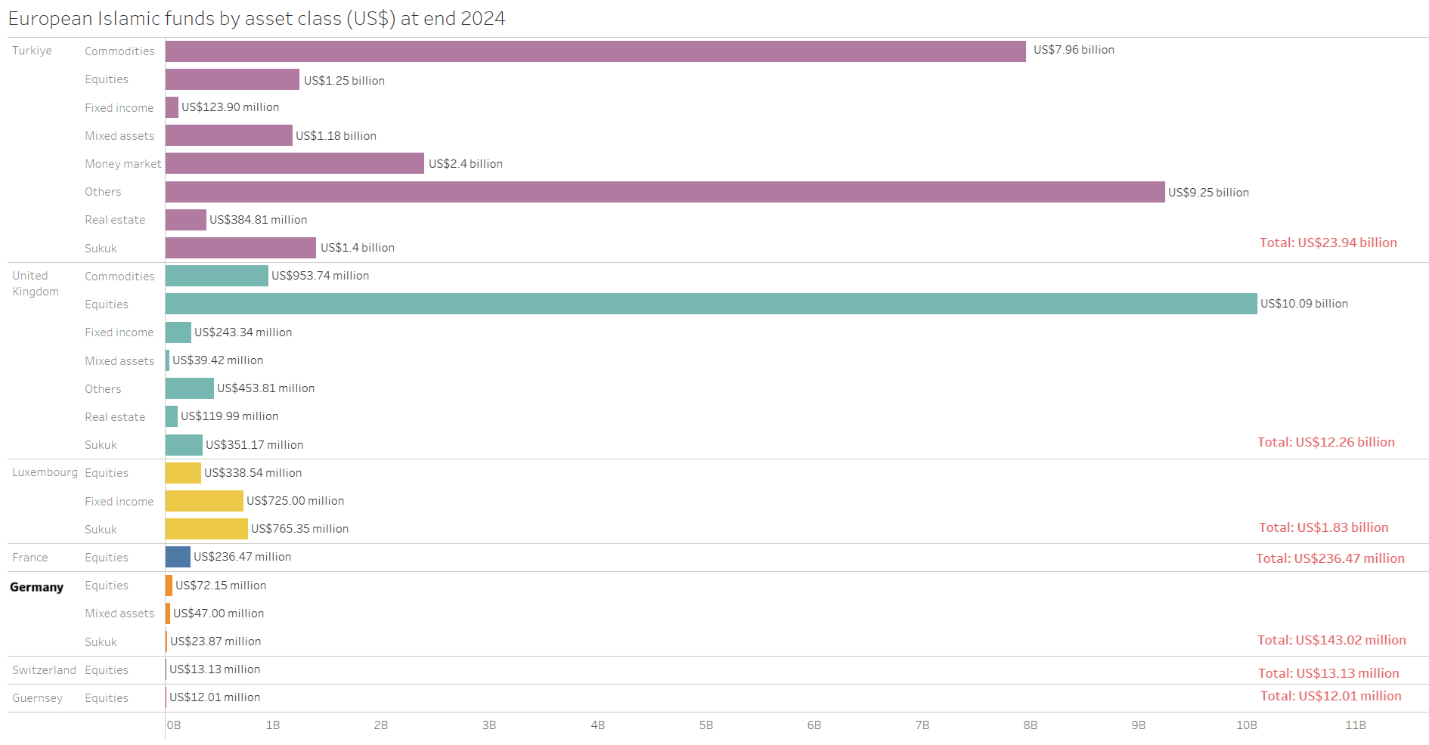

Germany’s Islamic funds industry is Europe’s fifth by size, with US$143 million AuM, according to the IFN Investor Funds Database. In contrast, the UK — which ranks second with nearly a million fewer Muslims than Germany – has US$12.3 billion in Shariah compliant assets. Turkiye sits atop the table with nearly US$24 billion in assets while Luxembourg is third with US$1.8 billion and France fourth with US$236.5 million.

Chart 1: Country rankings of European Islamic fund offerings

Germany’s Islamic fund AuM is split across 10 vehicles, two of which are domiciled at home and the balance in Luxembourg.

Equities dominate the mix, accounting for just over US$72 million in AuM. Mixed assets are the next largest with US$47 million, while Sukuk is third with almost US$24 million.

Table 1: Germany’s top performing funds in 2024

| Fund name | Fund manager | One-year returns (%) |

| Forward Lucy Global Islamic Equity Strategy | Forward You | 15.64 |

| Global ESG Momentum Equity | Arabesque | 5.27 |

| Global ESG Momentum Flexible Allocation | Arabesque | 3.29 |

| Forward Lucy Secure Islamic Income Strategy | Forward You | 2.9 |

| Forward Lucy Islamic Income Strategy | Forward You | 2.39 |

| Global Islamic ESG Flexible Allocation (USD) | Arabesque | 0.1 |

Forward You’s Forward Lucy Global Islamic Equity Strategy is Germany’s top performing fund, with a one-year return of nearly 16% through the 12th March 2025.

In a statement, Forward You said January was particularly a strong month for the fund as it rode a bout of market volatility to push higher, helped by expectations of more US rate cuts and anticipated deregulation by the new Trump administration.

But US President Donald Trump’s increasing desire for tariff wars, amid pressure on US techs from new Chinese AI innovations, are risks going forward, it said.

Outlook

With scant government – even corporate – support, growing Germany’s Islamic finance market has been a challenge. But the potential is enormous, given the size of the economy itself as well as its sizeable Muslim population. The country’s real estate market and booming technology sector are attractive to GCC investors, signifying potential for Islamic structuring of such investments.

Entry of foreign players, coupled with regulatory reform and fintech innovation, could be instrumental in unlocking this prospect for Islamic investments.

By addressing existing gaps and fostering a supportive environment, Germany can solidify its ranking in Europe’s Shariah financial landscape. Aligning with the global surge in ethical and impactful investing, Germany needs to prioritize foreign engagement, regulatory adaptation and fintech integration to bring its Islamic investment industry to the next level.