Being overweight on US stocks may have boosted global Islamic indices and consequent investments earnings in recent times, but Q1 2025 has shown how overexposed such indices were to shockwaves triggered by the Trump presidency’s tariff onslaught.

The indices performed badly last week after the US unveiled what was described as reciprocal tariffs on Wednesday the 2nd April 2025 – resulting in about US$6.6 trillion wiped off US stock values, according to Dow Jones market data.

The depressing start to Q2 2025 saw the S&P Global BMI Shariah index tumble 7.88% to 253.53 and the FTSE Shariah All-World Index slid 8.35% to 3,439.63 as at the 4th April 2025.

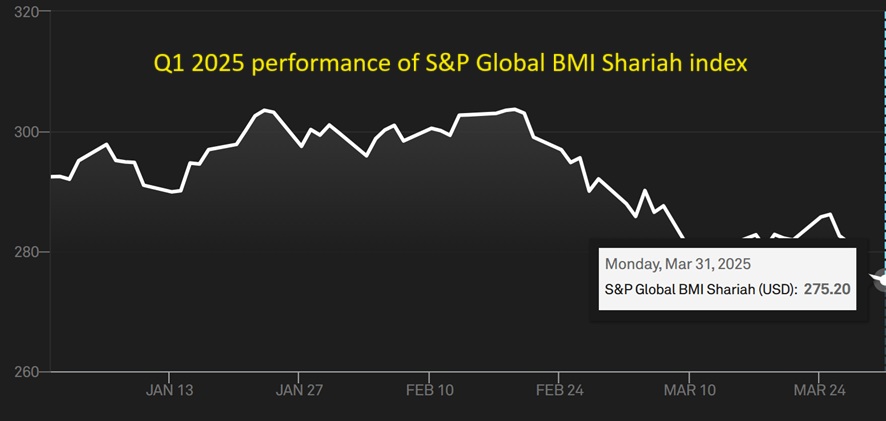

Last week’s rout continued 2025’s poor trend as the S&P Global BMI Shariah index fell from 292.48 at the year’s start to end Q1 2025 at 275.2, matching the year’s start of 404.93 for the corresponding S&P Global BMI index and closing the quarter at 396.73.

Chart 1: Consolidated performances of selected global equities in Q1 2025

Source: S&P Global

Excluding US stocks painted a different picture as the relevant S&P Global Ex-US BMI index rose from the year’s start of 233.64 to 241.9.

Chart 2: Consolidated performances of selected global equities outside the US in Q1 2025

Source: S&P Global

Zooming in on regional indices that were not so reliant on the US economy also illustrated such a contrasting trend. The S&P Europe BMI index rose from 452.27 to 494.06 while the S&P Emerging Europe, Middle East & Africa BMI index climbed from 221.44 to 230.73 over Q1 2025.

A similar trend was seen in two other sets of major stock indices.

The FTSE Shariah All-World Index went down from 3,879.49 to 3,749.95, matching the corresponding FTSE All-World index in falling from 552.51 to 545.2 – but the FTSE All World Ex US Index rose from 333.21 to 348.03 in the year’s first quarter.

The MSCI World Islamic Index fell from 3,064.69 to 2,956.76, matching the associated MSCI World Index drop from 17,352.3 to 17,059.75 – while the MSCI World ex USA Value Index was up from 16,690.47 to 18,441.22 in Q1 2025.

Another favourite asset among Islamic investors fared better – gold prices per ounce rose from US$2,624.6 at the year’s start to end the quarter at US$3,123.82.