- Gold powers commodities’ quiet, profound lead in Shariah funds

- With 27% annual growth, gold performance blows away competing assets

- Proliferation of ETF-styled products to keep gold at Islamic forefront

Overview

In the evolving landscape of global finance, a quiet but significant shift is underway within the Islamic world: The burgeoning Shariah compliant commodities market powered by its shiniest asset – gold.

Gold has blown past equities and other asset classes with a 27% rally this year that culminated in a record high of nearly US$3,510 an ounce for futures of the precious metal in April. In comparison, the S&P 500 is only up 4.6% for 2025.

Rooted in centuries-old principles that forbid interest and excessive speculation, the supply and demand of commodities offer a compelling alternative for investors seeking to align their wealth with ethical values.

Within the Shariah compliant raw materials space, gold is consistently highlighted as the “frontrunner,” with gold-based products constituting the lion’s share of Islamic commodity investment funds.

This preeminence is driven by gold’s traditional role as a safe haven, particularly in the face of ongoing geopolitical tensions such as the Trump tariff tensions and conflicts in Ukraine and Gaza, alongside persistent inflation concerns exacerbated by the US Federal Reserve’s cautious approach to interest rate cuts.

Alongside the global macroeconomic and geopolitical uncertainties, gold’s Shariah compatibility makes it a natural fit for Islamic portfolios seeking refuge and value preservation.

Beyond gold, other precious metals like silver, platinum and palladium as well as agricultural products such as soybeans, corn, wheat, sugar, cocoa and coffee and industrial metals like copper and aluminum, are also regarded as being Shariah compatible.

These commodities share the characteristic of having an intrinsic value and are commonly utilized in Islamic financing structures like Tawarruq or commodity Murabahah. The current heavy concentration on gold, however, suggests an untapped potential in these other Shariah compatible commodities.

Developing accessible and compliant structures for these assets could offer broader diversification for Islamic investors, reducing reliance on a single commodity and potentially providing varied risk-return profiles.

Investment opportunity

The allure of Shariah compliant commodity investing is multifaceted. For many, it’s about adhering to faith, ensuring investments are tied to tangible assets and real economic activity, rather than speculative ventures.

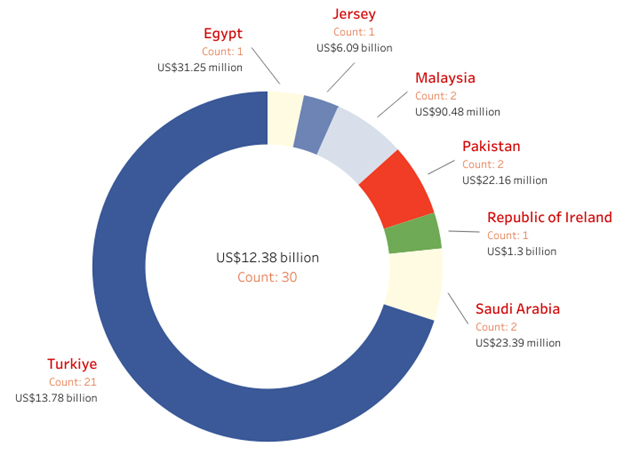

The growth of Islamic commodity funds is also not uniform, revealing distinct regional dynamics. Turkiye, a pioneer in Islamic finance, leads, with other centers like Jersey and the Republic of Ireland also showing substantial AuM, often concentrated in single, large funds, suggesting their role as international domiciles.

From Q1 to Q2 2025, the IFN Investor Funds Database showed the Middle East posting a remarkable 74.16% increase in AuM, while the Asia Pacific region grew by 46.57%, indicating a burgeoning interest in these core Islamic markets.

The performance of these funds has been robust, largely mirroring the ascent of gold. The Royal Mint Responsibly Sourced Physical Gold ETC, for instance, delivered a 15.6% return over three months, showcasing the strong correlation.

This contrasts sharply with the mixed fortunes of other Islamic asset classes this year; while some Islamic equity indices have seen modest gains, others – like the MSCI World Islamic Index – have faced declines, and the US Islamic funds industry experienced a significant drop in assets. Sukuk offered moderate positive returns.

Asset spread, performance

Turkiye boasts 21 Shariah compliant commodity funds with a collective AuM of US$13.78 billion. Turkiye notably pioneered the world’s first Islamic ETF in 2006.

Jersey, a Channel Island and tax haven, holds the second-largest collective AuM at US$6.09 billion, though this is concentrated in a single fund.

The Republic of Ireland ranks third, with US$1.3 billion in AuM, also from a solitary fund. Other notable jurisdictions include Malaysia (US$90.48 million across two funds), Pakistan (US$22.16 million, two funds), Saudi Arabia (US$23.39 million, two funds) and Egypt ($US31.25 million, one fund).

Chart 1: Shariah compliant commodities assets by country

The significant concentration of AuM in jurisdictions like Jersey and Ireland, despite their minimal fund count, indicates the presence of large institutional players or master funds.

This pattern suggests that these financial centers may be leveraged for favorable regulatory or tax environments, rather than reflecting a broad-based retail market.

Conversely, Turkiye’s higher fund count and substantial AuM point to a more developed domestic market with a wider array of offerings, illustrating a dual-tiered market development where some regions foster local product innovation while others serve as domiciles for large, internationally focused funds.

In terms of quarter-on-quarter growth, the Middle East, the hub for the GCC funds that practically dominate Islamic fund activity, grew 74.16% in commodities AuM between the end of the January-March and April to June periods.

Asia Pacific, led by Egypt, experienced the second largest expansion of commodities AuM between the two quarters, growing 46.57%.

Africa, led by Egypt, came in third, with a growth of 25.31%. The Americas, led by another significant hub for Islamic finance, Canada, was up 8.74% while Europe’s AuM growth was 2.38%.

Table 1: AuM growth for Islamic commodity funds from Q1 2025 to Q2 2025

| Region | AuM Q1 2025 (US$ million) | AuM Q2 2025 (US$ million) | Percentage difference (%) |

| Africa | 24.95 | 31.26 | 25.31 |

| Americas | 5,597.17 | 6,086.49 | 8.74 |

| Asia Pacific | 76.85 | 112.65 | 46.57 |

| Europe | 14,729 | 15,080 | 2.38 |

| Middle East | 13 | 23.39 | 74.16 |

WisdomTree Metal Securities’ WisdomTree Physical Gold is the single largest Shariah compliant commodities fund, with an AuM of US$6.09 billion.

Turkiye Hayat’s Ve Emeklilik is second with the Turkiye Life And Retirement Gold Participation Retirement Investment Fund that has US$3.94 billion.

AgeSA Hayat ve Emeklilik, another Turkish manager, came in third with an AuM of US$2.78 billion for the Agesa Life And Retirement Gold Participation Retirement Investment Fund.

| Largest Shariah compliant commodity funds in Q2 2025 |

| Rank | Fund | Manager | AuM (US$ million) |

| 1 | WisdomTree Physical Gold | WisdomTree Metal Securities | 6,086.49 |

| 2 | Turkiye Life And Retirement Gold Participation Retirement Investment Fund | Turkiye Hayat Ve Emeklilik | 3,935.45 |

| 3 | Agesa Life And Retirement Gold Participation Retirement Investment Fund | AgeSA Hayat ve Emeklilik | 2,775.44 |

| 4 | Garanti Retirement And Life Gold Participation Retirement Investment Fund | Garanti Emeklilik Ve Hayat | 1,814.43 |

| 5 | Anadolu Life Retirement Gold Participation Retirement Investment Fund | Anadolu Hayat Emeklilik | 1,531.85 |

| 6 | The Royal Mint Responsibly Sourced Physical Gold ETC | HANetf Management | 1,296.96 |

| 7 | Ziraat Portfolio Gold Participation Exchange Investment Fund | Ziraat Portfoy | 1,144.5 |

| 8 | Ziraat Portfolio Gold Participation Fund | Ziraat Portfoy | 997.73 |

| 9 | Participation Retirement And Life Gold Participation Retirement Investment Fund | Katilim Emeklilik ve Hayat | 474.41 |

| 10 | Silver Participation Exchange Traded Fund | QNB Finans Portfoy | 388.28 |

Fund performance

HANetf Management proved to be the best Shariah fund manager in commodities with a three-month return of 15.6% for its Royal Mint Responsibly Sourced Physical Gold ETC. The fund allows retail investors to redeem physical bars and coins stored at The Royal Mint’s secure vault in Llantrisant, Wales.

AHAM Capital Asset Management’s TradePlus Shariah Gold Tracker ETF is second-best, with a three-month return of 14.7% while Albilad Capital came in third with its Albilad Gold ETF that returned 7.38% for the three months through June.

| Top commodity funds by three-month returns |

| Rank | Fund | Manager | Three-month return (%) |

| 1 | The Royal Mint Responsibly Sourced Physical Gold ETC | HANetf Management | 15.6 |

| 2 | TradePlus Shariah Gold Tracker ETF | AHAM Capital Asset Management | 14.7 |

| 3 | Albilad Gold ETF | Albilad Capital | 7.38 |

| 4 | WisdomTree Physical Gold | WisdomTree Metal Securities | 5.43 |

| 5 | Meezan Gold Fund | Al Meezan Investment Management | 4.96 |

Regulatory network

At the core of Islamic commodity investing lies a rigorous adherence to Shariah law, specifically the prohibitions of Riba and Gharar. This means transactions must be free from interest and avoid undue risk, a challenge in the often speculative world of commodities.

To ensure compliance, global standard-setting bodies like AAOIFI and the IFSB play a vital role. AAOIFI’s landmark Shariah Standard on Gold, issued in 2016, provided crucial clarity, defining how gold can be traded ethically, paving the way for compliant products.

The IFSB, meanwhile, sets prudential standards, ensuring that Islamic financial institutions operate with stability and transparency, emphasizing the need for transactions to be backed by physical assets.

Despite these robust frameworks, the industry faces an ongoing challenge: ensuring that Shariah compliant contracts, while ethically sound, are also legally enforceable across diverse jurisdictions, particularly when they might resemble conventional financial instruments. This delicate balance requires continuous dialogue between religious scholars, legal experts and market participants.

Outlook

The future of the Shariah commodities market appears bright, with expectations of continued growth and innovation. The proliferation of ETF-styled products, often designed with features for long-term retirement planning, is set to continue.

Gold is anticipated to remain the cornerstone, its intrinsic value and role as a safe haven ensuring its prominence. Beyond gold, there’s untapped potential in other Shariah-compatible commodities like agricultural products, which could see price increases due to global demand and supply pressures.

Emerging trends, such as the integration of fintech to create more accessible digital platforms, and the natural alignment of Islamic finance with ESG principles, are expected to broaden the market’s appeal to a wider, ethically conscious investor base. While challenges like managing inherent speculation and achieving greater regulatory harmony persist, the opportunities for diversification and ethical investment within this dynamic sector are substantial, positioning it as a key component in the evolving landscape of global finance.