- Indonesia is third-largest Islamic fund market in Asia Pacific

- Favorable Muslim demographics, government support, enhanced awareness will help Shariah investing

- Inadequate financial literacy, regional rivals could slow Indonesia’s plan

Overview

Indonesia, the world’s largest Muslim-majority country, boasts a rapidly expanding Islamic investments sector with a relatively robust product suite, although mostly catered to the domestic market. Its Islamic funds market is currently third largest in Asia Pacific after Malaysia and Pakistan.

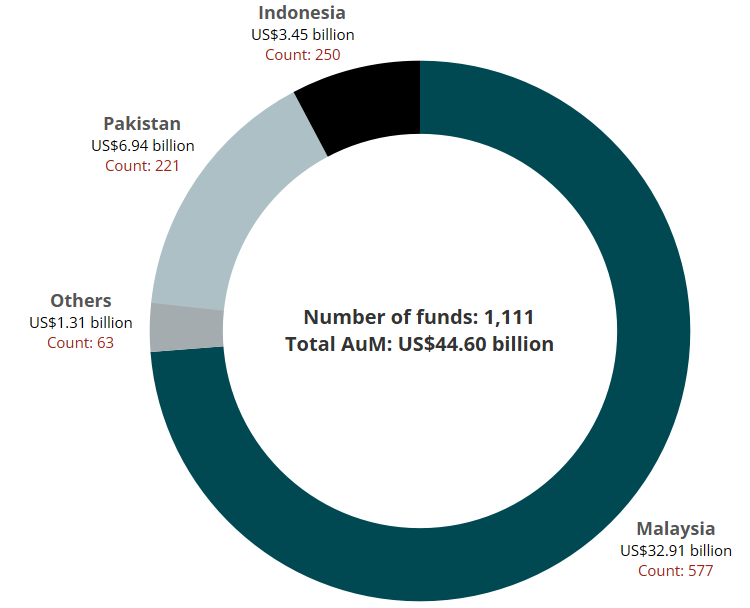

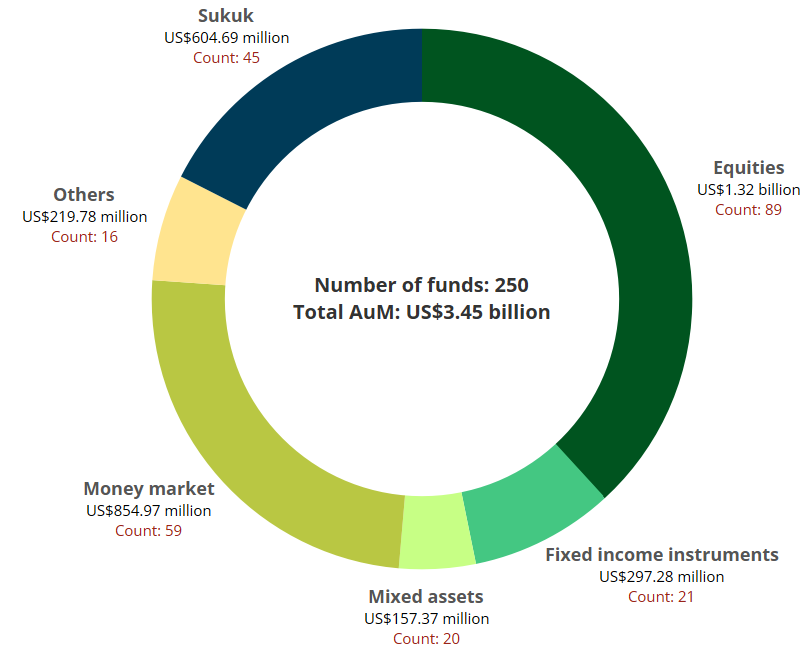

There are 250 Shariah compliant Indonesian funds, with a combined US$3.45 billion of assets under management (AuM), according to the IFN Investor Funds Database as of the end of Q4 2024. The Asia Pacific region hosts a total 1,111 Islamic funds with an AuM of US$44.6 billion.

Indonesia is pushing aggressively to develop its Islamic finance and investment industry, heating up the competition with Malaysia and Pakistan, as the three leverage on their respective Muslim-majorities to climb the global Shariah rankings, and play to their religious credentials.

On this score, Indonesia has an edge over its peers, but it still lags behind.

With nearly 90% of its 280 million population being Muslim, it has a vastly undertapped market to grow its Shariah penetration.

Malaysia, in comparison, has fewer than 23 million Muslims, who make up 65% of its population. However, Malaysia boasts a Shariah fund AuM of almost US$33 billion — nearly 10 times that of Indonesia’s — and 577 funds, more than double Indonesia’s.

Pakistan’s population of just under 240 million people, with a 97% Muslim majority, has almost twice the size of Indonesia’s Shariah assets at US$6.94 billion.

Islamic financial market

Islamic investors in Indonesia can access Halal equities on the Indonesia Stock Exchange (IDX). Shariah stocks were responsible for about half of total stock transactions in 2024 by number of listed shares, market capitalization, volume and transaction value. Market capitalization of Halal equities on the IDX rose 11% year-on-year (y-o-y) to IDR6.83 trillion (US$419.16 million) last year.

There are three Islamic indices in Indonesia: the Sharia Stock Index, the Shariah Online Trading System and Jakarta Islamic Index 70. Besides the three indices, there are Shariah investment opportunities in Sukuk, mutual funds, exchange-traded funds and money market funds.

One of the many initiatives Indonesia has implemented to bolster its Islamic investment industry is liberalizing rules for domestic Islamic funds allowing them to tap into the global capital markets in 2016, which gave Shariah funds advantages over conventional funds. Not only are Islamic funds allowed to invest in offshore instruments, but their minimum required AuM was more than halved.

The Indonesian financial services authority, officially known as Otoritas Jasa Keuangan, or OJK, projects Islamic finance industry assets will reach US$6.7 billion by 2027, from a current US$1.55 billion, driven by economic growth and government spending.

Islamic banking assets — another closely-watched metric because of their influence on the Shariah universe as a whole — reached IDR980.3 trillion (US$59.73 billion) in 2024, a year-on-year increase of 9.88%.

The market share for Islamic banking itself grew 7.72% in 2024, expanding from 4.8% in 2016, as Bank Indonesia, the central bank, introduced initiatives aimed at enhancing Shariah financial inclusion for the population and tax incentives for Shariah compliant products.

Adding to the potential of the Shariah marketplace is a booming middle class adjusting to the evolving array and sophistication of investment products.

The second sovereign wealth fund (SWF) for Indonesia – Danantara, short for Daya Anagata Nusantara – was launched on the 24th February 2025 with US$20 billion allotted to 20 high-impact national projects that include commodity production, artificial intelligence, food production, aquaculture and renewable energy.

Assets parked in Danantara include three banks – Bank Mandiri, Bank Rakyat Indonesia and Bank Negara Indonesia – as well as state electricity utility Perusahaan Listrik Negara, oil and gas company Pertamina, Telkom Indonesia, and Mining Industry Indonesia, which owns gold, coal and nickel mines. Danantara is expected to be valued at about US$900 billion in total AuM, making it the world’s fourth largest SWF, behind Norway but ahead of Saudi Arabia and Singapore. There are hopes that Danantara will adopt a Shariah strategy, at least partially, in one form or another.

Chart 1: Largest Islamic fund markets in Asia Pacific by AuM at the end of 2024

Source: IFN Investor Funds Database

Chart 2: Indonesia’s Islamic investments at the end of 2024 by asset class and AuM

Source: IFN Investor Funds Database

Regulatory environment

OJK is the country’s main financial regulator supervising banking, capital markets and non-bank financial institutions. In January 2025, the Indonesian Commodity Futures Trading Regulatory Agency, transferred the regulation of digital financial assets to OJK.

Indonesia has a robust Shariah governance framework, overseen by a National Shariah Board that issues Fatwas on Islamic financial products and services. The OJK also ensures Islamic financial institutions comply with Fatwas issued by the Shariah board.

For additional oversight, the institutions are required to have their own Shariah supervisory boards to monitor their adherence to what has been ordained.

Aside from policing the market, the OJK actively promotes development of various Islamic financial instruments, including Sukuk and mutual funds, to help grow the Shariah marketplace.

Despite such nurturing policies, foreign investors can still face numerous challenges in Indonesia. A 2024 report by the US State Department listed legal and regulatory uncertainty, economic nationalism, trade protectionism and vested interests as among potential complications for foreigners.

Exchange rate volatility is a concern too, with Bank Indonesia’s interventions to stabilize the rupiah having had enough of an impact on foreign reserves to prompt some investors to seek alternative markets.

Fund performance

Of Indonesia’s multiple Shariah asset classes that include fixed income instruments, money market funds and mixed assets, equities came out tops in the final quarter of 2024, with double-digit gains for the top three funds in the space.

Maybank’s Islamic equity fund, Dana Ekuitas Syariah, was the runaway performer, returning 14.5% for the quarter by mimicking “as closely as possible the performance of the Dow Jones Islamic Market Titans 100 Index”.

Table 1: Top performing Indonesian Islamic funds in Q4 2024

| Fund name | Fund manager | Three-month return (%) | |

| 1 | Maybank Dana Ekuitas Syariah | Maybank Asset Management Indonesia | 14.49 |

| 2 | Pacific Saham Syariah | Pacific Capital Investment | 11.32 |

| 3 | Pacific Saham Syariah II | Pacific Capital Investment | 10.05 |

| 4 | Pacific Saham Syariah III | Pacific Capital Investment | 7.81 |

| 5 | Bahana US Opportunity Sharia Equity USD | Bahana TCW Investment Management | 6.64 |

Source: IFN Investor Funds Database

For other asset classes, Syailendra Capital led the fixed income instruments space with its Syailendra Sharia Fixed Income Fund, returning 2.11%; Prudential Indonesia’s PRUlink Syariah Rupiah Multi Asset Fund led mixed assets with a 3.15% gain; PNM Investment Management’s PNM Falah 2 was the outlier in the money market, advancing 1.92%.

It is worth noting that while the Indonesian regulatory environment allows for Islamic REITs, there has yet to be one.

Table 2: Top Indonesian Islamic funds in Q4 2024 (excluding equities)

| Asset class | Rank | Fund name | Fund manager | Three-month return (%) |

| Fixed income instruments | 1 | Syailendra Sharia Fixed Income Fund | Syailendra Capital | 2.11 |

| 2 | I-Hajj Syariah | Insight Investments Management | 1.81 | |

| 3 | Trimegah Terpoteksi Syariah 2 | Trimegah Asset Management | 1.43 | |

| Mixed assets | 1 | PRUlink Syariah Rupiah Multi Asset Fund | Prudential Indonesia | 3.15 |

| 2 | Panin Sumber Berkat | Panin Asset Management | 2.45 | |

| 3 | Sucorinvest Sharia Balanced Fund | Sucorinvest Asset Management | 1.83 | |

| Money market | 1 | PNM Falah 2 | PNM Investment Management | 1.92 |

| 2 | Sucorinvest Sharia Money Market Fund | Sucorinvest Asset Management | 1.54 | |

| 3 | Ashmore Dana Pasar Uang Syariah | Ashmore Asset Management Indonesia | 1.47 | |

| Others | 1 | Bahana Salama Syariah 6 | Bahana TCW Investment Management | 1.33 |

| 2 | Bahana Salama Syariah 5 | Bahana TCW Investment Management | 1.28 | |

| 3 | MNC Syariah Pendapatan Tetap | MNC Asset Management | 0.45 |

Source: IFN Investor Funds Database

Outlook

Determining whether Indonesia can “win” the Islamic investment race involves variables that will test its strengths versus on-ground challenges, as well as competition.

Strengths include its vast Muslim population, government support for the sector, growing awareness among the population of the benefits of Shariah investing and Indonesia’s economic growth as a whole. As the largest and most dynamic ASEAN economy (and a member of the G20), Indonesia is incredibly attractive to long-term horizon investors seeking to capitalize on consumer-related market opportunities as well as growing sectors such as energy and construction. Indonesia has become a viable option for a China+1 strategy.

Challenges comprise having adequate financial literacy among the people to grow the marketplace, being prolific with product diversification that matches unique customer needs and withstanding competition from other nations also striving to become leaders in Islamic finance.

While it may be too early to definitively say whether Indonesia will “win,” it certainly has the potential to become a dominant force in the Islamic investment world. This is evident in its steadily growing Islamic investment sector – the number of Shariah investors increased by 23% y-o-y in 2024, according to the IDX; its houses one of the largest concentrations of Halal funds in the region and the government is one of the biggest Sukuk issuers globally.