Consistent with its long-term outlook investment strategies, Dubai-registered asset manager Invesense recently established a Sukuk fund to better tap promising returns, Portfolio Manager Ahmed Ali explained to IFN Investor.

“We think global interest rates are currently at their highest. It is time now to capture such stable returns and lock these in for the next five, seven or even 10 years with long-term Sukuk issues.

“For this fund, using quantitative strategies focused on term and structure factors, from a duration perspective and yield, the target is to achieve around 6.5% gross yield.”

Finance and Operations Chief Mathews B Abraham said many investors are seeking options that provide more income with stability, which provide an attractive alternative to actually leaving cash in the bank. “Some clients have deposits which are getting only about 2.5% yield in Shariah accounts.”

As a potential solution, the Invesense Global Sukuk Fund, domiciled in Bahrain, began operating since October 2024 and its assets under management (AuM) stood at US$3.55 million as at the 24th January 2025.

Mathews said the focus over the past few months was on ensuring this fund could deliver on the premise of monthly dividend payouts. “We put in the seed capital and conducted live tracking to verify actual returns, rather than being based on purely theoretical data.”

Having achieved this target, marketing of this Invesense Sukuk fund will begin in earnest with the upcoming Eid celebrations. “We are trying to get at least around US$7 million to achieve AuM of US$10 million by June 2025.”

Minimum entry to this open-ended fund is US$10,000 and a salient point is that Zakat (tax) applies only to the monthly distributions and not to the overall investment capital – due to the Ijarah-type fund structure, explained Ahmed.

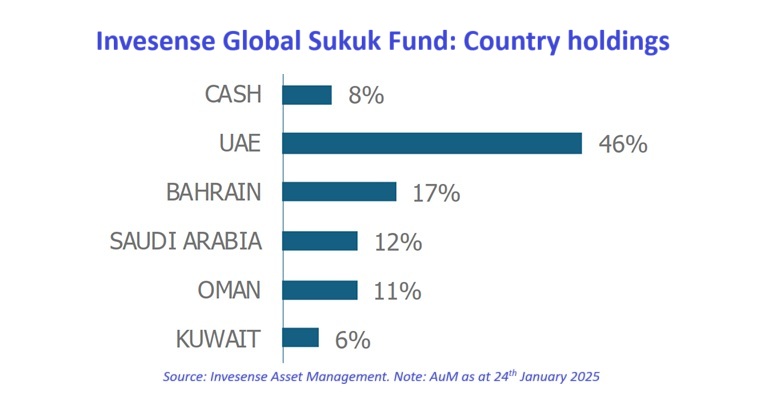

With 14 global Sukuk holdings currently, Ahmed said this fund is not limited to rated instruments. “There are sovereign-backed instruments issued by GCC national governments and these pay coupons of around 5% or more. We will keep on buying more of such Sukuk as our AuM grows.”

*Disclaimer: The opinions and viewpoints expressed in the Fund Profile do not constitute as a recommendation for any funds highlighted. The information presented is not investment advice and should not be treated as such.

| Invesense Global Sukuk Fund | |

| Fund manager | Invesense Asset Management |

| Asset class | Sukuk |

| Base currency | US dollar |

| Initial investment | US$10,000 |

| Investment objective | To achieve on achieving returns higher than cash rates and long-term capital growth by investing in global Sukuk |

| Risk profile | Low risk |

| Distribution | Monthly |

Source: Invesense Asset Management