Investments like small-and medium-sized enterprises(SMEs) are often regarded as the backbone of an economy, especially in low- and medium-income countries (LMICs). Investments typically straddle a wide spectrum of policies, strategies and products, each suited to the requirements of a requisite national, bilateral and multilateral investment playbook and involving several facilitators.

These may include governments, bilateral and multilateral institutional financing arrangements, domestic investors both institutional such as pension and social security funds, sovereign wealth funds, private sector capital, and more recently, the ascendancy of philanthropic capital.

Investment flows, of course, could be domestic – government, institutional and private funds including through family offices and incentivized tax and guaranteed retail mobilization – or through foreign direct investment (FDI) flows through direct project financing especially in infrastructure and key economic sectors such as energy, agriculture and food security, healthcare and climate related activities, via cross-border mergers and acquisitions (M&As) and through collaborative co-financing and blended financing mechanisms. This is in tandem with the risk mitigation and credit enhancement solutions offered by multilateral insurers such as the World Bank Group’s MIGA, the IsDB Group’s ICIEC, national export credit agencies (ECAs) and private providers of credit and investment insurance.

Dr Khalid Khalafalla, Officer-in-Charge

Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC)

Investment in the global context

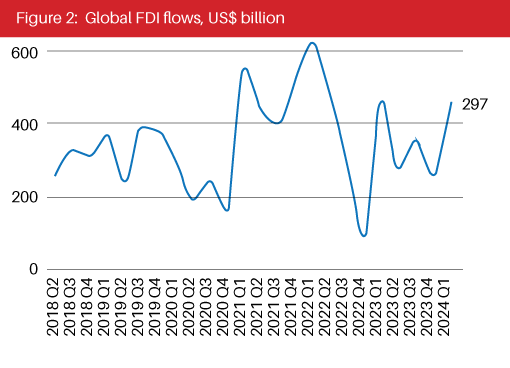

The mainstay however remains as global FDI flows, which according to the UN Conference on Trade and Development (UNCTAD)’s World Investment Report 2024, decreased marginally by 2% to US$1.3 trillion in 2023. The global environment for international investment, stated the Report, remains challenging in 2024. This is due to “weakening growth prospects, economic fragmentation trends, trade and geopolitical tensions, industrial policies and supply chain diversification” which are reshaping FDI patterns, causing some multinational enterprises (MNEs) to adopt a cautious approach to overseas expansion.

FDI observes the OECD, a group of the 20 largest economies including three ICIEC member states – Saudi Arabia, Indonesia and Turkiye – lies at the heart of globalization and serves as an important conduit for the transfer of capital, goods, services and information across economies. “Measuring FDI helps us better understand how countries are interconnected and integrated into today’s global economy. The OECD provides operational guidelines on how FDI activity should be measured and sets global standards for collecting FDI statistics. The OECD also disseminates comprehensive and comparable FDI data as well as in-depth insights into global FDI trends to support economic analysis and inform policy decisions and enhance investment strategies.”

With the global push to attract and retain financial flows, online information portals and single windows have proliferated to foster a conducive business and investment climate.

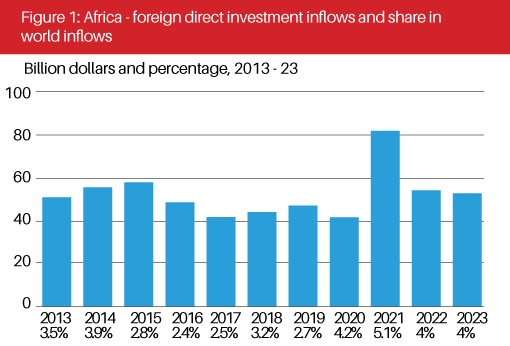

According to the UNCTAD report, FDI flows to developing countries fell by 7% to US$867 billion last year, reflecting an 8% decrease in developing Asia. FDI flows to Africa fell by 3% to US$53 billion in 2023. Two of the largest recipient economies – Egypt and South Africa – drove the overall trend. Asia and Africa account for the majority of ICIEC member states, with Azerbaijan, the host country for COP29 and the Togolese Republic acceding to membership as the 49th and 50th member states.

In contrast, flows to developed countries were strongly affected by financial transactions of MNEs, partly due to efforts to implement a global minimum tax rate on the profits of these corporations. In-flows to most parts of Europe and the US were down by 14% and 5%, respectively. A disturbing trend in 2023 was a 10% reduction in investment in sectors linked to the UN Sustainable Development Goals (SDGs) agenda, most notably impacting agrifood systems, water and sanitation power generation and renewables due to a 25% drop in investment flows in SDG-linked projects due in turn to the tight global financing and economic conditions.

Similarly, according to the OECD, preliminary estimates in Q1 2024 show global FDI flows increased by 78% compared to Q4 2023, reaching US$462 billion. However, on a year-on-year basis, global FDI flows remained comparable to the level recorded in Q1 2023. The top three sources of FDI outflows worldwide were the US (US$131 billion), the Netherlands (US$71 billion) and Japan (US$45 billion).

From a credit and investment insurance perspective, 2023 was an encouraging year for export credit with Berne Union (BU) members (including ICIEC) providing over US$3 trillion in new support for cross-border trade, with expansion across almost all business lines, auguring well for 2024 and beyond. The two stand out performance metrics for the industry in 2023 states the BU included a 40% increase to over US$165 billion for medium- and long-term businesses, following strong growth in manufacturing, infrastructure and transport sectors alongside a continuing rapid growth in renewable energy investments.

Source: UN Trade and Development (UNCTAD), FDI/MNE database

According to the BU, climate and the green transition are the main drivers of new opportunities with a record US$20.5 billion in reported new commitments for renewable energy across 68 countries in 2023.

Enter ICIEC as the pioneering alternative investment insurer disruptor

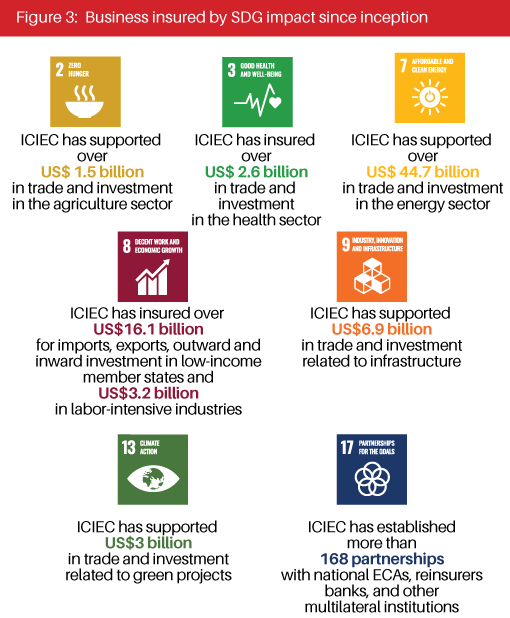

For a multilateral credit and investment insurer and serving effectively as the insurance pillar of the Islamic Development Bank (IsDB) Group, ICIEC has emerged in a relatively short period of a mere 30 years with a unique new model for the global industry – the ICIEC Takaful System, which is the market standard for Shariah-based credit and investment insurance. This makes ICIEC the only dedicated Shariah-based multilateral insurer in the world, currently with 50 member states and rising with a cumulative business insured since its inception in 1994 exceeding US$108.3 billion including US$22.1 billion in investment insurance.

Takaful is often described as the Islamic equivalent to conventional insurance, literally meaning solidarity or mutual support or guarantee, whereby a group of participants agree among themselves to support one another jointly for the losses arising from specified risks. The word ‘Takaful’ is derived from the Arabic word, Kafalah, which means ‘guaranteeing each other’ or ‘joint guarantee’ or ‘solidarity’, whereby a group of participants agree among themselves to support one another jointly for the losses arising from specified risks. Similarly, re-Takaful is the Islamic equivalent to conventional reinsurance where Takaful operators protect themselves against the risks they underwrite. The re-Takaful market is even smaller than the Takaful market with the major challenge being the lack of reliable data, capacity and the small number of re-Takaful providers and underwriters. In this respect, ICIEC brings a unique faith-based social finance.

As the corporation marks its 30th anniversary in 2024, ICIEC has excelled despite several constraints in spreading the message of the importance of export credit and investment insurance both through its increased membership, its product suite and its business activity in line with the specificities of the development agendas of its constituent member states.

As ICIEC continues to consolidate its market education and awareness as well as technical assistance functions among its member states, global partners and counterparties, it has the potential and capacity to dramatically increase its credit and investment insurance underwriting, reinsurance capacity. As in the Corporation’s stated commitment to helping member states achieve their development goals including resilience, mitigation and adaptation to the threats posed by climate change and food security, so devastatingly exposed by the fuel and food supply chain disruptions caused by the conflict in Ukraine, the Red Sea and Panama Canal trade route disruptions.

Noteworthy is the fact that ICIEC investment risk cover is directed toward various sectors, with US$2.35 billion in 2023 going specifically into clean energy initiatives such as solar energy systems and wind farms – assisting with their importation and use in national infrastructure projects. At COP28, IsDB President, H.E. Dr Muhammad Al Jasser also unveiled a US$1 billion group climate finance initiative for fragile and conflict-affected member countries over the next three years.

As H.E. Dr Al Jasser, who is also chairman of ICIEC’s board of directors, observed: “The journey of ICIEC is deeply intertwined with the vision and mission of IsDB. Our mutual commitment to fostering sustainable economic growth in member countries and Muslim communities in non-member countries has been the foundation of our collaborative endeavors.”

The IsDB Group’s commitment to developing green infrastructure will go a long way toward addressing this issue, as well as other issues related to the quality and sustainability of member states’ infrastructure. Equally important, a healthy and steady pipeline of good quality projects focusing on green and resilient infrastructure will allow the Group to be a leader in mobilizing cost-effective funds from global capital markets and private capital through green, sustainable and impact Sukuk targeting Environmental, Social and Governance (ESG) and SRI investor base, thus helping achieve the SDGs.

Investment facilitation is well-embedded in the IsDB Group’s Investment Promotion Technical Assistance Program (ITAP), an initiative by the IsDB Group, established in 2005. It was managed by ICIEC until 2016. ITAP aims at helping to unlock the developmental potential of the IsDB member states through a comprehensive and integrated program of foreign investment promotion technical assistance. Its focus areas include institutional development, sharing best practices, information dissemination on investment opportunities, needs assessment studies, specific sectors studies, capacity building of investment promotion agencies, country promotion events including seminars and conferences as well as policy advice to improve the investment environment.

Another major development which augurs well for ICIEC’s future operations is the 150% increase in ICIEC’s authorized capital from its current ID0.4 billion (US$0.54 billion) to ID1 billion (US$1.34 billion) and a 268% increase in its subscribed capital by ID500 million (US$670 million) to ID797 million (US$1.07 billion) which has already materialised in subscription commitments by several member states. The capital increase boosts the Corporation’s ability to underwrite more business and its reinsurance capacity.

The capital increase also enhances ICIEC’s financial strength, boosts its loss-bearing equity resources, improves its internal capital generation capacity, helps to continue its operation on a solid and stable foundation and strengthens its credit fundamentals. In addition, the Board of Governors approved a special share class comprising 20% of the increase in subscribed capital of ID100 million (US$134 million) for subscription by financial institutions owned/controlled by member states.

Another important factor which ICIEC brings to the table is its ability to leverage its capital which, in turn, determines capacity through the re-insurance market. Over the last few years, ICIEC indeed has re-engineered its insurance treaty to absorb some of the capital requirements that are needed instead of using its ordinary capital resources. In other words, ICIEC was using its insurance capacity to underwrite that business. At the same time, the corporation also initiated a study internally for the need of risk implications of recapitalization, taking in the experience of peer institutions in the multilateral development bank (MDB) domain and looking at new innovative ways to recapitalize.

Under its erstwhile authorized capital of ID400 million (US$556 million) for instance, ICIEC on average leveraged its capital five times from the reinsurance market over the last few years. For every dollar given to invest in a project, ICIEC could bring five dollars from the international market which is supported by its reinsurance capacity. Imagine the power of leveraging insurance can bring to the table as a major player that can release capacity to the developers.

ICIEC’s investment facilitation strategy

The ICIEC’s investment facilitation strategy is embedded through two core pathways – its business operations and its championing of the intra-OIC trade and investment and cooperation.

Over three decades since its inception in 1994, ICIEC has insured US$114 billion in trade and investment across the globe for its 50 member states, including US$90.7 billion in export credit and US$23.3 billion in investment insurance. The corporation has been a champion of intra-OIC businesses, supporting US$53.6 billion in trade and investment within OIC countries.

The flagship investment policies include: i) Equity Investment Insurance Policy (EIIP) – a policy that provides insurance coverage for cross border equity investment by any individual or company against transfer and convertibility, expropriation, war and civil disturbance and breach of contract, ii) Financing Facility Insurance Policy (FFIP) – a policy that provides insurance coverage for cross border financing by banks and financial institutions against transfer and convertibility, expropriation, war and civil disturbance and breach of contract, and iii) Non-Honouring of Sovereign Financial Obligations (NHSFO) – a policy that provides insurance coverage for corporates against the default of governments and government-owned entities in meeting their sovereign obligations.

This playbook can be further segmented into – i) Investment insurance for banks and financial institutions covering risks associated with NHSFO and political risk insurance of cross-border financing, ii) Investment insurance for corporates covering political risk insurance for equity investments and projects thus acting as a credit enhancement tool, and iii) Export credit and investment reinsurance for ECAs and insurers through a fronting exercise encompassing reinsurance and co-insurance.

Furthermore, ICIEC has also pioneered a Sukuk Insurance Policy, a third-party guarantee for standard Sukuk issuance aimed especially at investment grade, sub-investment grade or unrated member states, with a focus on green Sukuk issuance projects related to renewables in power generation, food security and agri-business, climate related projects and value-added healthcare transformation programs such as the ICIEC’s first public-private partnership (PPP) hospital project in 2015 – the Adana City Research and Training Hospital in Turkiye – a state-of-the-art facility with 1,550 beds, which was spared any damage as a result of the devastating earthquake in southern Turkiye in February 2023 and where treatment was provided to thousands of patients who were injured in the earthquake that caused extensive damage in 11 cities. This is just one example of ICIEC’s compelling success in delivering true development and life-enhancing impact investment outcomes in member states. On the commodities side, ICIEC played a key underwriting role in supporting the exports as well as imports of strategic commodities for member states.

In essence, ICIEC’s investment strategy and playbook are firmly embedded in its overall vision “to be recognized as the preferred enabler of trade and investment for sustainable economic development in member states,” in its mission “to facilitate trade and investment between member states and the world through Shariah compliant risk mitigation tools,” and through its mandate “to promote cross-border trade and FDI in its member states.” ICIEC also serves its mandate by providing alternative Shariah compliant risk mitigation and credit enhancement solutions to member states’ exporters selling to buyers and to investors from across the world investing in member states. The corporation also supports international exporters selling to member states if the transactions are for capital goods or strategic commodities.

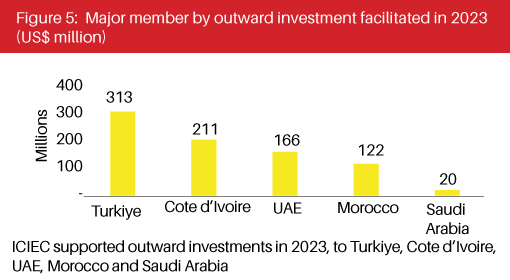

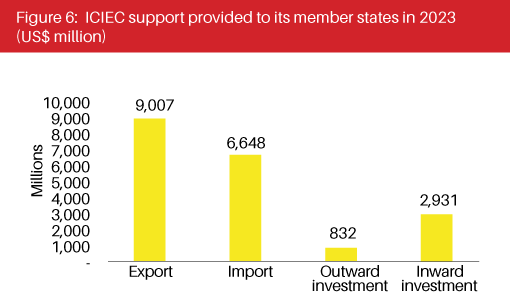

In 2023, ICIEC’s business insured (BI) reached US$13.3 billion, of which US$10.4 billion was for supporting exports and imports and US$2.9 billion for supporting FDI flows into member states. The major recipients were the energy sector with US$6,302 million, followed by manufacturing at US$3,340 million and services at US$2,086 million. The BI in infrastructure was only US$426 million, in healthcare US$287 million and in the agricultural sector US$67 million. BI by region was overwhelmingly in favor of Asia (including the MENA region) at US$6.2 billion, followed by sub-Saharan Africa (SSA) at US$3.91 billion, Europe at US$2.78 billion, the US at US$0.41 billion and Oceania at US$0.02 billion.

A notable shift in 2023 for new commitments was from short-term insurance to investment insurance as the share of foreign investment insurance increased from 27% to 43%, while medium-term business declined from 13% to 8%, and short-term business decreased from 60% to 49%. The significant growth in the combined medium-term and foreign investment insurance business indicates a strategic focus on more diversified and long-term investments.

In terms of the three business lines in 2023, the short-term business insured increased by 7% to US$10 billion from US$9.4 billion, while the combined medium-term and foreign investment insurance business insured increased by 48% to US$3.3 billion from US$2.2 billion in the previous year.

The top 10 recipients of ICIEC support in 2023 are demographically varied dominated by Turkiye, the UAE, Kazakhstan, Egypt, Algeria and Saudi Arabia. However, Senegal historically has been featured as a prime destination for ICIEC investment insurance cover for iconic impact projects with the unique ability to attract foreign private investment and project finance especially from global banking majors. Turkiye is also a major partner of ICIEC in this respect.

In Turkiye, ICIEC was involved with its NHSFO Insurance Policy in the Yerkoy Kayseri High Speed Railway (HSR) project, allowing for a direct rail connection between Yerkoy and Kayseri, which will eventually connect Ankara and Kayseri with a travel time of only two hours by HSR where it is currently seven hours by conventional train. Turkiye embarked on a significant infrastructure development in 2023 with the HSR project, funded through a syndicated financing facility of U$D143.5 million, with MUFG Securities leading a syndication comprising six banks including MUFG itself, playing a pivotal role in the transaction.

Another pathway for ICIEC in facilitating investment insurance is through collaboration with peer multilateral development institutions such as the African Development Bank (AfDB) Group. In a landmark collaboration between the AfDB Group and ICIEC, a strategic risk-sharing engagement was established to drive sustainable development in Cote d’Ivoire. ICIEC provided an insurance capacity of €194 million (US$212.86 million) in support of a €400 million (US$438.9 million) partial credit guarantee (PCG) issued by the AfDB. This PCG serves as protection against non-payment risk associated with a EUR533 million (US$584,83 million facility extended by Standard Chartered Bank to the government of Cote d’Ivoire. The funds are dedicated to a diverse array of eligible environmental and social projects, aligning with Cote d’Ivoire’s Sustainable Framework, encompassing areas such as renewable energy, education, pollution prevention, health infrastructure and water management.

A crucial aspect of this collaboration is ICIEC’s role in covering EUR184 million (US$212.86 million) of the PCG, optimizing the AfDB’s balance sheet and demonstrating a balanced risk-sharing approach. The bank retains a EUR206 million (US$226.03 million) stake (51.5%) in the PCG, emphasizing commitment to the project’s success.

The partnership enhances Cote d’Ivoire’s capacity to attract long-term, competitive financing for ESG projects and highlights collaborative efforts among multilateral institutions to support common member countries’ sustainable development aspirations. The transaction not only facilitates the realization of Cote d’Ivoire’s National Development Plan but also improves the country’s funding terms under challenging market conditions. It sets a precedent for future cooperation between ICIEC and the AfDB in common member states.

In relation to the Abidjan access to clean water project, Marc Guigni, deputy CEO of the Société Générale Cote d’Ivoire said, “ICIEC facilitated the implementation of credit at a very long maturity, which allows for smoothing repayments and reduction of the impact of debt service on the state budget. The choice of ICIEC for this project was natural and necessary for many reasons. One of them is that ICIEC was able to optimize the bank’s balance sheet through its participation. Thus, Société Générale de Côte d’Ivoire was able to participate with a much higher amount to finance this large-scale and strategic project for the state.”

The ICIEC-Senegal infrastructure investment partnership

The substantial infrastructure needs in Africa as elsewhere in the developing countries cannot be met unless there is a sizeable response from private sector financing. Attracting private sector investment is critical for SSA countries to make progress also towards achieving the SDGs.

ICIEC has supported several landmark transactions and projects in Senegal in various sectors over the last few years through its risk mitigation and credit enhancement solutions and through its reinsurance capacity. These include the Abdoulaye Wade Stadium (the National Stadium), Dakar Expo Center, the Market of National Interest, the Dakar Truck Station. Since inception, ICIEC has supported Senegal to the tune of USD5 billion, or 2.92% of its total operations.

One of the iconic impact investment projects for which ICIEC provided NHSFO insurance to cover an EUR266 million (US$291.87 million) Murabahah facility extended by Standard Chartered Bank, AKA Ausfuhrkredit-Gesellschaft mbH, Société Générale-Paris and Saudi National Bank, was the construction of Abdoulaye Wade National Olympic Football Stadium.

The stadium’s financing model developed in the form of EPC+F (Engineering, Procurement, Construction and Financing), and based on close collaboration between public and private players, proved to be particularly innovative, according to The Public Infrastructure Management Company in the Urban Centers of Diamniado and Lac Rose. In fact, the financing model adopted for the Stadium offered more flexibility to the executing company on its choice of imports and sub-contracting.

According to Selim Bora, chairman of Summa Group, Turkiye, the contractor that built the stadium “This ambitious project was also an EPC+F contract awarded in 2020, right before the COVID-19 pandemic hit the world and everything stopped. Even during those months of lock- down we were able to communicate and continue our correspondence with ICIEC officials which in fact saved the project since a Standard Chartered Bank led consortium were to facilitate the credit for 100% financing provided that the political risk insurance was covered by ICIEC.”

Senegal embarked on an ambitious infrastructure project in November 2023 involving the financing of the Dakar-Tivaouane Highway, including the construction of 37 bridges. With a total cost of EUR336 million (US$401.59 million) and a tenor of 12 years, the project represents a significant step in enhancing the country’s infrastructure.

Société Générale, managing the special purpose entity (SPE), sought the involvement of ICIEC, whose role was crucial, providing an NHSFO policy to cover the sovereign obligations of the government of Senegal. This coverage was pivotal for an Islamic financing facility amounting to EUR300 million (US$329.17 million) plus associated profit, as part of a larger EUR489 million (US$536.55 million) contract. The project is part of an overarching EUR1billion (US$1.1 billion) initiative, supported by the World Bank, AfDB, the Saudi Fund for Development and the Government of Senegal.

Other projects of note in which ICIEC played similar crucial investment insurance roles to help mobilize long-term funding include: i) The new Blaise Diagne International Airport which is at the heart of Senegal’s ‘Emerging Senegal’ Plan, ii) The CICAD Business Hotel, CICAD Expo Center and Diamniadio Multifunctional Sports Center (Dakar Arena) iii) The rehabilitation of a wastewater collector in Dakar, Senegal, iv) and the construction of the Dakar market of national interest and truck station.

ICIEC’s collaboration with Senegal was further cemented in 2023 with the signing of an MoU with APIX S.A, which is Senegal’s main agency for attracting inward FDI and facilitating business creation and development, including that of SMEs. The agreement also facilitates joint efforts to promote Senegal as an FDI destination for ICIEC and IsDB Group member states.

ICIEC also signed an MoU with the Sovereign Fund for Strategic Investments (FONSIS), the investment arm of the Government of Senegal. Under the agreement, ICIEC seeks to catalyze FDI flows into Senegal by promoting FONSIS among ICIEC member states and facilitating access to ICIEC’s political risk insurance products and guarantees.

The power of programs and partnerships

It is no coincidence that the 17 UN Sustainable Development Goals (SDGs) 2030 Agenda culminates with Partnerships for the Goals. “Never has there been a more critical time for strengthening cross-sectoral partnerships and securing the next 10 years of collaboration for sustainable development,” says the global body, urging much greater investment in empowering solutions in attempting to achieve the other 16 goals, whose sheer scope and challenges are matched by their urgency and complexity.

Estimates from the IMF/World Bank, OECD and UN put the cost of achieving the SDGs at US$3.9 trillion annually over the next 10 years. Sustainable development projects cannot be achieved by governments alone. The pressure on national budgets and scarce resources due to the impact of the pandemic and the global economic and geopolitical uncertainties has severely limited the ability of governments to mobilize the necessary funds.

As a signatory to the principles for responsible insurance and the fact that it is the only Shariah-based multilateral insurer, sustainable investment is firmly embedded in ICIEC’s due diligence process through linking all new business and other queries with the SDGs and climate action indicators. In this respect, ICIEC actively targets real impact and change in all its financing, insurance policies it underwrites and projects it supports, and acts as a catalyst for private sector capital mobilization towards achieving the SDGs.

ICIEC’s insurance policies, whether the policyholder is a financial institution, specialized company or contractor, that covers political and commercial risks, can contribute to the flow of climate action and food security related investments, specialized technology and equipment or services into member states. These projects help reduce electricity imports, lessening dependency on fossil fuels, creating jobs, supporting the local economy via local procurement of services and equipment, fostering technology transfer, empowering local people with new knowledge about renewable energy and improving local infrastructure via road construction and improvements in transmission lines and electricity distribution.

PPPs, such as the Adana City Hospital Project, have emerged as a critical tool for mobilizing the necessary resources and expertise to finance infrastructure and development projects in OIC countries. PPPs involve collaboration between public and private sector entities to achieve a common goal. PPPs can help to mobilize private sector investment, expertise and innovation to support the development of infrastructure and technologies.

Private sector engagement requires credit enhancement, which insurers such as ICIEC are uniquely positioned to do through their sustainability policies and access to their member country’s national and subnational bodies, which engage with relevant climate action and food security projects and transactions. Indeed, private sector development is one of the main pillars of ICIEC’s strategy. Embedding commercial opportunities and helping corporates and banks make a material difference to support positive development project outcomes is something that risk mitigation tools can facilitate.

Innovative finance solutions and partnerships are ideal to mitigate rising project and investment costs. ICIEC has been at the forefront of several initiatives over the last few years. They include:

i) The Arab Africa Guarantee Fund (AAGF), which was initiated by ICIEC under the Arab-Africa Trade Bridges Programme (AATB), of which the corporation is the insurance pillar. The AATB has been instrumental in fostering partnerships and enhancing trade and investment flows between Arab and African regions, to which ICIEC has already contributed USD25 billion. The AAGF aims to provide a scalable structure that aims at mobilizing financial resources and risk mitigation capacity to support trade and investment in Arab and African countries and ensuring that all-in pricing of transactions is optimized for the end beneficiaries through blended structures. The fund encompasses three sub-funds: the Arab Africa Green Facility, the Arab Africa Food Security Facility and the Arab Africa Health Facility.

ii) The Africa Co-Guarantee Platform was established by ICIEC, AfDB, the African Trade and Investment Development Insurance (ATIDI), the multilateral African ECA, AUDA-NEPAD, and GuarantCo, part of the Private Infrastructure Development Group (PIDG) which is supported by the governments of the UK, Switzerland, Sweden, Netherlands and Australia. It was set up in response to the growing need for de-risking instruments in Africa, with the focus on infrastructure development, intra-regional trade, addressing the food and fertilizer crises and enhancing coverage for various investments. Its mandate is to support trade and investment projects, to find proactive risk mitigation solutions which will help projects reach financial close by making them bankable especially relating to PPP projects, building capacity and in supporting African sovereigns respond to macro-economic challenges that may arise (e.g. food security, future pandemics, periods of extreme weather resulting from climate change, better debt management, balance sheet optimization for DFIs and commercial banks.) The CGP crucially has two in-built innovation components – a ‘financial products incubation’ pillar and a transaction-based longer-term risk mitigation capacity building pillar. There are currently 26 projects in the CGP pipeline, with total project costs of over USD6 billion. These projects are currently seeking an estimated USD2.3 billion in risk mitigation.

ICIEC leverages its already extensive network of relationships with multilaterals, regional agencies, industry bodies, ECAs and private insurance companies including the MIG, the Berne Union, the AMAN Union and DHAMAN. In August 2024, for instance, ICIEC signed its latest landmark MoU with the Japan Bank for International Cooperation (JBIC) to enhance cooperation and support the development of trade and investment flows between ICIEC’s member states and Japan by leveraging ICIEC’s insurance services and JBIC’s financial facilities. The partnership will facilitate transactions involving Japanese companies as exporters, EPC contractors or investors in projects that promote the development of ICIEC’s member states, with a particular focus on Central Asia.

An important development more recently is the accession of the IsDB and ICIEC to the Energy Transition Accelerator Financing (ETAF) Platform and Toolkit of the International Renewable Energy Agency (IRENA) during COP28 in December 2023. By acceding membership of ETAF, The IsDB and ICIEC commit to promoting renewable energy production in member states, to assisting with addressing climate change-related challenges and capitalizing on opportunities inherent to green growth. The IsDB and ICIEC also pledged USD250 million to projects on the platform by 2030. Through the ETAF Platform, ICIEC will provide credit and political risk insurance solutions to support the financing of renewable energy projects recommended by IRENA for the benefit of common member countries.

ICIEC and the facilitation of intra-OIC investment

One of the core mandates of COMCEC, the OIC and the IsDB Group specifically requires all three institutions to promote intra-OIC trade and FDI flows in their member states. In fact, COMCEC has set an IsDB Group target of reaching 25% of intra-OIC trade by 2025.

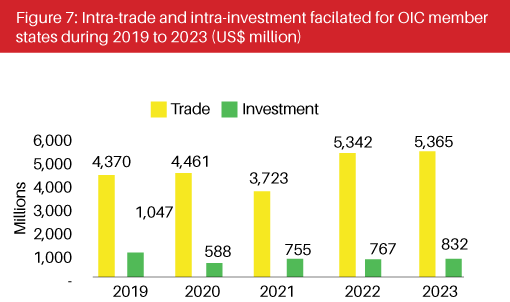

The fact that intra-OIC trade and investment has not even hit 25% of their total exports and imports and FDI flows, suggests what an uphill struggle it remains for member states to upscale their bilateral and multilateral trade and investment flows. According to the ICIEC 2023 Annual Report, intra-OIC trade facilitated by ICIEC increased from US$4,370 million in 2019 to US$4,461 million in 2020, reaching US$5,365 million in 2023. Similarly, intra-OIC investments decreased from US$1,047 million in 2019 to US$832 million in 2023.

ICIEC’s involvement in intra-OIC trade and investment is commendable – facilitating US$51 billion in intra-OIC trade and investment since inception. The latest data for FY2023 shows that there is much room for improvement despite the various barriers to boost such facilitation.

Intra-OIC trade and investment has the potential to be a game-changing facilitator to lead the OIC economies into recovery from the impacts of the post-pandemic era, the subdued global economic recovery and the vagaries of geopolitical tensions and their impacts on commodities price volatility, sovereign indebtedness, a global cost of living crisis and acting as a break on reaching the SDGs and Paris Net Zero targets – all of which affect developing countries including the IsDB ones disproportionately.

The OIC countries, which represent a sizeable portion of the global economy, are not immune to these global headwinds. Economic growth within the OIC, according to IMF data, is projected to follow a moderating trend, with estimates pointing to a growth rate of 5.6% in 2022, tapering to 3.5% in 2023 and 3.9% in 2024.

Nevertheless, Saudi Arabia’s outward FDI stock, according to the UNCTAD’s World Investment Report 2023, rose significantly from US$151.5 billion in 2021 to US$167.5 billion in 2022. Saudi investments within ICIEC member states are strategically placed across the Middle East, Africa and Asia. According to the Annual Report on Investment Climate and Opportunities in OIC Countries, 2022, Saudi Arabia holds the third-largest share of intra-OIC inward FDI stocks, in core investment markets including Egypt, Bahrain, the UAE, Turkiye, Pakistan and Jordan. The OIC has set a target of achieving 25% intra-Islamic trade and investment by 2025. The Kingdom is in pole position to demonstrate its role as a key investor in boosting ties with the OIC states towards achieving the 25% target.

Potential of ICIEC’s Sukuk insurance policy in facilitating investment

Sukuk, being asset-backed or based, are particularly well-suited for raising capital for projects and other developmental initiatives. The challenge many member states have faced in issuing Sukuk is their credit rating. Given that many member states do not have an investment grade credit rating, access to the capital market on favorable terms has become challenging. The role of ICIEC is implicit. While covering non-payment risk, ICIEC, with its credit rating of ‘Aa3’ by Moody’s and ‘AA-’ by S&P, may provide a boost to the Sukuk issuance of most of its member states.

ICIEC has over the years developed the ICIEC Sukuk Insurance Policy (SIP) to help member states to mobilize resources from international capital markets, to realize their developmental projects consistent with their declared developmental objectives, the SDGs, or other ESG factors. Some countries, especially those with credit ratings equal to or better than ICIEC’s credit rating, may not need ICIEC’s support to mobilize financial resources.

However, the ICIEC’s SIP will be very useful for member states rated below ICIEC’s credit rating. It will not only assist member states rated lower than ‘Aa3’ to access the international capital markets, but it is also expected to reduce their borrowing costs.

The policy is in line with ICIEC’s mandate to facilitate the flow of investments and project finance to its member states. As such, the corporation took the initiative to launch this innovative insurance product, which is the first of its kind in the market. It is the only Shariah-based Takaful product used as a credit enhancement in the Islamic capital and finance market and provided by a multilateral institution having long experience in the credit and political insurance industry.

The SIP is aimed at helping member states, especially those who have difficulties to access international capital markets with reasonable cost, to raise Shariah compliant resources to finance developmental projects. SIP is a credit enhancement and third-party guarantee aimed at promoting sovereign domestic issuances by member states especially those rated below investment grade and consequently attract less private capital for sustainable development projects. The SIP would allow issuers to attract capital for green projects better including for food security.

Future prospects for ICIEC investment facilitation and insurance

Last year saw a growing interest in diversifying sources of liquidity, with both investment-grade and sub-investment grade borrowers in many OIC countries increasingly turning to ECA finance. This trend underscores the evolving trust in ECA-backed financial instruments. This trend is set to increase in 2024 and beyond reflecting the rise in capital projects and infrastructure, especially related to sustainable and ESG finance linked to climate-related, food security and clean energy transition projects. The post-pandemic era ushered in a wave of capital expenditure across various industries. This surge is not just a sign of economic recovery but also a testament to the mounting pressures on traditional capital sources for borrowers.

For ICIEC, this trend signifies an expanded clientele base and an opportunity to further its mission. By offering tailored financial solutions that cater to this diversifying borrower landscape, ICIEC can solidify its reputation as a versatile and reliable financial partner for its member states well into the near- and medium-future.

The challenge lies in navigating these amplified demands, but the opportunity is in positioning itself as the go-to entity for its member states of ECA-supported financing during these transformative times. ICIEC’s foresight and agility in this space will determine its influence on shaping the economic and development trajectories of its member nations.