Highlights

- Gains from government support since 2010, with lower tax regime

- Provides direct access to EU markets, an extra advantage after Brexit

- Ireland is home to 60% of European ETF market

Overview

Ireland has welcomed Shariah compliant dealings since 2010, with the Irish Central Bank authorizing several Islamic institutions to operate in Dublin’s International Financial Services Centre – after the Irish government identified Islamic finance as a key growth area for its domestic economy.

As this policy shift was backed by a lower tax rate of 12.5% already applicable since 1997, together with access to operate within the EU by using the Irish domicile, many Islamic investment outfits were soon established in Ireland.

By 2017, the Irish Stock Exchange (now Euronext Dublin) had US$34.68 billion worth of Sukuk listed and was ranked second internationally behind NASDAQ Dubai. The Irish tax authority also further refined, by late 2018, the equal treatment to Islamic-based financial offerings, to create a level playing field.

Regulatory framework

With the Central Bank of Ireland as the regulatory authority, Ireland uses the undertakings for collective investment in transferable securities (UCITS) framework – which includes unit trusts, common contractual funds, variable capital companies, Irish collective asset-management vehicles (ICAV) or a combination of any.

Similar to other member states in the EU, UCITS authorised in one member state are allowed to be marketed throughout the EU without further authorisation based on the EU passport mechanism. Further, any Islamic fund has to appoint a board to guide the investment manager on Shariah matters.

Ireland also allows alternative investment funds (AIF), using a common framework practiced in the EU – especially the ICAV Act 2015. These are regulated for investments like real estate, commodities, cryptocurrency and collectibles.

Given the simplified cross-border dealings for Irish-domiciled funds, the central bank applies various regulations to entities dealing with intermediation activities pertaining to financial products. Ireland’s central bank also regularly publishes updates on its macroprudential policy for investment funds.

Investment market

The attractive tax regime has led to Ireland being home to 60% of European ETF market – with equity funds, alternative investment funds, bond funds and money market funds being the most prominent types domiciled in Ireland.

Being given equal tax treatment to the conventional counterpart has promoted Sukuk issuances in Ireland. Coupled with a good regulatory environment and a workforce to foster Islamic finance, it is no surprise that Ireland wholesale finance sector is at the forefront of Europe’s Sukuk industry.

The promise of access to a large EU investment market from one central location is an attractive factor for institutions with limited resources and human capital, by tapping the strong Islamic infrastructure and expertise pool that Ireland provides.

Asset management

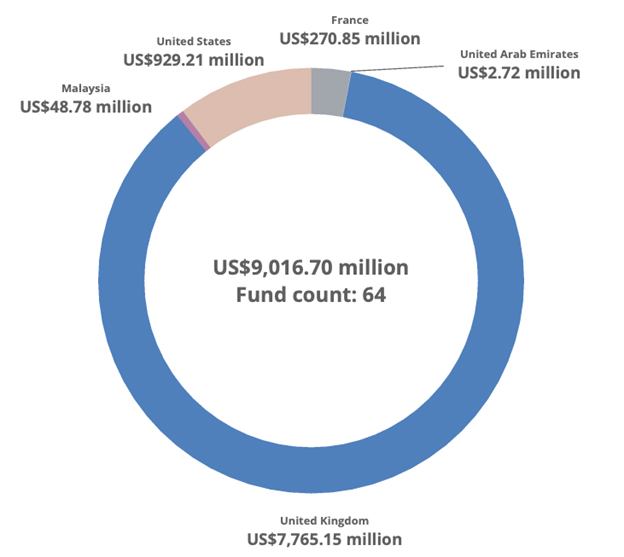

The IFN Investor funds database tracked 64 funds domiciled in Ireland with 44 managed by UK fund managers, 12 managed by Malaysia, three each for both the US and France, and two by the UAE.

Most of Ireland-domiciled funds are sold and listed in other jurisdictions in the Eurozone where trading liquidity is higher. Common examples include the Luxembourg Stock Exchange, the SIX Swiss Exchange and the Frankfurt Stock Exchange.

Chart 1: AuM by country breakdown for fund domiciled in Ireland

Source: IFN Investor funds database

Islamic funds domiciled in Ireland account for US$9.02 billion in assets under management (AuM). The largest fund according to the IFN Investors fund database is the HSBC UCITS Common Contractual Fund – Islamic Global Equity Index Fund, managed by HSBC Global Asset Management, with AuM totaling US$5.11 billion.

Table 1: Largest Islamic funds domiciled in Ireland

| Fund | Fund manager | AuM (US$ million) |

| HSBC UCITS Common Contractual Fund – Islamic Global Equity Index Fund – Class A2CGBP | HSBC Global Asset Management | 5105.35 |

| The Royal Mint Responsibly Sourced Physical Gold ETC | HANetf Management Limited | 873.24 |

| Invesco Dow Jones Islamic Global Developed Markets UCITS ETF Acc | Invesco Capital Management | 728.71 |

| iShares MSCI World Islamic UCITS ETF | iShares (BlackRock) | 593.15 |

| iShares MSCI EM Islamic UCITS ETF | iShares (BlackRock) | 283.17 |

Source: IFN Investors fund database

Fund managers HSBC Global Asset Management (UK), iShares (BlackRock) and HANetf Management were ranked as the top three companies by AuM at the end of Q2 2024, collectively offering 34 different Islamic funds.

Table 2: Largest Islamic fund managers with Ireland-domiciled funds

| Fund manager | AuM (US$ million) |

| HSBC Global Asset Management | 5,269.9 |

| iShares (BlackRock) | 1,138.38 |

| HANetf Management | 887.44 |

| Invesco Capital Management | 728.71 |

Source: IFN Investors fund database

Outlook

Having adopted the tax reform policy spearheaded by the Organization for Economic Co-operation and Development (OECD), Ireland has applied from 2024 a 15% minimum tax rate on the profits of multinationals – which applies to Islamic fund managers and operators.

While there were concerns of this rate hike badly impacting Ireland’s tax haven advantage, the application of the OECD policy in about 140 nations has largely dispelled such worries and the Irish Shariah compliant investment industry remains robust.

Ireland also remains attractive within the Islamic financial expert circles as an English-language entry point into the Eurozone, after Brexit took effect on the 1st February 2020.