Key Highlights

- Asset managers to find value elsewhere after AI tech boom

- The UK and the US hold the five largest Islamic equity funds, valued US$1 billion to US$5 billion

- AuM grew in all regions, except Asia Pacific

Overview

It took almost two years for global equities to shrug off the COVID-19 pandemic hangover, when rallies began in the second half of 2023 due to two main drivers – the artificial intelligence (AI) revolution exemplified by ChatGPT and the US Federal Reserve (US Fed) signaling rate cuts.

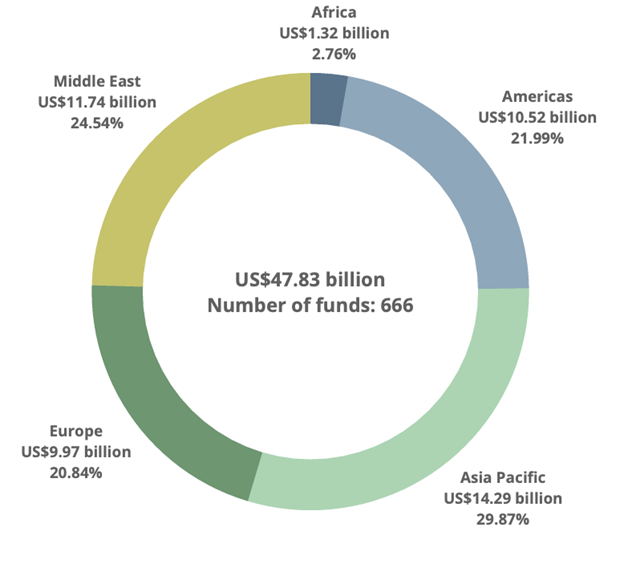

Chart 1: AuM of Islamic equity funds by region as at the end of Q2 2024

While the stock boom spurred most tech-related stocks and businesses that embraced AI potentials, this positive effect spilled over into other investments – including Islamic unit trusts, which generally have heavy weightage in tech stocks.

As the US Fed’s rate cut hints grew stronger, markets performed well riding on the positive sentiment – resulting in many Islamic funds also posting higher returns in 2024. Globally, Islamic equity funds posted 8.81% growth over the quarter ended the 30th June 2024.

Regionally, Americas, Africa, Europe and the Middle East posted positive growth of over 10%, except for Asia Pacific.

There are 666 equity funds in Q2 2024, according to the IFN Investor Fund Database. The Middle East hosts 173 funds, Asia Pacific 376 funds, Europe 69 funds, Africa 27 funds and Americas 21.

Table 1: Largest Islamic equity funds as at the 30th June 2024

| Fund | Fund manager | AuM (US$ billion) |

| HSBC UCITS Common Contractual Fund – Islamic Global Equity Index Fund (UK) | HSBC Asset Management | 5.11 |

| Amana Growth Institutional Fund (US) | Saturna Capital | 2.87 |

| Amana Growth Investor Fund (US) | Saturna Capital | 2.69 |

| HSBC Islamic Global Equity Index Fund (UK) | HSBC Asset Management | 1.61 |

| Amana Income Institutional Fund (US) | Saturna Capital | 1.05 |

Looking at total Islamic assets under management (AuM) managed by fund managers on a national basis, the US, the UK, Malaysia, Saudi Arabia, South Africa and Indonesia stood out as the largest markets.

Table 2: AuM of Islamic equity funds by top 6 countries as at the 30th June 2024

| Country | AuM (US$ billion) |

| Malaysia | 12.27 |

| Saudi Arabia | 10.65 |

| US | 10.13 |

| UK | 9.38 |

| South Africa | 1.31 |

| Indonesia | 1.25 |

However, delving into the fund count hosted by each country revealed some interesting insights. The US hosts only 16 funds with a combined AuM of US$10.13 billion, just US$2 billion shy of Malaysia’s US$12.27 billion but the latter has 225 funds, demonstrating that US funds are substantially larger.

Table 3: Top three Islamic equity funds in the US and Malaysia

| Country | Fund name | AuM (US$ million) |

| US | Amana Growth Institutional Fund | 2,870.00 |

| Amana Growth Fund | 2,690.00 | |

| Amana Income Institutional Fund | 1,050.00 | |

| Malaysia | Public Ittikal Fund | 934.21 |

| Public Asia Ittikal | 896.71 | |

| Public Islamic Dividend Fund | 813.71 |

AuM growth

The total AuM of Islamic equity funds grew in Africa, Americas, Europe and the Middle East in Q2 2024. AuM in Asia Pacific, however, fell 4.58%.

- Africa: Up by 23.84% from US$1.07 billion to US$1.32 billion.

- Europe: Up by 22.72% from US$8.12 billion to US$9.97 billion.

- Americas: Up by 12.23% from US$9.37 billion to US$10.52 billion.

- Middle East: Up by 12.94% from US$10.39 billion to US$11.74 billion.

- Asia Pacific: Down by 4.58% from US$14.97 billion to US$14.29 billion.

The fall in Asia Pacific AuM can be explained by the fact that at least 10 funds are no longer being tracked by IFN Investor due to them being liquidated or closed.

ROI analysis (Three-month returns)

Table 4: Top performing Islamic equity funds by region in Q2 2024

| Region | Fund | Fund manager | Three-month returns (%) |

| Africa | Al Barakat Bank Islamic Money Market Fund | Hermes Fund Management (EFG Holdings) | 19.1% |

| Americas | SP Funds S&P Global Technology ETF | ShariaPortfolio | 15.9% |

| Asia Pacific | Pacific Saham Syariah III | Pacific Capital Investment | 32% |

| Europe | HSBC Islamic Equity Index Sub-Fund | HSBC | 12.47% |

| Middle East | Derayah GCC Growth and Income Equity Fund | Derayah Financial | 25.02% |

An analysis of the entire equities fund data in Q2 2024 resulted in a three-month median return of roughly 4%. Overall, the bottom 75% of Islamic equity funds generated up to 8.64% in Q2 2024. The top funds returned substantially higher, as shown in Table 4.

New players and products

From the beginning of the year until the time of writing, IFN Investor witnessed two wholly Islamic equity fund launches in 2024.

The first was launched by United Arab Emirate’s fund manager Lunate Capital, with the Chimera S&P India Shariah ETF – Income, currently valued at US$11.18 million.

The other is Pakistan’s MCB Funds with the Alhamra Opportunity Fund – Dividend Strategy Plan, currently valued at US$720,000.

Outlook

Many see 2024 potentially being another fabulous year for the tech industry, with the keyword “AI” being thrown around every there and then. We can clearly feel its impact with the likes of tech companies NVidia, Apple, Google and Microsoft heavily promoting this new technological breakthrough as the future of smart-tech.

Some however believe this new frontier has already started to lose momentum and that it is only a matter of time before the market fully realizes the disconnect between the large sums invested in this sector and what the market really wants.

It is up to the fund managers to identify potential market gains and find value elsewhere to continue attracting investors in this post-AI peak landscape.