- Islamic money market is a fraction of the broader Shariah fund universe

- Petite funds and small AuM sizes show Muslim nations’ challenge in managing short-term cash reserves

- Stable returns, however, show promise in attracting investors albeit at a calmer pace

The Islamic money market is one of the smaller components of the Shariah finance universe, illustrating both the challenges and potential in developing this subset of Muslim markets.

Comprising a fraction of the sprawling conventional money market, Islamic money market funds represent the underlayer of Shariah finance dominated by the banking, capital and Takaful markets.

Total Sukuk outstanding for 2024 itself pierced the US$1 trillion mark for the first time, according to S&P Global.

In contrast, the 255 Islamic money market funds tracked by the IFN Investor Funds Database had combined assets under management (AuM) of US$37.25 billion at the end of Q1 2025. Quarter-on-quarter growth has also been modest, with the database tracking just 227 such funds worth US$32.04 billion in Q4 2024.

The relatively small fund and AuM size for Islamic money markets underscore the struggle financial institutions in many Muslim nations have in efficiently managing their short-term cash reserves.

Despite the rollout of multiple Shariah-friendly financial products, there’s a limited supply of accessible high-quality, cross-border dollar-denominated Islamic money market instruments.

The International Islamic Liquidity Management Corporation (IILM) is the sole issuer of investment-grade short-term Sukuk designed for global liquidity management. Between the end of 2024 and mid-May 2025, the IILM held eight auctions, cumulatively worth US$8.21 billion across 24 Sukuk series of varying tenors.

Currently, only a handful of countries have successfully cultivated their Islamic money markets. These include Southeast Asian pioneers like Malaysia and Indonesia, along with Turkiye, Pakistan, Bangladesh, Nigeria, Gambia and most GCC countries. The types of Islamic money market tools available vary significantly from one region to another, reflecting the diverse local regulatory landscapes and interpretations of Shariah compliance.

For instance, short-term Sukuk is not universally adopted as money market instruments. Its use is primarily concentrated in Malaysia, Bahrain, Bangladesh, Pakistan, Brunei, Indonesia and Qatar.

Malaysia stands out as a leader in this domain, arguably offering the most comprehensive array of interbank products. Its market boasts at least 12 distinct types of instruments, built on various Shariah structures ranging from Murabahah to Wadiah and Qard. Malaysia also issues Islamic Treasury bills, a tool shared with the UAE.

Within the GCC, Saudi Arabia and Bahrain heavily rely on commodity Murabahah for their liquidity management needs.

In Europe, the approach differs; countries like Luxembourg lean more towards mutual funds than traditional money market tools, though efforts are underway to develop more conventional Shariah compliant liquidity strategies.

Meanwhile, much of Africa and the Americas still have nascent Islamic money markets, largely due to underdeveloped financial infrastructure and insufficient regulatory support.

Regulatory framework

Leading the charge in developing robust Shariah money markets are jurisdictions with strong commitments to Islamic finance.

Malaysia continues to be a pioneering force, boasting a sophisticated regulatory framework and active interbank Islamic money market.

The UAE, particularly its financial hubs in Dubai and Abu Dhabi, and Bahrain in the GCC, are also pivotal centers, actively facilitating cross-border Islamic finance flows.

Regulatory harmonization, while a persistent challenge, is being addressed by bodies like AAOIFI, which provides Shariah standards.

Recent moves, such as Bangladesh’s establishment of a dedicated Islamic banking regulatory department, signal a global trend towards reinforcing the supervisory architecture for this burgeoning sector.

Investment opportunity

The Islamic money market’s biggest components largely revolve around short-term, liquid and low-risk instruments structured to adhere to Muslim principles.

Primary components include Murabahah and Wakalah structures for short-term financing, offering alternatives to conventional interbank lending.

Short-term Sukuk, asset-backed or asset-based instruments akin to bonds, are also integral, providing avenues for governments and corporations to raise Shariah compliant capital for short durations.

These instruments provide liquidity management solutions for Islamic financial institutions and corporations, offering competitive returns without involving Riba or Gharar.

The appeal of these instruments extends at times beyond Muslim-majority countries such as the UK, Luxembourg, Hong Kong, South Africa and Singapore, attracting a growing cohort of ESG-focused investors seeking ethical financial products.

AuM breakdown, fund performance

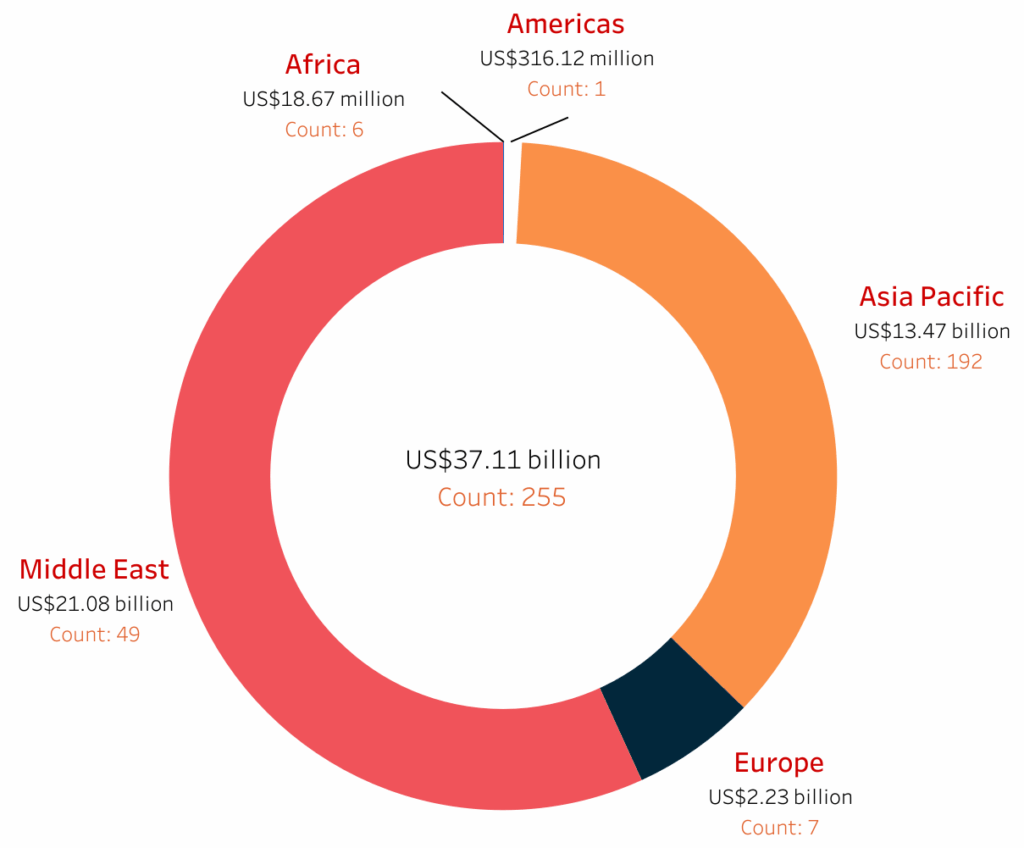

The Middle East has the highest combined AuM for Islamic money markets. Country-wise, Saudi Arabia leads the metric for this.

The IFN Investor Funds Database shows the Middle East money market AuM at US$21.08 billion, with a fund count of 49, from the overall US$37.11 billion and 255 funds in the space.

Saudi Arabia alone has US$17.7 billion, spread over 37 funds.

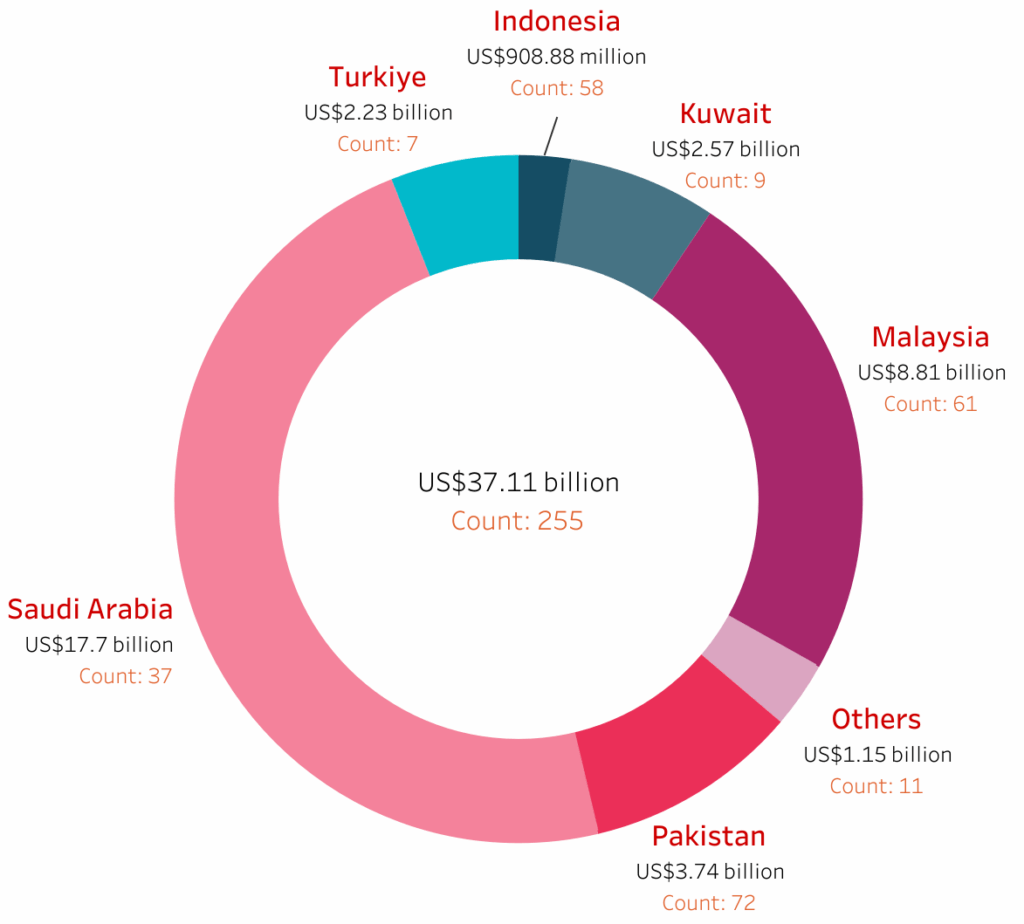

Asia Pacific, meanwhile, has the highest number of Islamic money market funds for a region, at 192. Here, Pakistan has the largest share of 72 funds that wield a collective AuM of US$3.74 billion, versus a regional total of US$13.47 billion.

Malaysia has Asia Pacific’s largest Islamic money market AuM of US$8.81 billion, spread over 61 funds.

Chart 1: Islamic money markets by region, AuM and fund count

Table 1: Regional AuM change from Q4 2024 to Q1 2025

| Region | Q4 2024 (AuM US$ million) | Q1 2025 (AuM US$ million) | Percentage change |

| Africa | 17.67 | 18.43 | 4.32 |

| Americas | 306.06 | 316.12 | 3.29 |

| Asia Pacific | 14,024.58 | 13,599.21 | -3.03 |

| Europe | 2,398.94 | 2,243.76 | -6.47 |

| Middle East | 17,002.04 | 21,069.13 | 23.92 |

| Grand Total | 33,749.29 | 37,246.65 | 10.36 |

Chart 2: Islamic money markets by country, AuM and fund count

Table 2: Country AuM change from Q4 2024 to Q1 2025

| Domicile | Count of public funds | Count of public funds | Q4 2024 (AuM US$ million) | Q1 2025 (AuM US$ million) | Percentage change |

| Egypt | 5 | 5 | 17.67 | 18.43 | 4.32 |

| Indonesia | 58 | 59 | 863.22 | 908.88 | 5.29 |

| Jersey | 1 | 1 | 580.69 | 615.79 | 6.04 |

| Kuwait | 9 | 9 | 2,546.65 | 2,573.20 | 1.04 |

| Malaysia | 61 | 60 | 9,009.51 | 8,930.78 | -0.87 |

| Pakistan | 72 | 74 | 4,146.78 | 3,754.49 | -9.46 |

| Saudi Arabia | 37 | 37 | 13,815.34 | 17,696.12 | 28.09 |

| Sri Lanka | 1 | 1 | 5.07 | 5.06 | -0.3 |

| Turkiye | 7 | 7 | 2,398.94 | 2,243.76 | -6.47 |

| UAE | 1 | 1 | 54.17 | 54.17 | 0 |

| US | 1 | 1 | 306.06 | 316.12 | 3.29 |

| Grand Total | 254 | 256 | 33,749.29 | 37,246.65 | 10.36 |

The highest capitalized Islamic money market fund in the world, according to the IFN Investor Funds Database, is the SNB Capital Al Sunbullah SAR run by Saudi Arabia’s SNB Capital, with an AuM of US$4.076 billion.

The second largest, the Al Rajhi Awaeed Fund managed by Al Rajhi Capital, is also Riyadh-based, with a rounded-up AuM of US$3.99 billion

The third, AHAM Aiiman Money Market Fund belonging to Malaysia’s AHAM Capital Asset Management, has a rounded-up AuM of US$3.18 billion.

Table 3: Top money market funds by AuM

| Rank | Fund | Manager | AuM (US$ million) |

| 1 | SNB Capital Al Sunbullah SAR | SNB Capital | 4,076.12 |

| 2 | Al Rajhi Awaeed Fund | Al Rajhi Capital | 3,988.13 |

| 3 | AHAM Aiiman Money Market Fund | AHAM Capital Asset Management | 3,175.35 |

| 4 | SNB Capital Saudi Riyal Trade Fund | SNB Capital | 3,019.55 |

| 5 | Alpha Murabaha Fund | Alpha Capital | 1,388.55 |

| 6 | Watani KD Money Market Fund II | NBK Wealth | 1,374.5 |

| 7 | Kuveyt Turk Portfolio Short-Term Participation Free (TL) Fund | Kuveyt Turk Portfoy | 1,236.87 |

| 8 | Principal Islamic Deposit Fund – Class AI | Principal Asset Management | 1,002.16 |

| 9 | Meezan Cash Fund | Al Meezan Investment Management | 881.91 |

| 10 | Boubyan KD Money Market Fund II | Boubyan Capital | 872.23 |

The top performing Islamic money market fund as of Q1 2025 was the ANB Capital SAR Trade Fund managed by Saudi Arabia’s ANB Capital. Posting a one-year return of 5.47%, the fund said its objective was to provide capital preservation and short-term growth through investments in Shariah instruments such as Murabahah and Ijarah.

Artal Capital and Yaqeen Capital, both also of Saudi Arabia, were second and third best, with one-year returns of 5.33% and 5.32%, respectively.

Table 4: Top money market funds by three-month returns

| Rank | Fund | Manager | One-year return (%) |

| 1 | ANB Capital SAR Trade Fund | ANB Capital | 5.47 |

| 2 | Artal Muharaba Fund (Class A) | Artal Capital | 5.33 |

| 3 | Yaqeen SAR Murabaha Fund | Yaqeen Capital | 5.32 |

| 4 | Jadwa Saudi Riyal Murabaha Fund – Class B | Jadwa Investment | 5.3 |

| 5 | SAB Invest Saudi Riyal Murabaha Fund | SAB Invest | 5.01 |

| 6 | SAB Invest Saudi Riyal Money Market Fund | SAB Invest | 4.63 |

| 7 | ANB Capital USD Trade Fund | ANB Capital | 4.47 |

| 8 | KASB Money Market Fund | Value Capital | 4.27 |

| 9 | Boubyan USD Liquidity Fund | Boubyan Capital | 4.26 |

| 10 | Boubyan KD Money Market Fund II | Boubyan Capital | 3.73 |

Outlook

The performance of the Islamic money market since the start of 2025 has largely been characterized by stability and consistent returns, contrasting with the more volatile trajectory of conventional money markets.

While global conventional markets have grappled with uncertainty stemming from geopolitical tensions, trade disputes and shifting interest rate expectations, the Islamic money market, particularly in regions like the GCC, has maintained a steadier course.

With returns in an annual range of 4.0-4.5%, Islamic money market funds have kept pace with their conventional counterparts’ performances despite having Fatwas and jurisdictional compliance to fulfill in addition to the Federal Reserve and other policy guidelines crucial to their operations. The stability in returns, coupled with the growing global emphasis on ethical investing and sustainable development, positions the Shariah money market for continued expansion. As the world increasingly seeks financial solutions that balance profit with purpose, the Islamic money market’s unique value proposition is likely to attract a wider array of investors, albeit at a calmer pace.