- A small but growing space dominated by Saudi, UAE and Malaysian funds

- REITs resonate with Muslims seeking Fatwa-governed bundled properties

- Major Islamic hubs look poised to pump billions of dollars into new properties

Overview

Islamic real estate funds that transact residential and commercial space on faith-based rules are a small but growing portion of the global property market, with the crown jewel of their assets in locations like Saudi Arabia, the UAE and Malaysia.

The IFN Investor Funds Database values the global Shariah compliant real estate market at just under US$12.5 billion.

In contrast, the European Association for Investors in Non-Listed Real Estate Vehicles puts worldwide AuM in conventional properties at approximately US$3.95 trillion.

Islamic REITs particularly resonate with Muslim investors drawn to the opportunity of investing in bundled quality properties governed by Fatwa principles.

The SP Funds S&P Global REIT Sharia ETF, which tracks the S&P Global All Equity REIT Shariah Capped Index, showed an AuM of US$149.38 million as of the 21st May 2025. The AuM a year ago was US$117.54 million, representing a year-on-year growth of 27%.

REITs have emerged as a darling asset class in Shariah compliant real estate investments with notable fund launches almost every month since the start of 2025.

The GCC, led by Saudi Arabia, is particularly a hotbed for these investments due to a confluence of factors that include ambitious national development plans, growing affluent Muslim populations and evolving regulatory frameworks.

In May, Dubai Residential REIT began trading as the GCC’s largest listed REIT with a gross asset value of AED21.6 billion (US$5.88 billion).

The Al Rajhi REIT Fund is the largest Saudi REIT by market capitalization, with an AuM of SAR2.3 billion (US$613 million).

Investment opportunity

Saudi Arabia stands out with its Vision 2030 and works such as the US$500 billion NEOM high-tech city, Red Sea Project, Diriyah Gate and Qiddiya which are creating entirely new cities and tourism destinations that require vast amounts of residential, commercial, hospitality and industrial real estate.

The Kingdom is actively attracting both foreign direct investment and encouraging domestic private capital to participate in its development. Reforms to improve accessibility and transparency of the commercial property market are making Saudi REITs an effective way for both local and overseas investors to gain exposure.

The Saudi real estate market is also experiencing rapid expansion driven by population growth, increased tourism and large-scale urban development. Rental yields in major cities can be between 5% and 8%, with higher potential in tourist zones.

Saudi Arabia has also been a leading contributor to global Sukuk issuances, intertwining this with property financing. The Kingdom actively promotes Shariah compliant mortgages featuring Murabahah and Ijarah through its banks. The SAR5.8 billion (US$1.55 billion) financing agreement between Areeb Capital and the Saudi National Bank for real estate ventures underscores this.

In other GCC countries, opportunities are emerging in various real estate asset classes including office, retail and industrial properties, specialized sectors like data centers as well as healthcare facilities and even timberlands through Shariah compliant REITs.

Fund spread

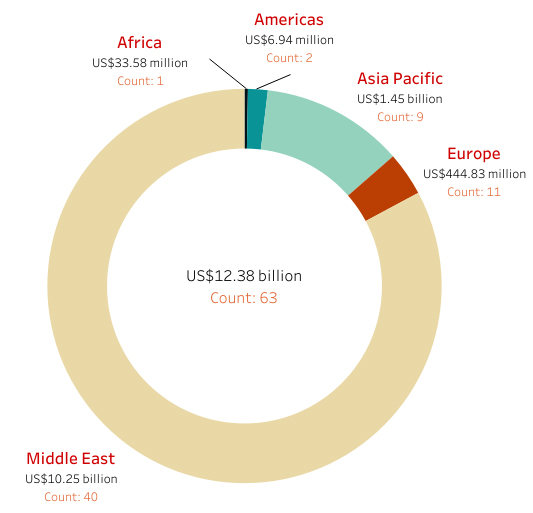

The IFN Investor Funds Database tracks 63 Shariah compliant real estate funds across the world, with a combined AuM of US$12.38 billion.

The Middle East has more than 60% share of the assets, with 40 funds and an AuM of US$10.25 billion. Asia Pacific has the second highest, with nine funds and a combined asset base of US$1.45 billion, followed by Europe (11 funds; US$444.83 million in AuM), Africa (one fund; US$33.58 million in AuM and the Americas (two funds; US$6.94 million in AuM).

Chart 1: Shariah real estate fund spread, by region

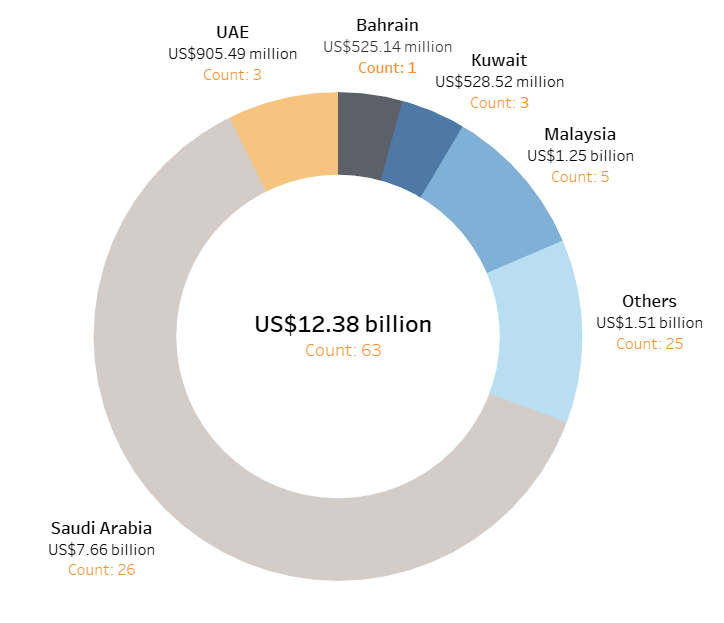

Country-wise, Saudi Arabia leads with 26 real estate funds presiding over assets totaling US$7.66 billion. Malaysia ranks second with five funds overseeing an AuM of US$1.25 billion, followed by the UAE (three funds; US$905.49 million), Kuwait (three funds; US$528.52 million) and Bahrain (one fund; US$525.14 million). The balance 25 funds with an asset base of US$1.51 billion are in unspecified countries.

Chart 2: Shariah real estate fund spread, by country

Fund performance

The Middle East was the only region to witness growth in Islamic real estate assets since the start of 2025, with a 7.13% expansion that took its AuM to US$10.25 in Q1 2025 from US$9.57 billion in Q4 2024.

The region with the smallest AuM contraction was Africa, where values declined by 0.16% to US$33.58 million in Q1 2025 from US$33.63 in Q4 2024.

Asia Pacific, which incidentally has the largest Shariah compliant real estate assets after the Middle East, also registered a nominal drop of 0.28%, which took its AuM down to US$1.44 billion in Q1 2025 from US$1.45 billion in Q4 2024.

Table 1: Regional growth of Islamic real estate funds as at Q1 2025

| Region | Q4 2024 (AuM US$ million) | Q1 2025 (AuM US$ million) | Percentage change (%) |

| Africa | 33.63 | 33.58 | -0.16 |

| Americas | 202.6 | 199.12 | -1.72 |

| Asia Pacific | 1,451.23 | 1,447.21 | -0.28 |

| Europe | 488.2 | 444.83 | -8.89 |

| Middle East | 9,572.36 | 10,254.44 | 7.13 |

| Grand Total | 11,748.02 | 12,379.17 |

UAE’s Rasmala Holdings was the best-performing fund manager in Shariah real estate since the start of 2025, with its Rasmala European Real Estate Income Fund coming out tops with a return of 10.42% for the year till the 31st March 2025. The fund’s investments are in REITs, open ended property funds and direct properties located in the UK and Continental Europe.

Kuwait’s KFH Capital came in second with a one-year gain of 8.08% on its KFH Capital REIT Fund while Jeddah-based SEDCO Capital registered a one-year return of 8.01% on its Global UCITS – SC Global Real Estate Equities Passive Fund.

Table 2: Top performing Islamic real estate funds as at Q1 2025

| Rank | Fund | Manager | One-year return (%) |

| 1 | Rasmala European Real Estate Income Fund | Rasmala Holdings | 10.42 |

| 2 | KFH Capital REIT Fund | KFH Capital | 8.08 |

| 3 | SEDCO CAPITAL GLOBAL UCITS – SC Global Real Estate Equities Passive Fund – Class R | Sedco Capital | 8.01 |

| 4 | Musharaka REIT Fund | Musharaka Capital | 7.8 |

| 5 | Hejaz Property Fund | Hejaz Financial Services | 7.74 |

| 6 | Markaz Real Estate Fund | Markaz (Kuwait Financial Centre) | 7.59 |

| 7 | Rasmala North American Real Estate Income Fund | Rasmala Holdings | 6.27 |

| 8 | Manzil Mortgage Investment Fund | Manzil | 5.78 |

| 9 | Amanah Hartanah Bumiputera | Pelaburan Hartanah | 4.45 |

| 10 | MCCA Income Fund | MCCA Asset Management | 4.42 |

The single largest Islamic real estate fund as of Q1 2025 was Malaysian sovereign property fund Pelaburan Hartanah, with an AuM of US$1.18 billion for its Amanah Hartanah Bumiputera fund.

Al Rajhi Capital’s Al Rajhi REIT Fund was second largest with an asset base of US$849.49 million while Jadwa Investment’s Jadwa REIT Saudi Fund emerged third with US$748.34.

Table 3: Top-largest Islamic real estate funds as at Q1 2025

| Rank | Fund | Manager | AuM (US$ million) |

| 1 | Amanah Hartanah Bumiputera | Pelaburan Hartanah | 1,182.13 |

| 2 | Al Rajhi REIT Fund | Al Rajhi Capital | 849.49 |

| 3 | Jadwa REIT Saudi Fund | Jadwa Investment | 748.34 |

| 4 | Jadwa REIT Fund | Jadwa Investment | 713 |

| 5 | Emirates REIT | Equitativa Group | 648.1 |

| 6 | Bonyan REIT | BSF Capital | 579.34 |

| 7 | Alkhabeer REIT Fund | Alkhabeer Capital | 540.86 |

| 8 | AlAhli REIT Fund (1) | SNB Capital | 532.85 |

| 9 | Eskan Bank Realty Income Trust | Eskan Bank | 525.14 |

| 10 | SEDCO CAPITAL REIT Fund | Sedco Capital | 498.39 |

Outlook

The future for Shariah compliant real estate funds is promising, with growth potentially fueled by a combination of increasing Muslim populations and their rising affluence.

Major hubs for Islamic real estate activity including Riyadh, Dubai, Kuala Lumpur, London and Manama, look poised to pump billions of dollars in coming years into new properties and specialized sectors. Saudi Arabia is explicitly aiming to solidify Riyadh’s position as the global Islamic finance capital by 2030.

The global embrace of ethical and socially responsible investing – where Islamic finance often finds common ground with ESG principles – is also expected to be a catalyst for the Shariah realty sector.