Malaysia’s KAF Investment Funds, which operates the two Shariah compliant KAF Islamic Dividend Income Fund and KAF Dana Adib, has identified two key investment themes for this year – data centers and artificial intelligence (AI).

Fund manager Ahmad Tajuddin Yeop Aznan shared with IFN Investor that the development of data center hubs is taking off in the region as the benefit is clear for players involved in the utilities, telecommunications, cybersecurity, power infrastructure and AI sectors.

Ahmad said technology and innovation funds – particularly those focusing on AI, biotechnology, fintech and renewable energy – have gained popularity recently. Such funds appeal to investors due to rapid technological advancements and high growth potentials.

Other key trends observed by fund managers in recent years that continue to attract investor attention are sustainable and ESG funds, which Ahmad said is likely to prevail for many more years ahead for its funds – which invest mostly in Malaysian holdings.

“In line with the positive outlook for 2024, our primary focus is on growth stocks, particularly in the technology and industrial sectors, which we believe will recover post inventory adjustments.”

Ahmad said that traditional dividend income growth funds are becoming increasingly attractive, especially in the current low-interest-rate environment. These funds provide a good combination of active management, higher growth potential and steady dividends, making them an excellent choice for investors seeking both growth and stable income streams.

“We are optimistic about the overall market conditions, as global central banks are moving toward loosening monetary policies, although it remains premature at this juncture.”

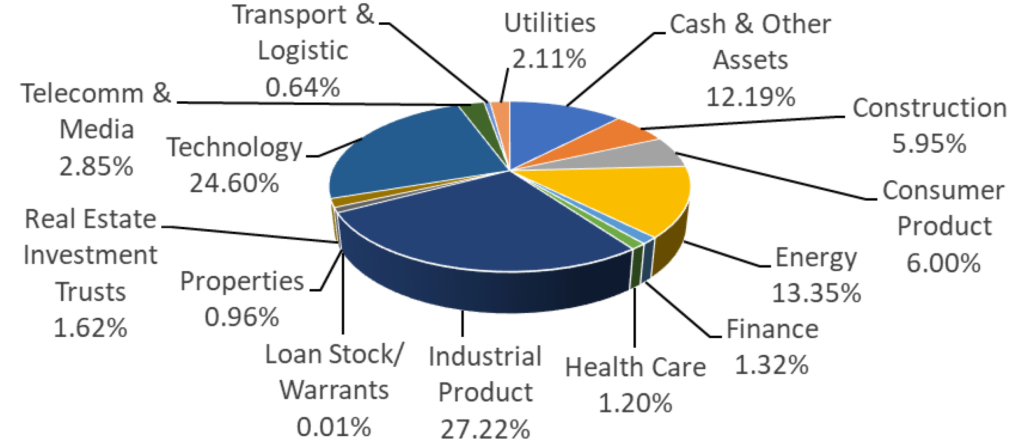

KAF Islamic Dividend Income Fund is an open-ended unit trust. The fund invests 70% to 98% of its assets in Shariah compliant equities and 2% to 30% in Sukuk, Islamic money market instruments and Islamic deposits.

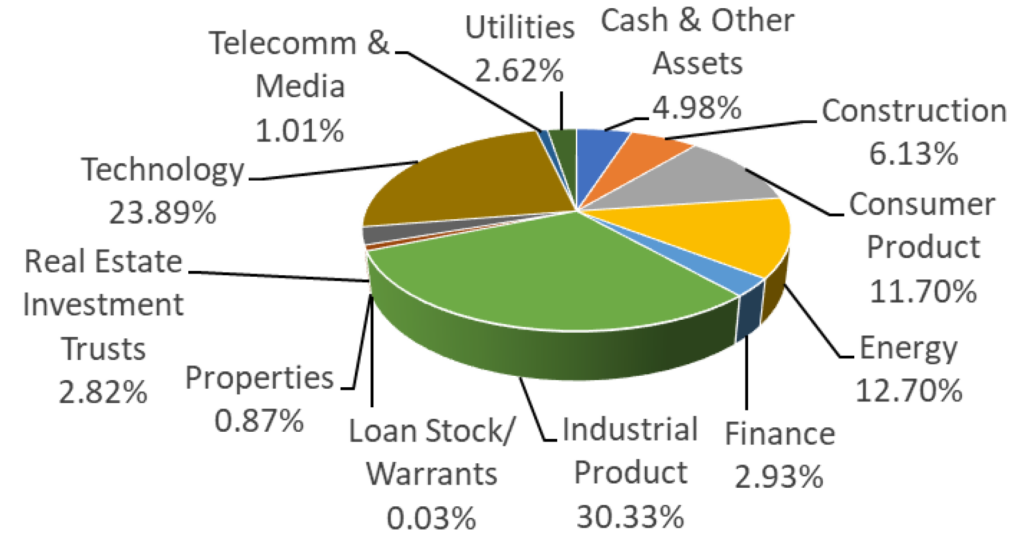

KAF Dana Adib is also an open-ended unit trust with the objective of attaining medium- to long-term capital growth. The fund invests in a minimum of 50% and a maximum of 90% in Shariah compliant equities and a minimum of 10% and maximum of 50% in Sukuk and Shariah based liquid assets.

Chart 1: KAF Dana Adib

on a daily basis.

Source: KAF Investment Funds Berhad.

Chart 2: KAF Islamic Dividend Income Fund

daily basis.

Source: KAF Investment Funds Berhad.

*Disclaimer: The opinions and viewpoints expressed in this report do not constitute as a recommendation for any funds highlighted. The information presented is not investment advice and should not be treated as such.