- Pros include influential Muslim populace, state support and financial hub

- Despite regulatory support, Islamic investments struggle to take hold meaningfully

- Public awareness on Shariah investing and more financial literacy needed

Overview

Kenya is not Africa’s biggest Islamic financial center, but it is one of the continent’s key Shariah players – due to an influential Muslim population, regulatory support from the government and a vantage position as an East African financial hub.

While Christians make up 85% of the 55 million plus Kenyans, Muslims at just around 11% have commensurate political sway, with 32 seats reserved for them in the country’s 222-member parliament.

Kenya is the largest economy in East Africa, commanding approximately 40% of the region’s GDP in 2024 at an estimated KES15.35 trillion (US$116.32 billion). The government’s push to grow Kenya’s stature as a financial hub under the Vision 2030 blueprint has spillover potential for its Shariah market.

Relatively stable politics, an emerging middle class and a youthful skilled demographic are other attributes that work in favor of turning the country into an attractive investment destination.

But low financial literacy among the public, especially on Islamic finance, has hampered growth in the area. Competition from conventional banking and investment services has also thwarted growth of the Shariah market.

Investment market

Kenya offers a liberalized investment environment, permitting 100% foreign ownership across most sectors, provided such investments do not compromise national security as defined under the Capital Markets Act.

The investment framework is flexible, with no mandatory approval required from a central authority for most foreign investments. This openness extends to private equity and alternative investment funds (AIFs), where foreign investors can freely participate.

AIF providers must obtain a license from Kenya’s Capital Markets Authority (CMA) before raising or managing funds. There are no residency restrictions for investment entities, though a minimum local-currency investment threshold applies.

Kenya’s Treasury has been exploring a sovereign Sukuk to fund infrastructure projects such as roads and affordable housing but has yet to do so.

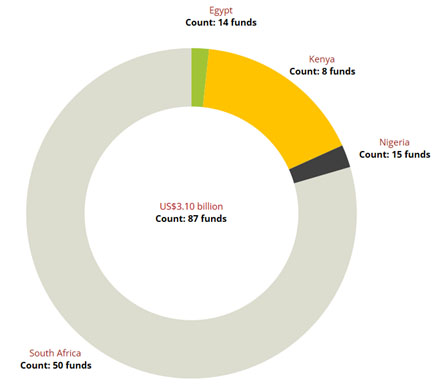

The country only welcomed its first-ever Sukuk offering last year when Linzi Finco Trust tapped the market to raise KES3 billion (US$23.15 million). Lagging more developed Islamic finance hubs such as South Africa, Nigeria and Egypt, Kenya had just eight Islamic funds tracked by the IFN Investor Funds Database as of the end of Q4 2024.

Despite its moderate size, Kenya’s Islamic market stands out for some prolific deal making in banking and investing services.

For instance, the Shariah division of Kenya’s Standard Investment Bank (SIB) is on the cusp of launching its own Shariah compliant pension scheme. Several Islamic banks in Kenya, plus a government agency, have taken SIB Najah Islamic Investment Banking’s lead in offering Islamic-friendly pension scheme options to their staff.

The CMA has encouraged the registration of new investment firms as part of its drive to deepen and develop the country’s capital markets. The authority has licensed more than 20 fund managers since 2020, reflecting the interest and demand in the market.

Chart 1: Africa’s Islamic fund markets at the end of 2024

Source: IFN Investor Funds Database

Chart 2: Kenya’s Islamic funds at the end of 2024

| Manager | Fund | Type of fund | Asset class | AuM (in US$) |

| Lapfund | Lapfund Amal Fund | Retirement | Mixed assets | 508.86 million |

| Standard Investment Bank | Mansa-X Shariah | Income | Mixed assets | 5.32 million |

| Kuza Asset Management | Kuza Shariah Momentum Special Fund | Growth | Mixed assets | 12,336 |

Regulatory environment

Kenya is positioning itself as a regional Islamic finance hub, competing with Tanzania and Uganda, as the CMA and Central Bank of Kenya (CBK) introduce regulations to support Islamic finance. Licensing of full-fledged Islamic banks such as Gulf African Bank and First Community Bank, along with a Nairobi International Financial Centre help to further attract Islamic investments.

The Kenyan government has shown commitment to growing its Shariah market by enacting the Finance Act 2020 that provides tax neutrality for Islamic finance transactions. In fact, the government had since 2017, been working on a slew of policy reforms to establish a more Islamic-friendly financial ecosystem.

The CMA’s Sharia-Compliant Collective Investment Schemes (CIS) Regulations (2022) also encourages Islamic asset management.

Kenya has also been lobbying for GCC investments and diversifying into Islamic trade finance with Muslim-majority markets via products such as tea, flowers and horticulture.

Nevertheless, entities specializing in Islamic finance are grappling with the need to satisfy both religious legal codes and the Central Bank of Kenya’s directives, creating a situation where they must comply with two sets of rules, placing them at a disadvantage in the marketplace.

Outlook

Despite having a relatively conducive regulatory environment, Kenya’s Islamic asset management and investment sector remains nascent with limited product diversity and take-up.

Kenya’s Vision 2030 provides fertile ground for more robust Islamic finance growth, but toexpand the reach of Islamic finance, Kenya must prioritize development of an inclusive capital market that provides Shariah compliant investment alternatives to individuals and businesses currently dependent on conventional, interest-based services.

It also has to enhance public awareness to educate both Muslim and non-Muslim populations on the benefits of Islamic finance and streamline regulations to reduce compliance costs and attract more investors.