Pressures on the overall Iranian economy, due to ongoing economic sanctions, seem to have nevertheless seen better yields from gold-related investments in the past two years, Parto Aftab Kian Investment Advisory (PAKIA) CEO Mehdi Tahani shared with IFN Investor.

With IRR73.9 trillion in total assets under management, which Mehdi said would be valued at around US$370 million, “we have been able to cover part of the local stock market’s downturn with growth in the gold market and also control investment risks using the options market. We have always strived to maintain at least 20% returns for our investor clients”.

Table 1: Overview of Kian Investment Advisory annual returns performance (%)

| Year* | PAKIA | Tehran Stock Market Index (TEDPIX) | Gold price** |

| 2016 | 11 | -5 | 11 |

| 2017 | 33 | 25 | 33 |

| 2018 | 107 | 86 | 180 |

| 2019 | 215 | 187 | 40 |

| 2020 | 224 | 15 | 80 |

| 2021 | 18 | 5 | 13 |

| 2022 | 74 | 43 | 115 |

| 2023 | 3 | 12 | 22 |

* Percentage calculations based on Persian calendar which starts with the spring equinox, typically on the 20th March of each year

* Gold price changes tracked by the Central Bank of Iran

As gold is considered to be a US dollar-denominated asset – allowing for tracking of this commodity’s price movements on the global front, in effect offsets the progressive local currency depreciation by the Central Bank of Iran – Mehdi said the current investment climate in Iran should see gold make up the largest share of an individual’s investment portfolio.

Equities used to perform better previously – with a massive influx of millions of investors in 2020.

“That was a unique year for the Iranian capital market. But when followed by a multi-year period of stagnation, it undermined investor trust because they entered the market at an unfavorable time,” Mhedi explained.

Confidence in local equities is nonetheless showing signs of recovery from 2022 as a result of recent efforts by the Iranian Investment Institutions Association to address the inefficiencies of information flow to investors, noted Mhedi.

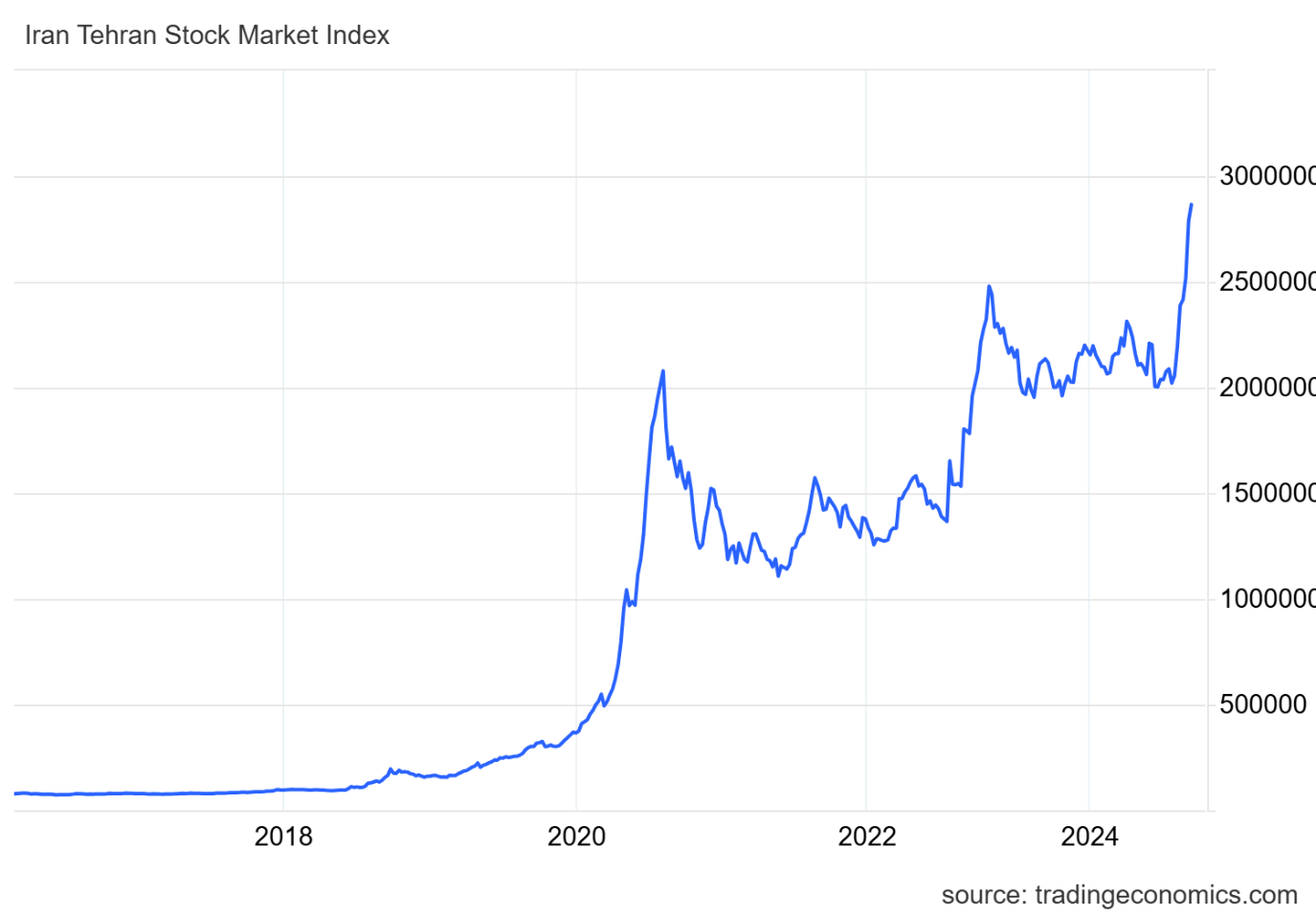

Chart 1: Iran’s stock market performance 2016–25

While awaiting positive results of economic stabilization efforts by policymakers to catalyze capital markets, Mehdi said investors also face another major challenge as many investment instruments and institutions are seen as being relatively new in Iran.

“Investors are not yet familiar with these investment methods. This requires time, effective advertising and holding familiarization events, as well as continuous media activities to educate people about these investment methods.”

Established in 2016 as part of the Kian Financial Group, PAKIA now operates eight funds featuring several asset classes. The investment strategy is based on the cash flow of companies, dividend distributions, development plans and management performance.

Another important factor that is helping restore investor confidence in the local capital market would be to measures taken by the Securities and Exchange Organization of Iran’s oversight department to ensure accuracy in companies’ financial reporting, noted Mehdi.

This report was produced by IFN Investor editor Francis Nantha and data analyst Arash Malekfard