- Malaysia’s Shariah ecosystem holds its own against GCC and neighbor Indonesia

- Strategic laws, innovation propel Islamic finance in the Southeast Asian nation

- Stability and commitment to growth signals Malaysia will stay ahead in the game

Overview

In the increasingly complex landscape of global finance, Malaysia has quietly yet decisively emerged as a preeminent center for Shariah compliant financial services.

Located next to Indonesia – the world’s largest Muslim population – and far from Middle East finance powerhouses Saudi Arabia and the UAE, Malaysia has developed a sophisticated ecosystem for Islamic finance that consistently outperforms many peers and sets new standards in ethical and sustainable investing.

The Southeast Asian nation’s commitment to Islamic finance dates back to the establishment of Tabung Haji – Malaysia’s Hajj pilgrim fund board – in 1963. A pivotal moment came two decades later via the Islamic Banking Act 1983 that led to the creation of Bank Islam Malaysia and catalyzed a host of other Islamic lenders.

Post-global financial crisis, Malaysia further solidified its position with institutions like the International Centre for Education in Islamic Finance and the International Shariah Research Academy for Islamic Finance. Standardization of Shariah contracts by Bank Negara Malaysia and the introduction of the Value-Based Intermediation (VBI) strategy in 2017 have helped Malaysia’s Shariah sector navigate present-day challenges.

Regulatory network

The cornerstone of the regulatory framework in Malaysia’s Shariah sector is the Islamic Financial Services Act 2013, which governs Islamic banking and financial institutions. This law mandates the establishment of Shariah committees within all Islamic financial institutions to ensure adherence to Islamic principles in all products and services.

The sector is also regulated by Bank Negara Malaysia. The central bank introduced the Shariah Governance Policy in 2019 that is overseen by the Shariah Advisory Council, which serves as Bank Negara’s highest authority on Shariah compliance. The council provides binding advice to Islamic banks and financial institutions, ensuring uniform interpretation and application of Islamic principles across the industry.

Core principles like prohibiting Riba, avoiding Gharar and promoting risk-sharing are deeply embedded in the legal framework.

Asset size, investment opportunity

With 577 Islamic funds tracked by the IFN Investor Funds Database that together account for an asset base of US$39.07 billion, Malaysia’s Shariah market is less than 5% the size of Saudi Arabia’s, estimated at approximately SAR3.1 trillion (US$826 billion) at the close of 2024.

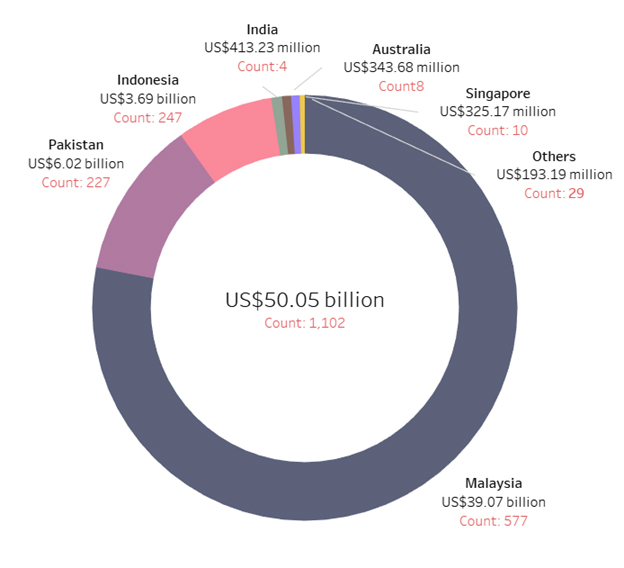

But within Asia, Malaysia reigns supreme, accounting for 78% of the region’s 1,102 funds that have a collective AuM of US$50.05 billion.

Pakistan ranks second in Asia and Indonesia third, with 227 funds valued at US$6.02 billion and 247 funds worth US$3.69 billion, respectively. Further down the table, India runs four funds worth US$413.32 million, followed by Australia (eight funds; US$343.68 million) and Singapore (10 funds; US$325.17 million). Others in the region manage a combined 29 counts with an AuM of US$193.19 million.

Chart 1: Asia Pacific Islamic assets by country and fund count

Source: IFN Investor Funds Database

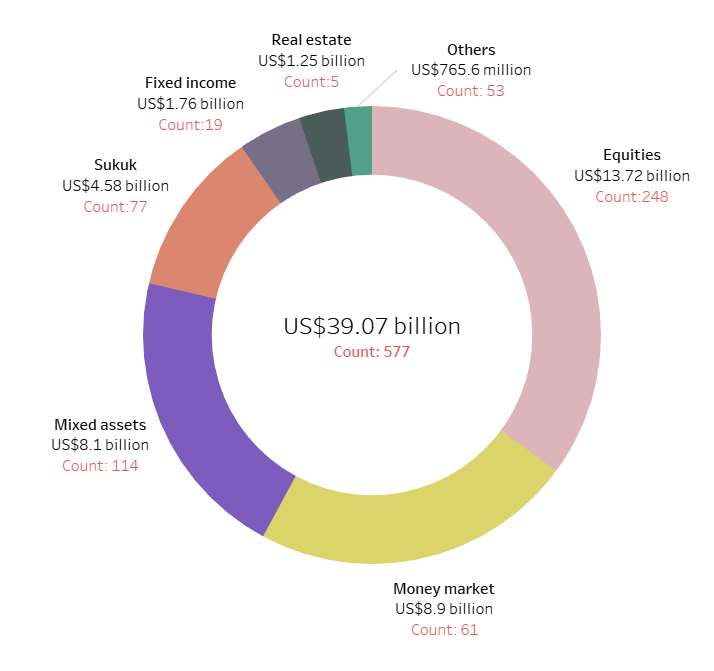

Of the Islamic funds in Malaysia, the largest number – 248 – are in equities, with US$13.72 billion in AuM. Mixed assets are next, with 114 funds holding US$8.1 billion, followed by money market (61 funds; US$8.9 billion), Sukuk (77 funds; US$4.58 billion), fixed income (19 funds; US$1.76 billion), real estate (five funds; US$1.25 billion) and others (53 funds; US$765.5 million).

Chart 2: Malaysian Islamic assets by market segment and fund count

Source: IFN Investor Funds Database

The largest capitalized Islamic fund in Malaysia is the US$5.25 billion mixed-assets Public Islamic Asia Tactical Allocation Fund managed by Public Mutual.

AHAM Aiiman Money Market Fund, run by AHAM Capital Asset Management, sits in the second spot with US$3.16 billion, followed by Pelaburan Hartanah’s real estate-focused US$1.18 billion Amanah Hartanah Bumiputera.

Holding fourth and fifth places, respectively, are Principal Asset Management’s US$998.76 million Principal Islamic Deposit Fund – Class AI Fund and Public Mutual’s US$918.87 Public Asia Ittikal Fund.

Table 1: Largest Malaysian Islamic funds by AuM

| Rank | Fund | Manager | Asset class | AuM (US$ million) |

| 1 | Public Islamic Asia Tactical Allocation Fund | Public Mutual | Mixed assets | 5,245.48 |

| 2 | AHAM Aiiman Money Market Fund | AHAM Capital Asset Management | Money market | 3,164.6 |

| 3 | Amanah Hartanah Bumiputera | Pelaburan Hartanah | Real estate | 1,178.13 |

| 4 | Principal Islamic Deposit Fund – Class AI | Principal Asset Management | Money market | 998.76 |

| 5 | Public Asia Ittikal Fund | Public Mutual | Equities | 918.87 |

The Islamic capital market represents over 60% of Malaysia’s total capital market, offering diverse avenues for investment. Green Sukuk, in particular, appeal to both domestic and international investors seeking ethical and sustainable financing options. As of November 2024, an impressive 79% of all listed securities on Bursa Malaysia were Shariah compliant, totaling 817 out of 1,034 companies.

For the future, a significant opportunity for Islamic finance lies in Malaysia’s green investments, which are projected to reach MYR1.3 trillion (US$290 billion) by 2050. Already, some MYR8.8 billion (US$1.95 billion) has been channeled into over 4,500 renewable energy and green projects through VBI initiatives.

Innovation-wise, Bursa Malaysia-i, an initiative launched in 2016 by the stock market operator, provides an end-to-end Shariah compliant investing ecosystem with i-Stocks, i-ETFs, i-REITs as well as exchange-traded bonds and Sukuk. There’s also exposure to Shariah-friendly US blue-chip companies through the MyETF Dow Jones US Titans 50.

Adding to that is the Investment Account Platform, launched in 2016, offering a bank-intermediated fintech platform that connects investors with viable Shariah compliant economic ventures, including SMEs and innovative growth areas. Fintech companies like Funding Societies are also increasing their Islamic finance portfolios, empowering the technological landscape for Shariah with more choices.

These innovations have propelled Malaysia to be number one among 15 countries according to the ICD Thomson Reuters’ Islamic Finance Development Indicator, with a score of 103. The closest competitor was Saudi Arabia, which scored a significantly lower 70.

Fund performance

PMB Investment’s equities-focused PMB Shariah Premier Fund is the best performing Malaysian Islamic fund with a 41% return for the year to 31st March 2025.

The fund is designed to achieve capital growth over the medium- to long-term through investment in any of the 50 largest Shariah compliant stocks by market capitalization.

AHAM Capital Asset Management’s TradePlus Shariah Gold Tracker ETF ranks second with a one-year return of 39.5%.

AmIslamic Funds Management’s Precious Metals Securities came in third with a return of 38.36%, followed by AHAM Capital Asset Management’s AHAM Shariah Gold Tracker Fund (29.1%) and Manulife Investment Management’s Manulife Shariah China Equity Fund – Class A USD (25.24%).

Table 2: One-year return of Malaysia’s top Islamic funds

| Rank | Fund | Manager | Asset class | One-year return (%) |

| 1 | PMB Shariah Premier Fund | PMB Investment | Equities | 41 |

| 2 | TradePlus Shariah Gold Tracker ETF | AHAM Capital Asset Management | Commodities | 39.5 |

| 3 | Precious Metals Securities | AmIslamic Funds Management | Others | 38.36 |

| 4 | AHAM Shariah Gold Tracker Fund | AHAM Capital Asset Management | Commodities | 29.1 |

| 5 | Manulife Shariah China Equity Fund – Class A USD | Manulife Investment Management | Equities | 25.24 |

In terms of growth, Malaysia’s Islamic banking sector recorded an 8.1% financing growth in 2024, outpacing conventional banking at 3.7%, RAM Ratings said, citing an average of 72% to overall loan growth over the past five years.

Asset quality within Islamic banking was strong too, with the gross impaired financing ratio easing to 1.3% by year-end 2024, RAM Ratings said.

Malaysia’s Takaful sector also saw robust growth, with global gross written contributions increasing by 15.1% year-on-year.

Outlook

The outlook for Malaysia’s Islamic finance market is one of continued stability and growth. RAM Ratings forecasts an 8% expansion in Islamic financing for 2025, driven by healthy domestic demand and ongoing investments. This robust projection is underpinned by the industry’s strong capital base and sound asset quality.

Bank Negara Malaysia remains dedicated to deepening the Islamic financial market and enhancing liquidity management. The government’s 2025 Budget further highlights this commitment, allocating MYR100 million (US$23.25 million) to spur financial innovation within the sector.

While the global Islamic finance industry faces challenges such as geographical concentration, Malaysia’s proactive adoption of digitalization and emphasis on sustainability position it as a resilient and adaptable leader, primed for sustained growth and an expanded international presence.