Key Highlights

- Global Islamic mixed asset funds stood at US$7.41 billion as of 30th June 2024

- Malaysia and Saudi Arabia are the two leading markets in the industry

- Three funds were launched in the first half of 2024

Overview

The primary goal of mixed assets investing is to optimize returns while managing risk by spreading the portfolio with different types of assets – including equities, bonds, real estate, commodities and cash – adopting a strategy that leverages on the unique characteristics of each asset. Fund managers strategically allocate investments based on market conditions, economic trends and individual asset performance – adjusting the mix of assets with the aim of enhancing overall portfolio stability and growth potential.

The IFN Investor Fund Database, which monitors the performance of Islamic mixed asset funds globally (excluding Iran), shows diverse results in quarter-on-quarter comparisons. In Q2 2024, there was an increase of three Islamic mixed asset funds globally. However, the assets under management (AuM) for mixed assets funds globally fell by 10.62%, decreasing from US$8.29 billion in Q1 2024 to US$7.41 billion in Q2 2024.

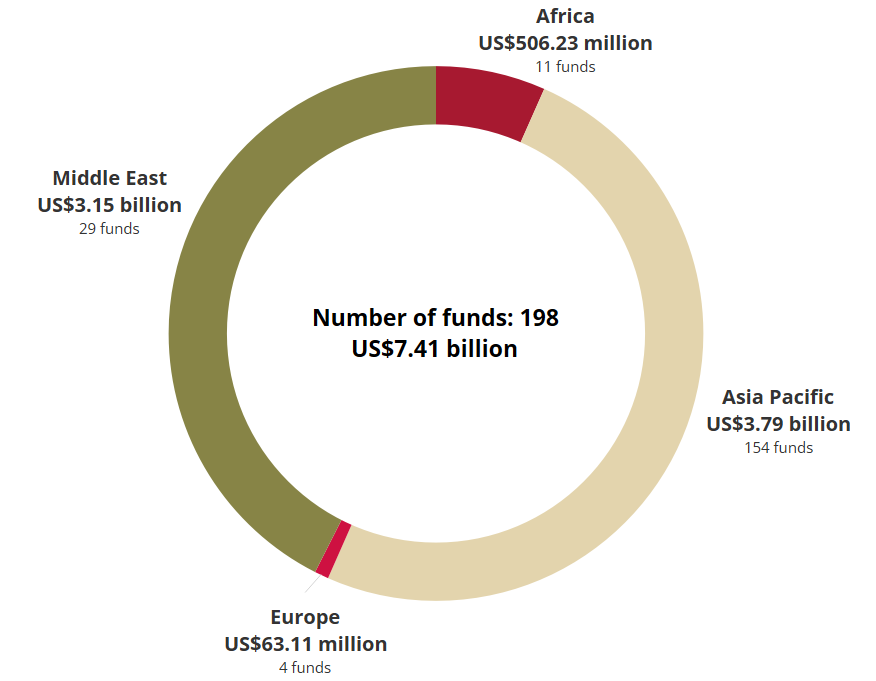

Chart 1: Global Islamic mixed asset funds AuM breakdown by region

Source: IFN Investor Fund Database

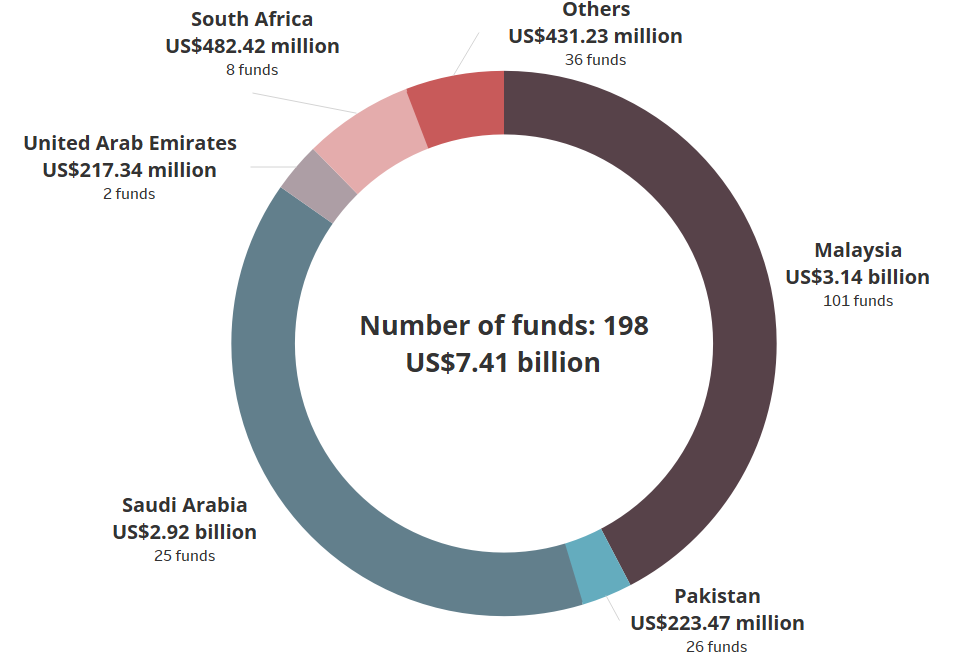

Chart 2: Largest markets for Islamic mixed asset funds by AuM

Source: IFN Investor Fund Database

Malaysia holds the top global position in Islamic mixed assets funds by AuM with an impressive US$3.14 billion (84.8% of Asia Pacific’s AuM) across 101 funds, followed closely by Saudi Arabia with US$2.92 billion (92.6% of Middle East’s AuM) distributed among 25 funds. South Africa ranks third with US$482.42 million spread across eight funds, followed by Pakistan with US$223.47 million across 26 funds. The UAE’s Islamic mixed assets total US$217.34 million across two funds. Together, these five countries account for 94.19% of the total global AuM in mixed assets funds. (See Chart 2)

AuM growth

In the second quarter of 2024, Islamic mixed assets AuM increased in Asia Pacific, the Middle East, and Europe, with Asia Pacific experiencing the largest growth at 39.10%. In contrast, Africa saw a decline in AuM, with a decrease of 6.35%.

- Asia Pacific: Up by 39.10% to US$3.70 billion from US$2.66 billion.

- Middle East: Up by 27.22% to US$3.15 billion from US$2.47 billion.

- Europe: Up by 8.63% to US$63.53 million from US$58.48 million.

- Africa: Down by 6.35% to US$506.32 million from US$540.64 million.

Table 1: Top performing Islamic mixed asset fund by region in Q2 2024

| Region | Fund | Fund manager | Three-month returns (%) |

| Asia Pacific | PMB Shariah Tactical Fund | PMB Investment | 21.2 |

| Middle East | Derayah Freestyle Saudi Equity Fund | Derayah Financial | 32.24 |

| Africa | Al Baraka Fund (EGP) | Hermes Fund Management (EFG Holdings) | 15 |

Source: IFN Investor Fund Database

New players and products

In the first half of 2024, three new mixed asset funds were introduced: Alkhabeer Capital launched the Diversified Income Fund 2030 on 28th April 2024; Foneria Portfoy introduced the Foneria Portfolio Multi Asset Participation Fund on 19th January 2024 and Sedco Capital released its Multi Asset Traded Fund on 19th May 2024. Together, these funds have accumulated a total of US$162.11 million in AuM.

Table 2: Islamic mixed assets funds launched in H1 2024

| Fund | Fund manager | AuM (US dollar) | Domicile |

| Alkhabeer Income Fund 2030 SEDCO | Alkhabeer Capital | 81.40 | Saudi Arabia |

| Sedco Capital Multi Asset Traded Fund | Sedco Capital | 79.95 | Saudi Arabia |

| Foneria Portfolio Multi Asset Participation Fund | Foneria Portfoy | 0.76 | Turkiye |

Source: IFN Investor Fund Database

Outlook

In 2023, persistent inflation led central banks to delay their rate responses longer than expected, causing investors to hold cash and stay out of investment markets. But once central banks cease rate hikes, analysts observed that locking in cash yields has historically delivered better overall returns compared to holding cash.

As we look toward the second half of the year, investors are cautious about investing in riskier assets, especially equities. With the global easing cycle now in progress, they have seen the risk on equity investment recede, bolstered by the strong supply-side factors that are likely to free up growth potential while keeping inflation in check.

The commodities market in Islamic finance is entering a phase of measured optimism. Analysts forecast a gradual stabilization in global economic conditions, which could lead to more stable and predictable commodity markets. Nonetheless, this positive outlook is tempered by uncertainties, especially concerning ongoing geopolitical tensions and environmental issues, which may significantly impact commodity prices and supply chain dynamics.