Key highlights

- Islamic money market instruments remain limited and concentrated in a handful of jurisdictions

- Al Rajhi Awaeed Fund emerged as the largest Islamic money market fund launched in 2024, with a total AuM of US$2.26 billion

- Money market funds in Pakistan reported strong performance in Q4 2024, supported by a recovering economy

Overview

The Islamic money market serves as a vital platform for short-term investments, offering Shariah compliant instruments that provide liquidity, income stability and ethical investment opportunities. It allows surplus funds to flow from institutions with excess liquidity to those with deficits, ensuring efficient liquidity management within the financial system.

Despite ongoing new initiatives and offerings in the market, Islamic financial institutions in various countries still struggle to efficiently manage liquid reserves, primarily due to challenges in accessing short-term money market instruments due to limited supply. Only a handful of countries have developed Islamic money market tools including Malaysia, Indonesia, Turkiye, Pakistan, Bangladesh, Nigeria and Gambia and most of the GCC states.

Islamic money market instruments vary across regions, reflecting local regulatory and compliance framework. Short-term Sukuk for example, are only used in a few markets including Malaysia, Bahrain, Bangladesh, Pakistan, Brunei, Indonesia and Qatar.

Malaysia arguably has the most diverse range of tools including with at least 12 different types of interbank products based on a variety of Shariah structures from Murabahah to Wadiah and Qard. It also has Islamic Treasury bills, a tool that is also available in the UAE.

In the GCC, Saudi Arabia and Bahrain heavily utilize commodity Murabahah for liquidity management. In Europe, countries like Luxembourg focus more on mutual funds rather than traditional money market tools, with ongoing efforts to develop Shariah compliant liquidity strategies. Meanwhile, Africa and the Americas have underdeveloped Islamic money markets due to limited infrastructure and regulatory support.

There is a severe dearth of cross-border high-quality dollar money market instruments. Presently, the International Islamic Liquidity Management Corporation (IILM) is the only entity issuing investment-grade short-term Sukuk. The IILM offers Sukuk with maturities of one, three, six and 12 months. As of December 2024, the IILM recorded a near 20% increase in the outstanding issuance, reaching US$4.14 billion, while also broadening its investor base across different jurisdictions

Additionally, money market mutual funds serve as an alternative for short-term investing, focusing on trading short-term debt securities such as commercial paper, certificates of deposit and treasury bills.

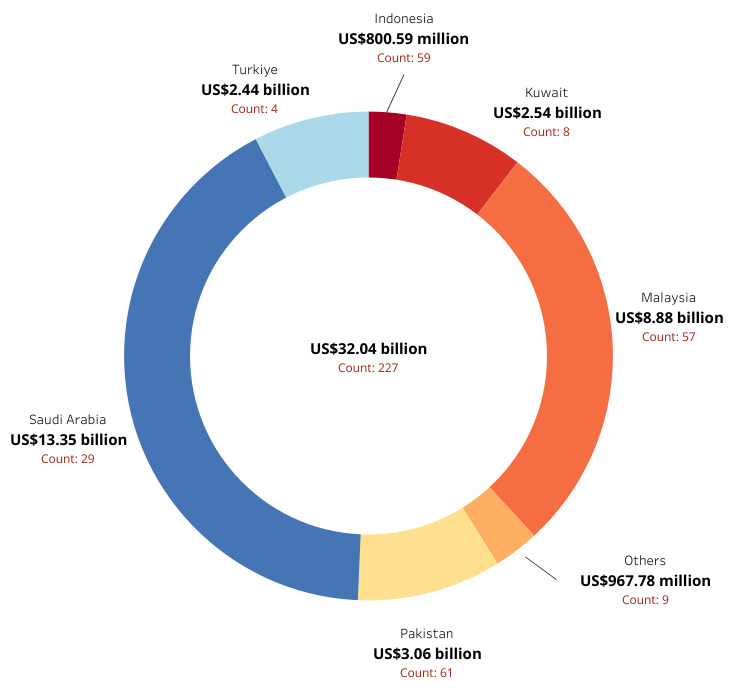

The IFN Investor Fund Database reports a total of 227 Islamic money market funds worldwide with a collective asset under management (AuM) of US$32.04 billion as of the end of 2024.

Saudi Arabia leads the sector with the highest AuM at US$13.35 billion across 29 funds, followed by Malaysia with US$8.88 billion in 57 funds. Pakistan has the largest number of Islamic money market funds, totaling 61, with a combined AuM of US$3.06 billion.

The database also identifies a significant presence of money market funds in Turkiye, amounting to US$2.44 billion across four funds, while Kuwait follows closely with US$2.54 billion in eight funds. Indonesia ranks last among the major countries with Islamic money market funds, holding US$800.59 million across 59 funds.

Chart 1: Top Islamic money market funds by AuM

AuM growth

According to the IFN Investor Funds Database, Islamic money market funds experienced significant growth in Q4 2024, with the total AuM rising by 11.29% quarter-on-quarter (q-o-q), from US$28.79 billion to US$32.04 billion. Growth was steady in all regions with the Middle East leading the way, followed by strong performances in Asia Pacific and the Americas.

Table 1: Regional AuM overview as at the end of Q4 2024 (q-o-q)

| Middle East | Up by 16.17% from US$14.24 billion to US$16.54 billion |

| Asia Pacific | Up by 10.19% from US$11.61 billion to US$12.79 billion |

| Americas | Up by 8.97% from US$280.87 million to US$306.06 million |

| Africa | Up by 2.4% from US$7.51 million to US$7.69 million |

| Europe | Down by 5.98% from US$2.65 billion to US$2.49 billion |

Table 2: Top performing funds by region as at the end of Q4 2024

| Region | Fund name | Fund manager | Three-month returns (%) |

| Asia Pacific | Meezan Paaidaar Munafa Plan XII | Al Meezan Investment Management | 23.14% |

| Europe | AXA Life and Retirement Oks Aggressive Participation Variable Retirement Investment Fund | AXA Hayat ve Emeklilik | 14.52% |

| Middle East | KFH Capital Money Market Fund (KWD) | KFH Capital | 13.44% |

| Americas | Azzad Wise Capital Fund | Azzad Asset Management | -0.52% |

Asia Pacific’s outstanding performance was driven by Pakistan’s money market funds. In 2024, Pakistan benefited from monetary easing, lower inflation and strategic investments in stable sectors. The Meezan Paaidar Munafa Plan XII delivered strong three-month returns under Meezan’s Fixed Term Fund, which focused on Shariah compliant short-term instruments.

New players and products

According to the IFN Investor Database, 13 new money market funds were launched globally in 2024, collectively amassing US$2.42 billion in AuM. The primary regions driving inflows were Pakistan and Saudi Arabia, with AuM totals of US$22.87 million and US$2.39 billion respectively.

Saudi Arabia’s dominance was anchored by its largest fund, the Al Rajhi Awaeed Fund, an open-ended vehicle. Pakistan’s smaller yet notable inflows reflected growing confidence in its economic reforms and appetite for stable, short-term instruments.

Table 3: Top five Islamic money market funds by AuM launched in 2024

| Country | Fund name | Fund Manager | AuM |

| Saudi Arabia | Al Rajhi Awaeed Fund | Al Rajhi Capital | US$2.26 billion |

| Saudi Arabia | Derayah Money Market Fund | Derayah Financial | US$125.67 million |

| Pakistan | Meezan Paaidaar Munafa Plan X | Al Meezan Investment Management | US$11.32 million |

| Indonesia | Mandiri Pasar Uang Syariah (Kelas C) | Mandiri Manajemen Investasi | US$6.13 million |

| Pakistan | Atlas Islamic Cash Fund | Atlas Asset Management | US$5.27 million |

Regulatory developments

Islamic collateralized funding plays a crucial role in liquidity management within the Islamic interbank money market. On the 28th June 2024, Bank Negara Malaysia released a comprehensive policy document on Islamic collateralized funding that replaces the existing Sell and Buy Back Agreement Guidance Note and consolidates Islamic repo instruments which will come into effect on the 30th June 2025.

This development aims to enhance the operational framework for Islamic financial institutions by standardizing practices related to collateralized funding. It is designed to promote sound risk management and ensure compliance with Shariah principles in all transaction.

According to the Islamic Financial Services Stability Report 2024, the Islamic Financial Services Board emphasized the need for jurisdictions to develop Shariah compliant liquidity management tools, such as Shariah compliant Lender of Last Resort facilities.

Outlook

The outlook for the Islamic money market in 2025 is promising The IILM intends to broaden its investor base and network of primary dealers. This expansion will focus on strengthening regional partnerships and entering new markets, ultimately integrating Islamic liquidity solutions more deeply into the global financial system.

This growth not only enhances liquidity in the Islamic money market but also creates significant opportunities for short-term investments in high-quality liquid assets.

Central banks are also easing monetary policies, improving liquidity conditions, which allows issuers to capitalize on favorable market dynamics. Regulatory bodies are increasingly supportive of Islamic finance, creating a vibrant environment for growth through policies changes and liquidity management tools.

Pakistan in particular is noteworthy – its conversion into a fully Shariah compliant financial system will only boost its already strong Islamic money market proposition.

Collectively, these factors position the Islamic money market as an attractive landscape for investors seeking ethical and competitive returns in 2025.