- Islamic finance not just faith-based alternative but also pragmatic tool in Nigeria

- Strong push into interest-free banking reestablishes nation’s Shariah standing

- Trajectory for future looks firm given global growth in Islamic finance

Overview

In Nigeria, a country often grappling with the complexities of its vast religious and ethnic diversity, Islamic finance is quietly emerging as a significant force, not merely as a faith-based financial alternative, but as a pragmatic tool for economic inclusion and development.

While the global conversation around Islamic finance often centers on its historical strongholds in the Middle East and Southeast Asia, Nigeria, with its deeply intertwined Christian and Muslim populations, presents a unique narrative of adaptation and growth.

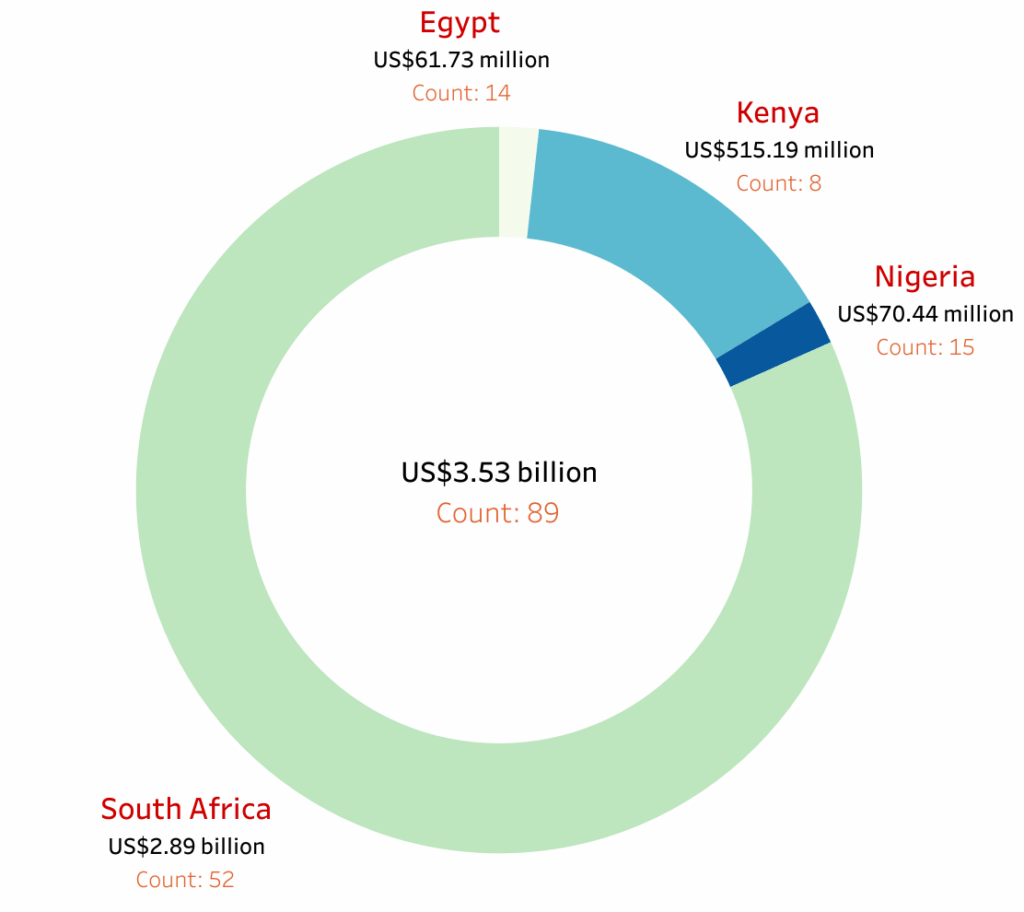

Data tracked by the IFN Investor Funds Database shows Nigeria’s 15 Islamic funds to be valued at US$70.44 million. Nigeria’s tally makes up about a sixth by fund count in the African continent, where the total stands at 89 funds worth US$3.53 billion.

That places Nigeria on the third spot for Shariah content in the continent, after top-ranked South Africa’s 52 funds worth US$2.89 billion and second-ranked Kenya’s eight funds valued at US$515.19 million. Nigeria’s standing is also just ahead of Egypt’s 14 funds worth US$61.73 million.

On a broader scale, Fitch Ratings estimates Nigeria’s entire Shariah finance sector to be worth approximately US$4 billion.

The genesis of Islamic finance in Nigeria is marked by both early aspirations and modern resurgence. Fleeting attempts in the early 1960s to establish Shariah compliant banking faced quick closure.

However, the 21st century has witnessed a determined and strategic reintroduction, spearheaded by the licensing of Jaiz Bank in 2012. This move by the Central Bank of Nigeria signaled a recognition of the demand for ethical, interest-free financial services, particularly among the nation’s substantial Muslim populace, estimated to be over 80 million.

The modern embrace of Islamic finance in Nigeria is not merely a religious endeavor; it is increasingly seen as a pathway to reaching the vast unbanked segments of the population and channeling investment into tangible, impactful projects.

Chart 1: African Islamic assets by country

Investment Opportunity

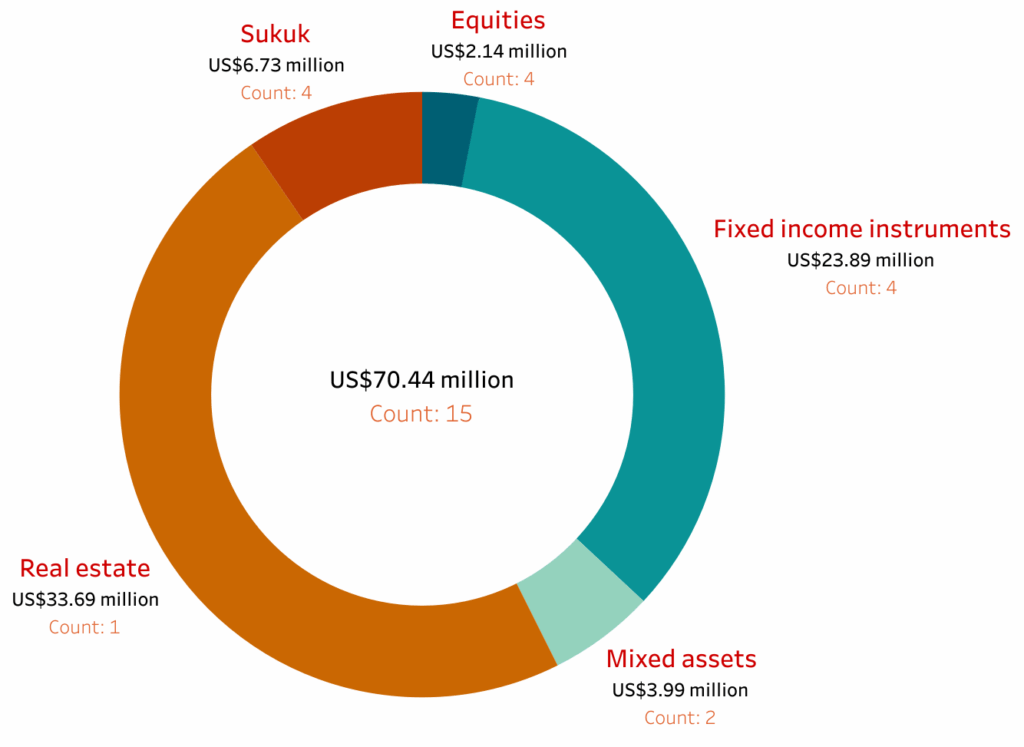

The investment landscape within Nigeria’s Shariah finance market offers distinct opportunities, primarily revolving around real estate, fixed income instruments, Sukuk, equities and mixed assets.

Of the 15 Islamic funds worth US$70.44 million in Nigeria, there are four each in fixed income instruments, equities and Sukuk; two in mixed assets and one in real estate. But asset-wise, the solitary fund in real estate fetches the highest value at US$33.69 million, as tracked by the IFN Investor Funds Database. Fixed income instruments was next, at US$23.89 million, followed by Sukuk (US$6.73 million), mixed assets (US$3.99 million) and equities (US$2.14 million).

These asset-backed instruments have become a linchpin in Nigeria’s infrastructural development, particularly for critical road projects. The Federal Government’s sovereign Sukuk issuances have consistently garnered overwhelming investor interest, often being oversubscribed by several hundred percent.

This enthusiasm reflects a dual appeal: the financial returns offered by the bonds and the inherent ethical alignment for a significant portion of the investor base. The Debt Management Office has leveraged this demand to raise substantial funds, demonstrating how Islamic finance can directly contribute to national development goals.

The Islamic banking sector, comprising 45.2% of the market, is experiencing vigorous growth. Non-interest banks saw their assets more than double year-on-year in 2024, driven by a surge in deposits and financing activities. Institutions like Jaiz Bank have reported robust financial results, indicating a healthy operational environment.

However, despite this rapid expansion, Islamic banking still holds a modest 1.7% share of Nigeria’s broader banking industry and is projected to only reach 2% by 2026, according to Fitch. This statistic highlights a significant growth frontier, particularly given Nigeria’s large unbanked population for whom conventional banking might not resonate culturally or ethically.

Chart 1: Nigerian Islamic funds by asset class

Fund performance

The largest Islamic fund in Nigeria asset-wise is the US$33.69 million Nigeria Real Estate Investment Trust run by Chapel Hill Denham Management.

Lotus Capital’s US$18.37 million Lotus Halal Fixed Income Fund was second. FBN Quest Asset Management’s US$4.98 million FBN Halal Fund, another fixed income play, was third, followed by Stanbic IBTC Asset Management’s US$3.76 million Sukuk-based Stanbic IBTC Shariah Fixed Income Fund and Lotus Capital’s US$3.33 mixed assets-based Lotus Halal Investment Fund.

Table 1: Largest Islamic funds in Nigeria by assets

| Rank | Fund | Manager | Asset class | AuM (US$ million) |

| 1 | Nigeria Real Estate Investment Trust | Chapel Hill Denham Management | Real estate | 33.69 |

| 2 | Lotus Halal Fixed Income Fund | Lotus Capital | Fixed income instruments | 18.37 |

| 3 | FBN Halal Fund | FBN Quest Asset Management | Fixed income instruments | 4.98 |

| 4 | Stanbic IBTC Shariah Fixed Income Fund | Stanbic IBTC Asset Management | Sukuk | 3.76 |

| 5 | Lotus Halal Investment Fund | Lotus Capital | Mixed assets | 3.33 |

In terms of performance, Stanbic IBTC’s equities-focused Stanbic IBTC Imaan Fund came out tops, returning 32% during the one year to 31st March 2025. The fund’s objective is to achieve long–term capital appreciation by investing a minimum of 70% of its portfolio in Shariah compliant equities and a maximum of 30% in assets such as Sukuk.

Lotus Capital’s mixed assets-based Lotus Halal Investment Fund was second, with a one-year return of 31.24%.

The other high achievers were Sukuk-focused plays, namely FSDH Asset Management’s FSDH Halal Fund, which returned 15.57%; Cordros Asset Management’s Cordros Halal Fixed Income Fund (6.12%) and Stanbic IBTC’s Stanbic IBTC Shariah Fixed Income Fund (4.68%).

Table 2: Nigeria’s top performing Islamic funds by one-year return

| Rank | Fund | Manager | Asset class | One-year return (%) |

| 1 | Stanbic IBTC Imaan Fund | Stanbic IBTC Asset Management | Equities | 32 |

| 2 | Lotus Halal Investment Fund | Lotus Capital | Mixed assets | 31.24 |

| 3 | FSDH Halal Fund | FSDH Asset Management | Sukuk | 15.57 |

| 4 | Cordros Halal Fixed Income Fund | Cordros Asset Management | Sukuk | 6.12 |

| 5 | Stanbic IBTC Shariah Fixed Income Fund | Stanbic IBTC Asset Management | Sukuk | 4.68 |

Regulatory Framework

Nigeria’s approach to regulating Islamic finance is a testament to its evolving financial landscape. Guidelines drawn by the Central Bank of Nigeria (CBN) for non-interest financial institutions provide the core regulatory framework, ensuring Shariah compliance while integrating these entities into the broader financial system.

The Securities and Exchange Commission also plays a vital role in overseeing Islamic capital market products. While stakeholders acknowledge that the regulatory framework is still maturing, particularly in terms of product innovation and market awareness, the government’s consistent support for sovereign Sukuk and the CBN’s strategic moves to enhance capital requirements for banks are positive steps.

The integral role of Shariah supervisory boards ensures that all financial products and operations adhere strictly to Islamic principles, fostering trust and credibility.

Outlook

The trajectory for Nigeria’s Shariah finance market appears to be firmly upward. The nation’s demographic profile, coupled with a growing awareness and acceptance of ethical financial practices, positions the sector for sustained expansion.

While year-to-date performance figures for the entire sector are still being aggregated, the strong showing of key players like Jaiz Bank in the first half of 2024, alongside the consistent oversubscription of sovereign Sukuk, suggests a resilient and dynamic market.

Globally, Islamic finance has shown its stability, particularly during times of conventional financial distress, due to its risk-sharing principles. Nigeria’s market, though smaller, is demonstrating similar resilience and growth independent of global headwinds.

The path forward for Nigeria involves continued efforts in financial literacy, diversification of Shariah compliant products beyond banking and Sukuk as well as the fostering of deeper understanding of the economic benefits for Shariah finance across all segments of society, which would reinforce its role as a hub for Islamic finance in Africa.