Key Highlights

- New government pursuing bold economic reforms to reverse sluggish progress

- Growing Muslim population driving Islamic finance focus and Halal investment agenda

- Islamic fixed income funds dominate Halal funds space by the number of funds but real estate funds command the majority of AuM

Overview

Nigeria is undergoing dramatic reforms under its new government, elected in 2023, which is attempting to rebuild its economy after a protracted period of sluggish growth due to lower oil production, stronger trade protectionism and external shocks including the COVID-19 pandemic. In May 2024, inflation hit a 24-year high of 33.95%.

| Nigeria’s Composite CPI for 2024 | ||

| Month | Year-on-year change (%) | Month-on-month change (%) |

| January | 29.90 | 2.64 |

| February | 31.70 | 3.12 |

| March | 33.20 | 3.02 |

| April | 33.69 | 2.29 |

| May | 33.95 | 2.14 |

| Source: National Bureau of Statistics, Nigeria | ||

Despite weaker economic fundamentals, the country is still one of Africa’s largest economies by GDP (over US$400 billion) boasting a young and rapidly growing population. Its abundant natural resources, strategic location and membership in the Economic Community of West African States make it an attractive investment destination.

With almost half of its 218 million-strong population identifying as Muslims, the government has also taken a strong Islamic finance stand and intends to grow its Halal economy and finance sector.

Regulatory landscape

Navigating the investment landscape, depending on the sector, in Nigeria could get complicated. However, authorities have been attempting to streamline processes and improve the legal environment. Reform examples include the Companies and Allied Matters Act 2020 and the Presidential Enabling Business Environment Council.

The government has introduced incentives including tax holidays, import duty exemptions and investment guarantees to attract foreign investment. Foreign entities are also allowed to assume full ownership of companies in Nigeria except in certain industries.

The Nigerian Investment Promotion Commission is the government’s primary vehicle to promote local and foreign investment, operating the One-Stop Investment Centre.

Financial regulators including the Central Bank of Nigeria, Securities and Exchange Commission (SEC), and the National Pension Commission have introduced various regulations and guidelines to support Islamic banking, finance and investment activities. These include rules on Sukuk, investments in Shariah compliant assets and conversion of conventional financial institutions to non-interest entities.

The most recent measure is the exposure draft by the SEC on the issuance and allotment of securities, including Sukuk for private companies in May this year. FMDQ Securities Exchange in 2023 published an exposure framework for the issuance of Islamic commercial paper to grow the Islamic structured debt capital market. Last year, the National Pension Commission introduced a framework to establish a Pension Industry Non-Interest Advisory Committee to grow the Halal pension sector.

Asset management

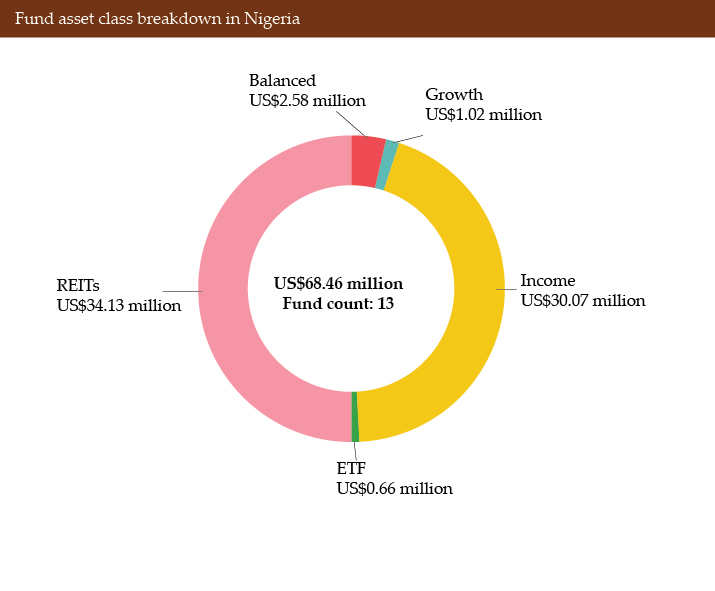

Apart from a fledgling Sukuk market (six sovereign Sukuk, two sub-sovereign offerings and a handful of corporate papers), Nigeria is also home to a small, but growing, Halal funds sector. There are 13 Islamic funds in the country with at least 10 Islamic asset managers, according to the IFN Investor Fund Database. As at the end of Q2 2024, assets under management (AuM) of these funds reached almost US$70 million. As of the end of June 2024, Halal funds commanded 1.67% of total market valuation, according to the SEC.

For years, fixed income funds have dominated the Islamic space in number and size, but the country’s first Halal REIT launched in 2020 has grown rapidly, accounting for half of Islamic funds assets, according to the IFN Investor Fund Database.

| Table 1: Ten largest Islamic funds in Nigeria | ||

| Fund name | AuM (US$ million) | |

| 1 | Nigeria Real Estate Investment Trust | 34.13 |

| 2 | Lotus Halal Fixed Income Fund | 12.62 |

| 3 | Stanbic IBTC Shariah Fixed Income Fund | 5.88 |

| 4 | FBN Halal Fund | 5.84 |

| 5 | SFS Fixed Income Fund | 4.75 |

| 6 | Lotus Halal Investment Fund | 2.58 |

| 7 | Norrenberger Islamic Fund | 0.69 |

| 8 | Lotus Halal Equity ETF | 0.66 |

| 9 | ARM Ethical Fund | 0.59 |

| 10 | Stanbic IBTC Imaam Fund | 0.43 |

| Source: IFN Investor Fund Database | ||

Outlook

External and internal risks continue to weigh upon Nigeria’s economy including the risk of higher inflation and elevated debt servicing costs. However, analysts and economists are cautiously optimistic in view of the government’s commitment to reforms. Such measures may stabilize the foreign exchange market and slightly ease inflationary pressures; the IMF expects Nigeria’s GDP to grow by 3.3% this year. The government remains committed to its Islamic finance agenda and is expected to continue to be proactive in engaging the private sector to stimulate investments.