The growth potential of India’s Shariah equity investment space is constrained by a mix of regulatory hurdles, general cautiousness and a lack of awareness, M S Shabbir, founder and managing director of SenSage Financial Services shared with IFN Investor.

“Many investors, even those who might be inclined toward Shariah compliant investments, are not fully aware of how these products work and what their benefits are. As such, there’s often confusion around Islamic finance principles, which limits demand,” said Shabbir.

While NGOs and pension funds – both local and foreign – are showing interest in Shariah investments, the lack of awareness and cautiousness prevents them from fully committing, noted Shabbir. As a result, most Shariah investment participants are individuals.

Shabbir said many NGOs in India have significant cash reserves, but those managing these organizations are not financially savvy and instead choose to keep their money in fixed deposits as they think it is too risky to entrust their money to fund managers or invest in mutual funds.

This apprehension towards Shariah investments was sparked by several past fraudulent schemes in India, that misused the ‘Shariah’ or ‘Islamic investment’ label to lure investors, especially from the Muslim community with promises of high, risk-free returns under the guise of Halal investing.

“The data on losses presented in the Parliament five years ago showed that an estimated US$300 million had been lost with private and Ponzi schemes,” asserted Shabbir.

Hence, India’s Shariah investment sector needs to be streamlined and regulations put in place while simultaneously educating the population on the benefits of Shariah compliant investments, Shabbir noted.

Another group that could boost Shariah investments are non-resident Indians, since they are the biggest cash contributors by repatriations – especially from the Middle East region, Shabbir observed.

Equally daunting is how India has a total of five regulators – the Reserve Bank of India, Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India, Pension Fund Regulatory and Development Authority and Insolvency and Bankruptcy Board of India.

The first challenge is that SEBI does not have a dedicated regulatory framework for Shariah compliant investments but regulates them within its broader financial market rules. Shariah compliance is instead overseen by independent advisory boards appointed by fund houses, while SEBI ensures the overall integrity and transparency of the products.

Secondly, though there are 120 million Muslims living in India, most of them have little or no financial knowledge mainly due to extreme poverty and they are highly heterogeneous in terms of age, gender, occupation, education and economic status. Therefore, terms like inflation, power of compounding and mutual funds are alien concepts to most.

There are no fully Islamic banks in India, Shabbir said. “I think the total assets under management in ethical mutual funds is less than US$190 million and out of this, only 50,000 are Muslim contributors.”

To help bridge the gap in terms of trust issues, Shabbir urged regular dialogues to be conducted between Shariah scholars and Shariah financial experts for better understanding.

An example of how to reassure the naive investor, is that Shariah compliant funds utilize the term ‘ethical’, due to the fact that the words like ‘Muslim’ and ‘Shariah’ raise some uneasiness among the majority of non-Muslim.

According to Islamicly, a Shariah equity screening and advisory firm, out of the total stocks listed on Indian stock exchanges, around 54% are Shariah compliant, amounting to 2,648 stocks.

Table 1: Component stocks tracked by selected Indian outfits

| Nifty 500 | Nifty 500 Shariah | AMFI | AMFI Shariah | |

| Large cap | 100 | 46 | 100 | 55 |

| Mid-cap | 141 | 64 | 150 | 80 |

| Small cap | 265 | 156 | 4,847 | 2,648 |

Source: SenSage and Association of Mutual Funds in India (AMFI) as at the 31st December 2024

Given this result, Shabbir said India has potential when it comes to Shariah compliant stocks and noted that is why many investors – both local and foreign – are puzzled as to why India is largely underserved in terms of Shariah investment options.

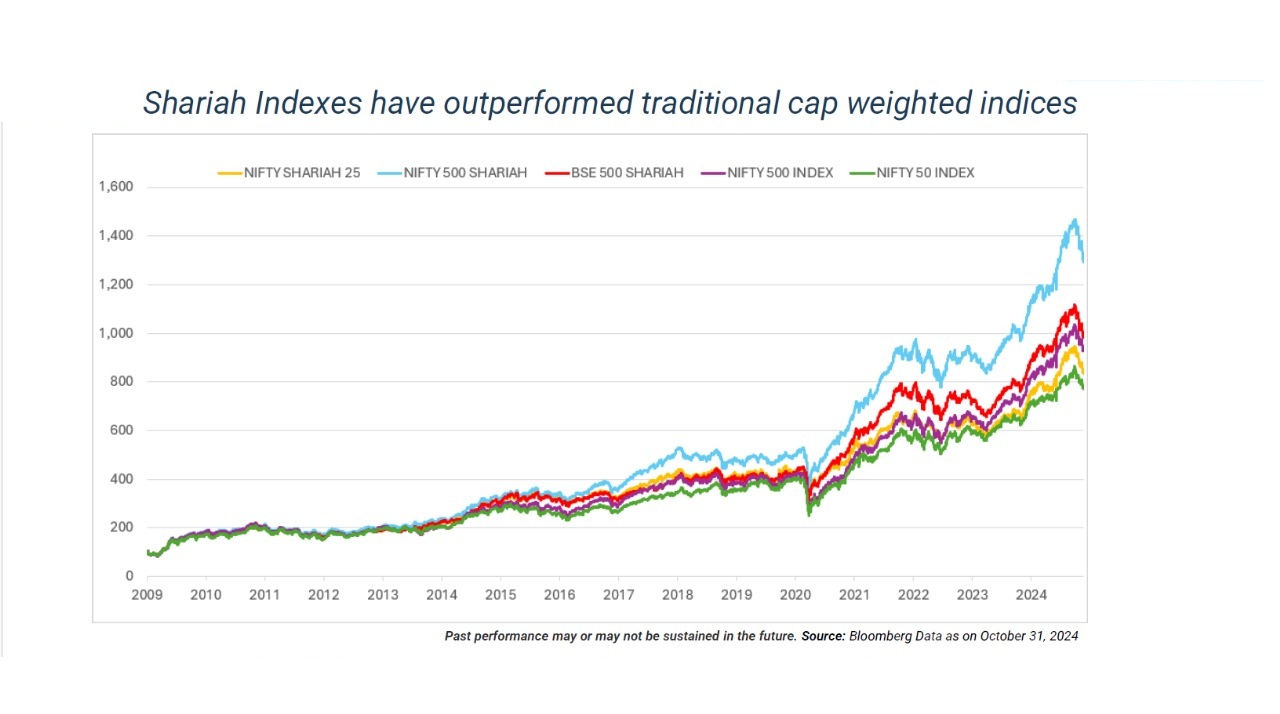

Chart 1: India’s conventional and Shariah indices comparison by SenSage

“Looking at the potential, the performance of the Shariah compliant indices has outperformed other indices. If you give an equal weightage to the Shariah compliant 50 companies and create a portfolio you will find that the performance is much better than Nifty 100, BSE 100, Nifty 200 and Nifty Midcap 150, among others,” he stated.

Nifty Shariah 50 Index has shown returns comparable to its parent indices like the Nifty 50 or Nifty 500. During certain periods, especially in market downturns, the Nifty Shariah 50 Index has even outperformed broader indices due to its focus on quality, low-debt companies, Shabbir shared in his proprietary analyses.

Likewise, Shabbir’s data showed the BSE TASIS Shariah 50 generally tracks closely with conventional indices and outperforms them, though not consistently. “So, it is surprising that the Shariah investment offerings in India are so poor, seeing the credibility and integrity that Shariah mutual funds can bring.”

SenSage Services partners with asset management companies, exchanges and fintechs to support the development of Shariah compliant investing in India.