Key highlights

- Fragile Pakistan economy still dependent on IMF financing

- Pakistan is the second-largest Asia Pacific market in terms of Islamic mutual fund AuM

- Its Islamic asset management space invests heavily in money market instruments

- Shariah capital market is developed, almost half of the mutual funds offered is compliant.

Overview

Pakistan has a fragile national economy, which managed to avert a sovereign debt default last year only by securing a short-term IMF loan.

It is seeking more financial aid, which would be its 24th IMF bailout so far, as foreign currency reserves at its central bank stood at US$9.39 billion as at the end of Q2 2024. This South Asian nation needs US$24 billion for debt and interest servicing in the current year from 1st July 2024.

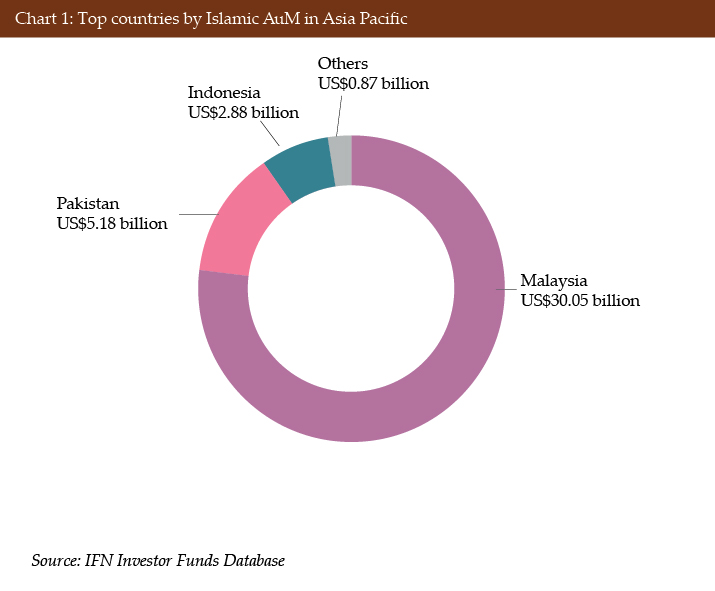

Despite this bleak landscape, Pakistan is the second-largest country in terms of Islamic asset management in Asia Pacific, just behind Malaysia, followed by Indonesia. Pakistan’s Islamic assets under management (AuM) total value was US$5.18 billion, making up 13.28% of total Islamic AuM in the Asia Pacific region as at the end of Q2 2024.

The Islamic capital market has been thriving in Pakistan thanks to strong regulatory support including the introduction of Shariah Governance Regulations 2018, a comprehensive framework for everything Shariah-related that was initiated back in the year 2016. It serves as the guideline for companies and future development for capital markets in offering Shariah compliant securities.

The Securities and Exchange Commission of Pakistan (SECP) also adheres to AAOIFI standards, targeting to attain the highest standards possible to remain relevant in the Shariah finance playing field and to ensure the soundness and efficiency of the Islamic capital market.

Like Malaysia, Pakistan runs a dual banking system where the Islamic and conventional banks operate in parallel.

This nation diligently improves its Shariah financial system by keeping abreast with recent global updates and standards, which can be seen in frequent public updates by the SECP on adopting the latest AAOIFI and ethics standards guidelines.

Further, the SECP has an active engagement with the International Organization of Securities Commissions (IOSCO) to understand the various initiatives within the IOSCO, especially on sustainable finance, fintech and the retail market. The SECP also holds full signatory status to IOSCO’s Multilateral Memorandum of Understanding, an international benchmark for exchanging information between securities regulators – showing the nation’s commitment to promote regulatory cooperation and compliance.

Regulatory framework

The SECP is the relevant authority for the corporate sector and capital markets. It has oversight on regulations for insurance companies, non-banking financial companies (NBFC), private pension schemes and oversees external service providers to the financial sector – including chartered accountants and credit rating agencies. The SECP also holds investigative and enforcement powers.

For investments offered to the public, the SECP and the Mutual Funds Association of Pakistan (MUFAP) have very stringent rules – this includes any voluntary pension schemes (VPS) or pension funds. Entities providing asset management services for such investments are required to obtain a license from the SECP.

Once licensed, this entity – or asset management company (AMC) – is then allowed the management of a mutual fund. The mutual fund is governed by the NBFC Rules 2003, NBFC & Notified Entities Regulations 2008, Part VIII of The Companies Ordinance 1984 plus circulars and directives issued by the SECP.

In the primary capital market, any entity raising financial capital by issuing Shariah compliant securities must be approved by the SECP under the Companies Act 2017. At present, there are 139 Shariah advisors registered with SECP.

VPS is governed by Part VIII of the Companies Ordinance, 1984 and Voluntary Pension System Rules, 2005. A pension fund has to be authorized by the SECP and managed by a pension fund manager registered with the SECP, under the VPS Rules 2005. Participants of VPS investments are eligible for tax relief up to certain monetary value.

Under the Shariah Governance Regulations 2023, the SECP outlined the minimum screening criteria for Shariah compliant companies and securities. Thereafter, entities or companies are required to apply and obtain the due declaration from the SECP before being able to claim themselves as Shariah compliant.

Investment market

Pakistan had three stock exchanges prior to 2016 – the Karachi Stock Exchange, Islamabad Stock Exchange and the Lahore exchange. All had different trading interfaces, indices and management. The three integrated their operations in January 2016, under the new name Pakistan Stock Exchange (PSX). The PSX currently lists 11 indices.

As of the end of June 2024, a total of 528 companies were listed on PSX with a total market capitalization of PKR10.371 trillion (US$37.11 billion).

Asset management

According to MUFAP, AMCs in Pakistan as a whole manage 469 funds – encompassing conventional and Shariah compliant funds plus VPS. Shariah compliant funds make up almost half, at 222 out of 469.

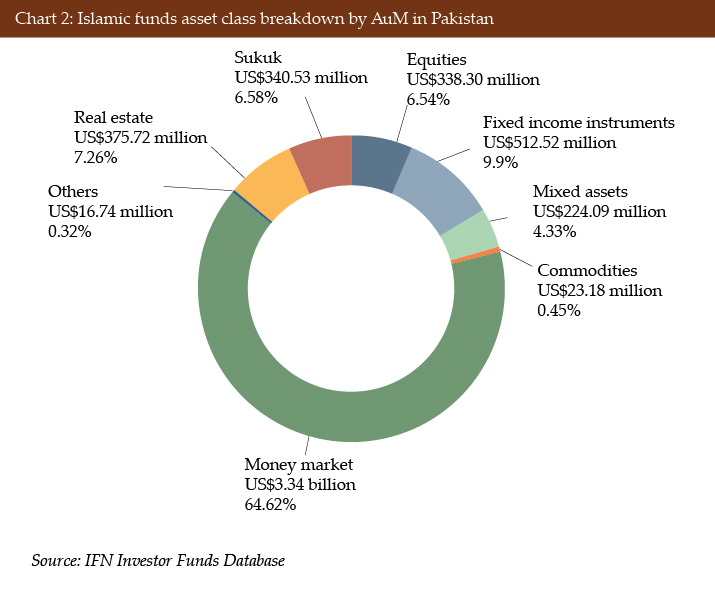

The Islamic asset management space is heavily money market-biased, and one-third of these money market funds are managed by AMCs for retirement and pension purposes – a very familiar structure practiced by the Pakistani companies and the government. Money market funds also dominate eight out of the top 10 largest funds in the nation.

According to the IFN Investor Fund Database, Islamic funds domiciled in Pakistan have total AuM of US$5.18 billion at the end of Q2 2024. The top three largest funds in Pakistan are the Meezan Daily Income Plan, managed by Al Meezan Investment Management with an AuM of US$587.04 million, followed by the Meezan Rozana Amdani Fund at US$450.81 million and the Faysal Halal Amdani Fund, managed by Faysal Asset Management at US$285.78 million. These two fund managers are also the two largest in the nation.

Table 1: Pakistan’s top performing Islamic fund in Q2 2024

| Fund | Fund manager | Three-month returns (%) |

| Mahaana Islamic Cash Fund | Mahaana | 20.79 |

| Meezan Financial Planning Fund of Funds (Very Conservative) | Al Meezan Investment Management | 20.30 |

| HBL Islamic Money Market Fund | HBL Asset Management Ltd | 20.09 |

Source: IFN Investor Database

Outlook

The PSX offers an extensive range of investment vehicles for interested investors, ranging from common equities and derivative trading to exchange traded funds and margin trading. July 2024 saw another initiative by the PSX to enhance market liquidity. Meezan Bank, which is already a market maker for Shariah compliant debt securities and has been a key player in PSX, has become be the first market maker for Pakistan government-issued Ijarah Sukuk.

Roshan Equity Investment Account is another initiative through collaboration between the State Bank of Pakistan, PSX and other major authorities – to allow Pakistani nationals to access trading on the PSX regardless of their current residency, greatly increasing investment opportunities for its citizens abroad.

Investments in the PSX for foreign nationals and institutions are also possible by opening a Special Convertible Rupee Account through a brokerage firm or a designated bank – which gives access to investment instruments, including equities and bonds.

A further initiative in progress is the SECP seeking to reduce the overall fee structure for investments in mutual funds and pension schemes, with the aim to attract more retail investors to these financial offerings.

To further boost investor access to these funds, the SECP proposed several changes aimed at making distributor compensation more attractive.

This report was produced by Elliot Yip, financial data analyst at IFN Investor.