Key highlights:

- Healthy growth in Asia Pacific and Americas

- REITs subdued in Middle East, where direct property sales soared

- Data centers are promising prospects for property funds industry

Overview

It has been a mixed performance for Islamic REITS in Q2 2024, with these property funds continuing to do well in jurisdictions where the rental income remains strong – but sluggish in areas which has seen more property purchases in preference for tenancies.

Consequently, REITs in Asia Pacific and the Americas have outperformed their counterparts in both the Middle East and Europe during Q2 2024 in terms of growth for assets under management (AuM).

In particular, the UK has seen an increase in properties available for sale in this period, with market research firm CBRE reporting an increase in industrial space vacancy rates while residential mortgage approvals are up 30% compared to the same period in 2023.

Also, real estate purchases have soared in both Saudi Arabia and the UAE – with the latter seeing a significant influx of foreign buyers, resulting in absorption of existing inventory. Property Monitor charted an increase of over 30% for Dubai property sales in H1 2024 and CBRE reported Riyadh’s residential market saw a sales growth of 51.6% in Q2 2024, with double digit increases also recorded in Jeddah and Dammam.

On the global front, abrdn reports investment in real estate asset class has been upgraded from underweight to neutral. While this might seem a modest improvement, the clear message is that it’s no longer beneficial to carry an underweight allocation to the asset class.

Chart 1: Islamic real estate funds (including REITs) breakdown by region

Source: IFN Investor Funds Database

Stepping into Q2 2024, the IFN Investor Funds Database tracked five more Islamic REITs. Notably, the SC Global Real Estate Equities Fund has been liquidated or turned inactive whereas the BLOM Fund of REITs has been recategorized as a feeder fund.

This puts the IFN Investor fund database tracking total at 44 funds as of the time of writing – with 32 funds are from the Middle East, eight from Asia Pacific, two from Americas and one each in Africa and Europe.

The Middle East continues to hold the largest market share in real estate investment funds at 79.16%, followed by Asia Pacific at 18.62%.

Total AuM of these 44 funds sit at US$8.52 billion, an increase of US$100 million compared to Q1 2024 AuM of US$8.42 billion. Within the four regions, growth in total AuM was seen with the Asia Pacific gaining US$350 million and the Americas rising US$23 million.

The Middle East witnessed a mild reduction in Islamic REITs AuM, falling roughly US$290 million while Europe retarded US$ 2.6 million to experience a substantial slump – over a quarter of its value – for the HSBC FTSE EPRA NAREIT Developed Islamic UCITS ETF.

- Europe: Down by 25.12% from US$10.35 million to US$7.75 million

- Asia Pacific: Up by 28.23% from US$1.24 billion to US$1.59 billion

- Americas: Up by 18.22% from US$126.11 million to US$149.09 million

- Middle East: Down by 4.13% from US$7.03 billion to US$6.74 billion

AuM growth

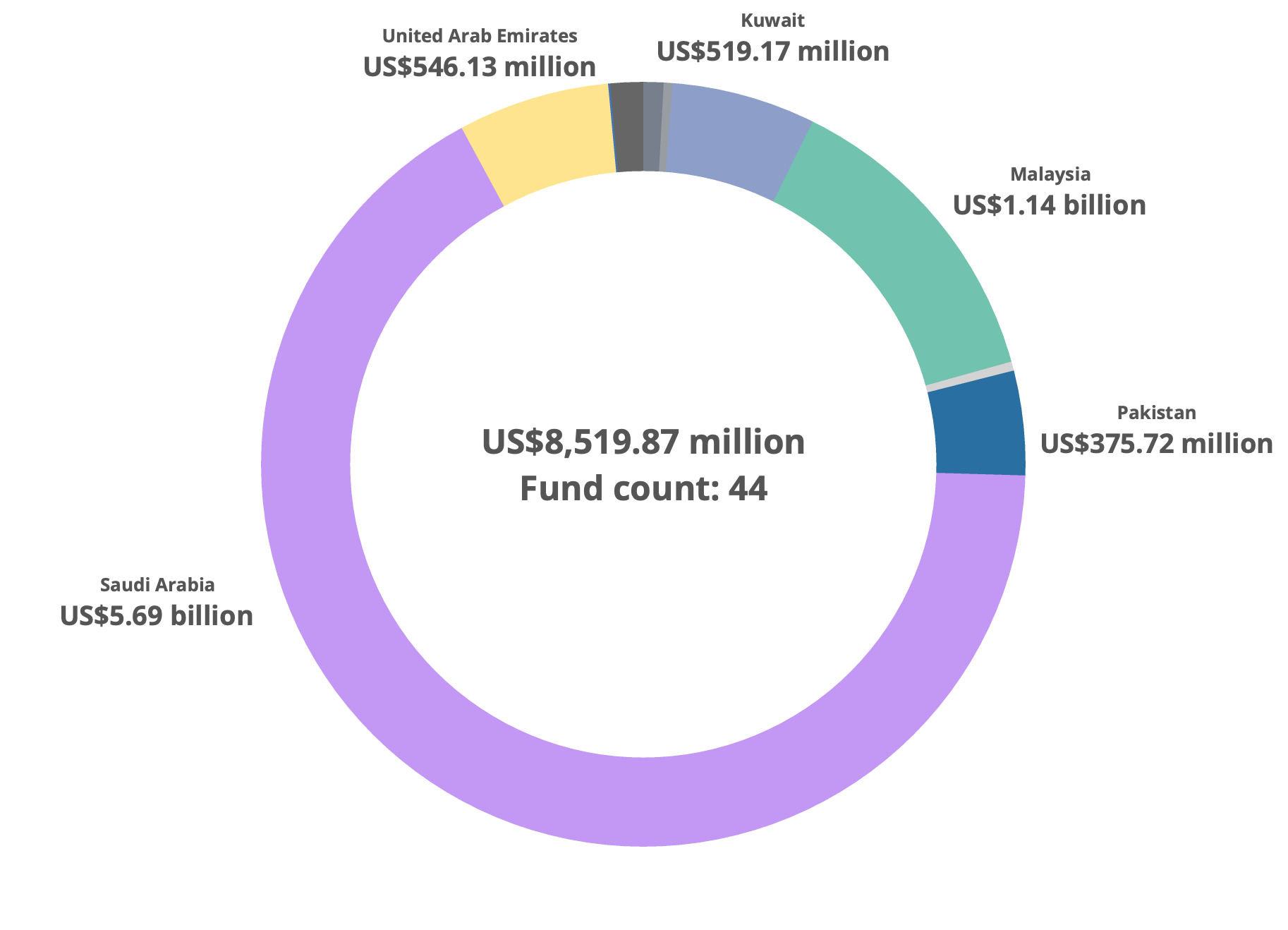

Chart 2: Top five Islamic real estate total fund valuations by country

Source: IFN Investor Funds Database

Drilling down into the country level, comparisons with the previous quarter showed substantial percentage rises in total AuM value being seen in the UAE, Kuwait and Malaysia – with respective increase of US$175.4 million, US$2.67 million and US$50 million. Total valuation of property funds in Saudi Arabia was down US$460 million.

Islamic REITs

Saudi Arabia and Malaysia, the two largest nations for Islamic REIT holdings according to the IFN Investor Funds Database, continue to enjoy tailwinds brought by an increasing demand for property for both business and residential purposes.

The majority of the property counters in Malaysia’s stock market rose from the beginning of 2023 till Q2 2024 and the government is confident in the trajectory of this industry stepping into H2 2024, built upon the stability and resilience the industry is currently experiencing.

Saudi Arabia enjoys the same treatment with strong demand for office space, but the REITS space is dampened slightly by the over 50% growth in residential transactions in Riyadh. Hosting the largest total AuM in Islamic REITs, Saudi Arabian entities like Aljazira, Derayah Financial, MEFIC Capital, Emirates REITs and AlRajhi REITs have reportedly undertaken significant real estate-related activities in H1 2024 and continue to build their REITs investment portfolio and market presence in the commercial properties space.

Table 1: Top Islamic real estate funds by AuM percentage growth in Q2 2024

| Fund Name | Q1 2024 AuM (US$) | Q2 2024 AuM (US$) | % change |

| Manzil Mortgage Investment Fund | 26.06 million | 31.29 million | +20.07 |

| SP Funds S&P Global REIT Sharia ETF | 100.14 million | 117.8 million | +17.64 |

| Al Rajhi Real Estate Monthly Distribution Fund | 95.02 million | 106.04 million | +11.60 |

Source: IFN Investor Funds Database

Table 2: Largest Islamic real estate funds by AuM in Q2 2024

| Fund Name | Fund manager | AuM (US$) |

| Amanah Hartanah Bumiputera | Pelaburan Hartanah | 1,070.92 million |

| Al Rajhi REIT Fund | Al Rajhi Capital | 833.12 million |

| SC REIT Fund | Sedco Capital | 652.96 million |

Source: IFN Investor Funds Database

Outlook

Commercial properties continue to register strong resilience for REITs and with the boom of machine learning algorithms powering artificial intelligence offerings, many investments from IT giants like AT&T, Microsoft, Google are driving demand for more data centres with the ever-increasing size of their proprietary data.

The US National Association of Real Estate Investment Trusts has pointed out that business opportunities of leasing data centres with well-stablished infrastructures are proving to be viable REITs investment.

Real estate sector developments in H1 2024 have paved the way for increased confidence for investors and policy makers alike, with many spurred to keep their eyes peeled for opportunities as well as potential hiccups in the second half of the year.

With the current market momentum in the Asia Pacific, coupled with sound investment planning, REITs could be a promising industry for the year in this region.

This report was produced by Elliot Yip and Aravinth Rajendran, financial data analysts at IFN Investor.