Key Highlights

- Middle East leads with 63% of market for Shariah compliant real estate funds

- Europe witnessed 34% growth in funds AuM over Q4 2024

- REITs transforming Islamic real estate investment landscape

Overview

The global real estate market at the end of 2024 showed clear signs of shrugging off any lingering effects of the pandemic slowdown, with Europe taking the lead in asset appreciations – fueled mainly by inflationary pressures in Turkey.

Demand for commercial spaces – mainly logistics, rather than retail and office spaces – also remained strong, with the poster child of datahousing demand catering for rapid rises in AI technology, powering many different sectors.

On the residential front, demand picked up for housing in both city centers and surrounding areas in the usual mainstays of the US, the UK and also across Europe as new-build supply shortages have yet to be fully reconciled. The student housing market also remains strong, mainly driven by private equity investments.

Shariah investors have traditionally focused on residential and commercial properties.

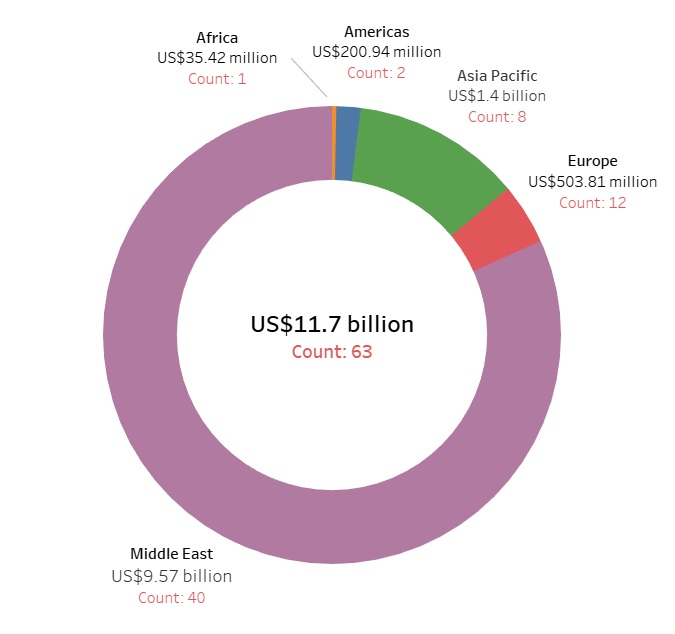

For public real estate funds tracked by the IFN Investor Funds Database, the Middle East had the largest presence of Islamic real estate — accounting for 40 funds, or 63% of the market total. Shariah real estate assets under management (AuM) in the Middle East stands at US$9.57 billion, or 82%, of the global AuM of US$11.7 billion.

Asia Pacific was the second-largest market for Shariah compliant real estate with nearly US$1.4 billion in AuM. Europe, with 6% of the global Islamic population, ranks third with an AuM of almost US$504 million. But the European real estate Shariah market was dynamic by itself, witnessing a 34% AuM growth in the last quarter of 2024 alone — more than any other region.

Chart 1: Geographical breakdown of Islamic real estate funds as of Q4 2024

Table1: Regional growth of Islamic real estate funds as at end Q4 2024*

| Europe | Up by 34.16% from US$375.54 million to US$503.81 million. |

| Middle East | Up by 4.86% from US$9.12 billion to US$9.57 billion. |

| Americas | Up by 2.09% from US$196.82 million to US$200.94 million. |

| Africa | Up by 0.76% from US$35.25 million to US$35.42 million. |

| Asia Pacific | Down by 0.76% from US$1.41 billion to US$1.40 billion. |

Performance

The best performing Islamic real estate fund was Turkiye’s Albaraka Portfoy, which achieved a one-year return of 54% on its Albaraka Portfolio Real Estate Participation Short Term Participation Free (TL) Fund, according to the IFN Investor Funds Database.

Table 2: Top performing Islamic real estate funds as at end 2024

| Fund name | Fund manager | One-year return (%) |

| Albaraka Portfolio Real Estate Participation Short Term Participation Free (TL) Fund | Albaraka Portfoy | 54.02 |

| Allianz Life and Retirement Oks Aggressive Participation Variable Retirement Investment Fund | Allianz Yasam ve Emeklilik | 47.64 |

| Markaz Real Estate Fund | Markaz (Kuwait Financial Center) | 12.77 |

| Rasmala European Real Estate Income Fund | Rasmala Holdings | 10.42 |

| Musharaka REIT Fund | Musharaka Capital | 7.8 |

REIT significance

REITs — or real estate investment trusts — are becoming a key component of Islamic real estate investment portfolios, making up 35 of the 63 public real estate funds tracked by the IFN Investor Funds Database. The focus is on acquiring and leasing real estate, including tenancies and sub-tenancies, where the activities and operations are Shariah compliant.

The manager of the single largest Islamic REIT for 2024 was Malaysia’s Pelaburan Hartanah, with US$1.1 billion in AuM. Malaysia was a pioneer of global Islamic finance, being the first to launch a Shariah compliant REIT in 2006 via a healthcare property-based offering listed on the local stock exchange valued then at US$100 million. The Southeast Asian country was also the first to establish guidelines for Islamic REITs.

The first country in the GCC to launch an Islamic REIT was Kuwait back in 2007, followed by Bahrain and the UAE.

Separately, the S&P Global REIT Shariah Index showed mixed returns over a three-year course, suggesting that Islamic real estate was not immune to the vagaries of other asset classes.

In 2022, the S&P Shariah index tumbled 28.7%, after the global plunge in stocks, before an uptick of 15.4% in 2023 and a slide of 2.6% in 2024 — again directionally following equities. Since the start of 2025, it is down 3%.

Table 3: Top five largest Islamic REITs

| Fund name | Fund manager | AuM (US$ million) |

| Amanah Hartanah Bumiputera | Pelaburan Hartanah | 1,129 |

| Al Rajhi REIT Fund | Al Rajhi Capital | 837.45 |

| Jadwa REIT Saudi fund | Jadwa Investment | 748.06 |

| Jadwa REITs Fund | Jadwa Investment | 712.74 |

| Emirates REIT | Equitativa Group | 648.1 |

Outlook

As infrastructure development intensifies in most GCC countries as they diversify from oil and gas, the opportunities for Shariah compliant structuring and investments are looking optimistic. Saudi Arabia, Bahrain and Qatar have a five-year deadline to transform their economies under respective Vision 2030 plans. Kuwait, meanwhile, has a 2035 target, to become a sustainably diversified economy while the UAE has set a 2031 goal and Oman in 2040.

In Europe, the push for development is at its zenith as the bloc turns toward self-reliance amid rupturing alliances with the US. Across the Asia Pacific, the post-pandemic recovery is chugging along, led by its main driver, China.

Despite rising volatility, driven primarily by the policies of the Trump administration in the US, analysts are cautiously bullish that the global real estate market is on track for a rebound in 2025. Diversification will continue to be the theme for Islamic investors who will remain focused on asset quality and income growth as they explore assets in industrial and living sectors.