Key Highlights

- Islamic funds in Saudi Arabia account for 28.48% of Islamic investment funds globally by AuM.

- 282 Islamic funds registered in Saudi Arabia, with 46% primarily focused on equity.

- Three fund launches in Q2 2024 with a combined AuM of US$237 million.

Overview

As the birthplace of Islam, Saudi Arabia embraces an economic system grounded in Shariah law – which promotes risk-sharing, ethical investments and asset-backed financing. The evolution of Islamic finance in Saudi Arabia, especially in recent years, has been influenced by efforts to diversify the Kingdom’s economy beyond oil-based revenues to leverage on its rich cultural heritage and its strategic goals of becoming a global financial hub.

The Saudi Central Bank (SAMA) reported that Islamic banks and windows offering Shariah compliant products recorded a growth of 10.5% year-on-year to about SAR2,245 billion (US$598.66 billion) as of Q1 2024.

Saudi Arabia stands as the second largest Sukuk issuers globally after Malaysia. According to a report by Fitch Ratings, Saudi Arabian outstanding Sukuk totalled US$50 billion, 97.3% of which was investment-grade, and all Sukuk issuers had a stable outlook, as of Q4 2023.

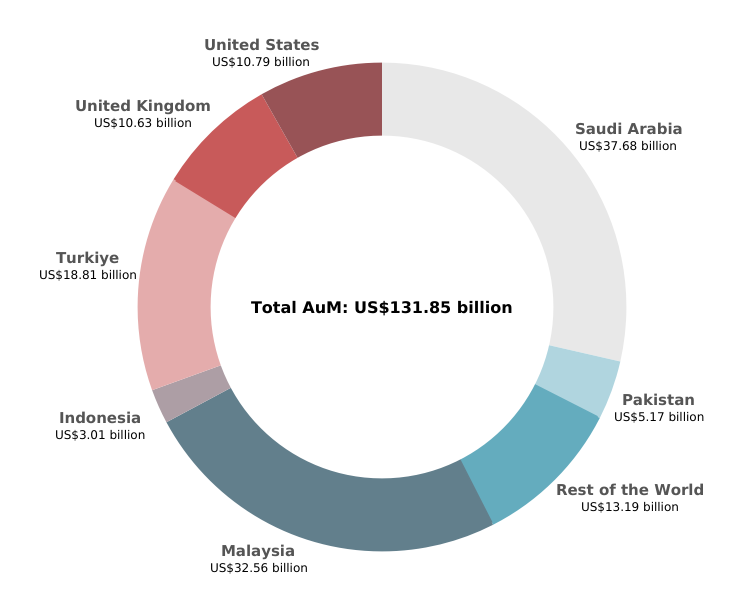

Due to multinational restrictions imposed on Iran, Shariah compliant investment funds in Saudi Arabia account for 28.48% of Islamic investment funds globally as of the 30th June 2024. The number of Islamic funds in Saudi Arabia stands at 282 with investments in the money market, fixed income instruments, Sukuk, equities, real estate and mixed assets.

Chart 1: Shariah compliant funds in total AuM by country

Regulatory framework

In Saudi Arabia, financial regulation is overseen by two principal authorities: SAMA and the Capital Market Authority (CMA). SAMA manages banks, insurance companies, payment service providers and finance companies, while the CMA regulates the securities and capital markets. Both agencies are actively refining regulations to foster an environment that boosts investor confidence, encourages prudent risk management while stimulating economic growth and innovation.

Although the Kingdom lacks a centralized Shariah board, SAMA since 2020 has implemented a series of measures to enhance Shariah governance and transparency including mandating Islamic banks to include disclosures related to profit-sharing investment accounts in their financial statements since the end of 2023.

The CMA’s 2024-2026 roadmap envisions more investments from private institutions and individuals via the issuance of Sukuk and alternate private financing for national initiative projects. It further aims to increase the percentage of international investor ownership in Sukuk, debt instruments and investment funds within Saudi Arabia.

Capital market

The CMA reported significant advancements in the Islamic capital market over the past year – including the implementation of a comprehensive Debt Market Development Strategy and the removal of the authority’s trading commission on Sukuk and bonds to stimulate secondary market activities and enhancing overall liquidity.

According to the CMA’s Q2 2024 Quarterly Statistical Bulletin, there has been notable growth in the sector. The number of companies rose from 231 to 238 within the first half of the year. Concurrently, the Nomu – a parallel equity market known for its lighter listing requirements – has seen an impressive surge in the number of listed companies, rising by 16.46% to reach a total of 92 by the 30th June 2024 compared to 79 as at the end of Q4 2023.

Foreign investment in the main market has reached SAR402.4 billion (US$107.32 billion) in H1 2024, a 7.07% increase from H1 2023. This figure represents a remarkable 5.6-fold rise since the direct opening of the Saudi capital market to foreign investors in 2015.

Asset management

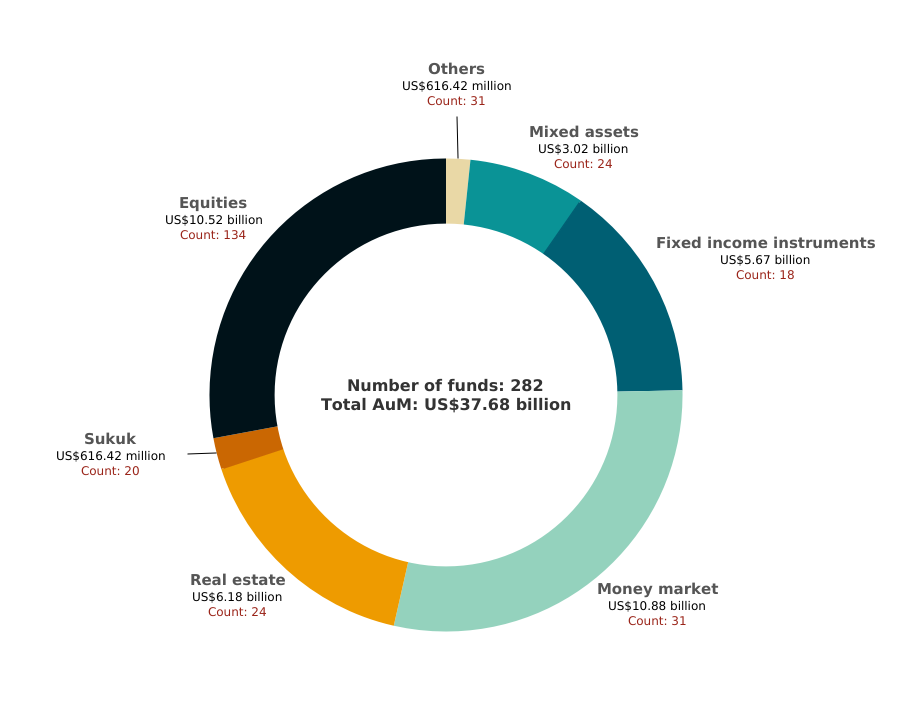

The IFN Investor Funds Database reports a total of 282 Islamic funds registered in Saudi Arabia. Among these, approximately 46% focus predominantly on equity, totalling 134 funds with assets under management (AuM) of US$10.52 billion.

While equities represent the largest number of funds, money market funds lead in terms of AuM value – handling a higher total of US$10.88 billion across 31 funds. Real estate and mixed asset funds each account for 24 funds, with AuM totals of US$6.18 billion and US$3.02 billion respectively. Fixed income instruments comprise 18 funds, collectively managing US$5.67 billion in AuM. Lastly, Sukuk funds total 20, with total AuM amounting to US$616.42 million.

Chart 2: Islamic fund breakdown by asset class in Saudi Arabia

As of the 30th June 2024, the leading fund in Saudi Arabia – based on its six-month return – is the Derayah Freestyle Saudi Equity Fund, achieving a 32.47% yield. Following closely is the Derayah GCC Growth and Income Equity Fund, recording a return of 25.13%. Together, these funds manage a combined AuM of US$431.43 million. The Yaqeen Saudi Equity Fund followed with a return of 21.16%, managing US$49.64 million in AuM.

Table 1: Top performing Islamic funds in Saudi Arabia by six-month returns

| Fund | Fund manager | Six-month returns (%) |

| Derayah Freestyle Saudi Equity Fund | Derayah Financial | 32.47 |

| Derayah GCC Growth and Income Equity Fund | Derayah Financial | 25.13 |

| Yaqeen Saudi Equity Fund | Yaqeen Capital | 21.16 |

| Yaqeen Gold Fund | Yaqeen Capital | 12.57 |

| SNB Capital North America Index Fund | SNB Capital | 12.04 |

The IFN Investor Funds Database tracked three fund launches in the second quarter of 2024. Alkhabeer Capital introduced the Alkhabeer Income Fund 2030 on the 28th April 2024, raising SAR305.45 million (US$81.37 million). SEDCO Capital followed on the 19th May 2024, with the launch of the Multi Asset Traded Fund, starting with SAR300 million (US$79.92 million) in capital. The latest addition to the Saudi Arabian market is the Derayah Money Market Fund by Derayah Financial, launched on the 26th June 2024, with SAR287.62 million (US$76.62 million) in initial funding.

Outlook

Saudi Arabian’s Islamic finance is flourishing due to the dominant Muslim population and a further shift toward Shariah compliant products along with government initiatives such as Sukuk debt issuance programs. SAMA strives to support the Saudi Vision 2030 and its associated initiatives, such as the Financial Sector Development Program.

The CMA sees Sukuk and the debt instruments market as a critical way of diversifying sources of financing while providing additional investment options, especially in relation to major national projects. Further, the CMA anticipates the listing of companies and assets owned by the government – to better reflect the true size of the contribution of these companies to the Kingdom’s economy.

Among key initiatives in progress would be the CMA allowing foreign funds to be distributed directly in the Kingdom while also reducing ownership restrictions to attract international investors to invest in the Saudi financial market.