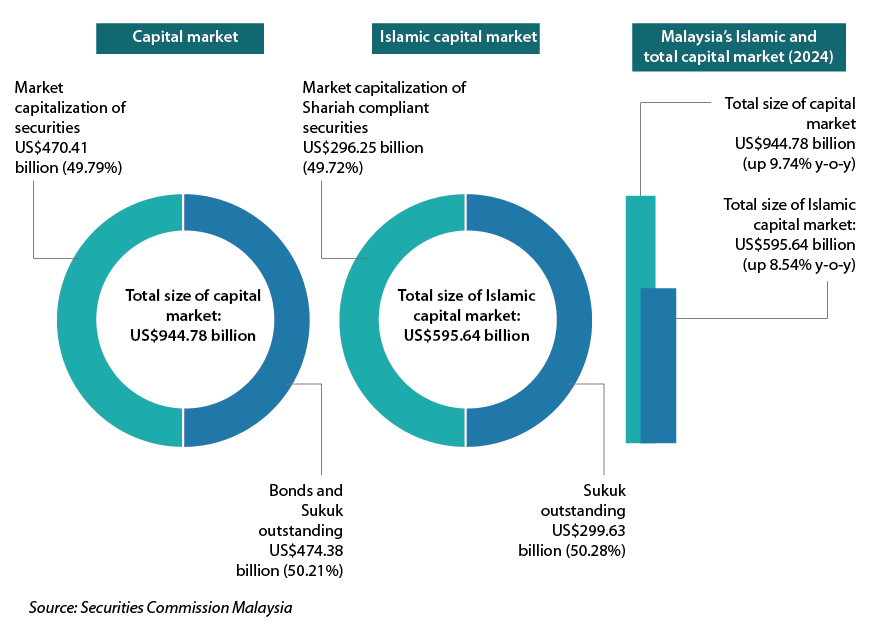

Malaysia’s public Islamic capital size rose 8.5% year-on-year (y-o-y) to stand at 63.04% of the overall RM4.12 trillion (US$945.84 billion) capital market at the end of 2024, the Securities Commission Malaysia (SC) said in its latest annual report.

Rising to RM2.63 trillion (US$595.64 billion), from RM2.43 trillion (US$548.76 billion) in 2023, the Islamic capital market is split almost evenly with total RM1.31 trillion (US$296.25 billion) capitalization of Shariah compliant securities and RM1.32 trillion (US$299.63 billion) in outstanding Sukuk.

Chart 1: Malaysia’s Islamic capital compared to total market size at end 2024

As of end 2024, the market capitalization of Shariah compliant securities rose 11.71% from 2023 while the number of Shariah compliant securities increased from 811 to 822 – but the ratio fell to 79.11% of the total 1,039 listed securities on Bursa Malaysia, compared to 81.51% of 995 counters in 2023.

The SC said total Islamic assets under management (AuM) rose 8.82% y-o-y to RM246.09 billion (US$55.75 billion) – handled by 62 fund managers, with 24 being full-fledged Islamic and 38 with Islamic windows as at December 2024.

The Islamic fund management AuM was 23.02% of Malaysia’s RM1.07 trillion (US$242 billion) total fund size, a ratio that was similar at the end of 2023 compared to the overall AuM of RM975.48 billion (US$220.76 billion).

Total number of Islamic collective investment schemes stood at 422 as of December 2024 – covering unit trust funds, wealth funds, private retirement schemes (PRS), real estate investment trusts (REITs) and exchange traded funds (ETFs). This figure includes 30 Islamic socially responsible investing (SRI) funds.

Table 1: Malaysia’s Islamic collective investment schemes

| Type | Total (2023) | Total (2024) | Value (RM billion) | Value (US$ billion) |

| Unit trust funds | 291 | 299 | 122.22 (NAV) | 27.67 |

| Real estate investment trusts | 5 | 5 | 20.29 (Market cap) | 4.59 |

| Wealth funds | 76 | 74 | 15.8 (NAV) | 3.58 |

| Private retirement schemes | 37 | 37 | 2.55 (NAV) | 0.58 |

| Exchange traded funds | 6 | 7 | 0.5 (Market cap) | 0.11 |

| Total | 415 | 422 | 161.36 | 36.54 |

Source: Securities Commission Malaysia

On a y-o-y comparison, the various collective investment scheme ratios were little changed.

Islamic unit trust funds AuM in 2024 constituted 22.38% of the Malaysia’s RM546.08 billion (US$123.55 billion) industry net asset value (NAV) total, REITS at 41.47% of the overall RM48.93 billion (US$11.07 billion) market capitalization.

Islamic wealth funds made up 19.13% of this sector’s RM82.6 billion (US$18.68 billion) NAV, the PRS share was 33.44% of the RM7.61 (US$1.72 billion) total NAV and ETFs constituted 21.19% of the overall RM2.36 billion (US$53.4 million) market capitalization.

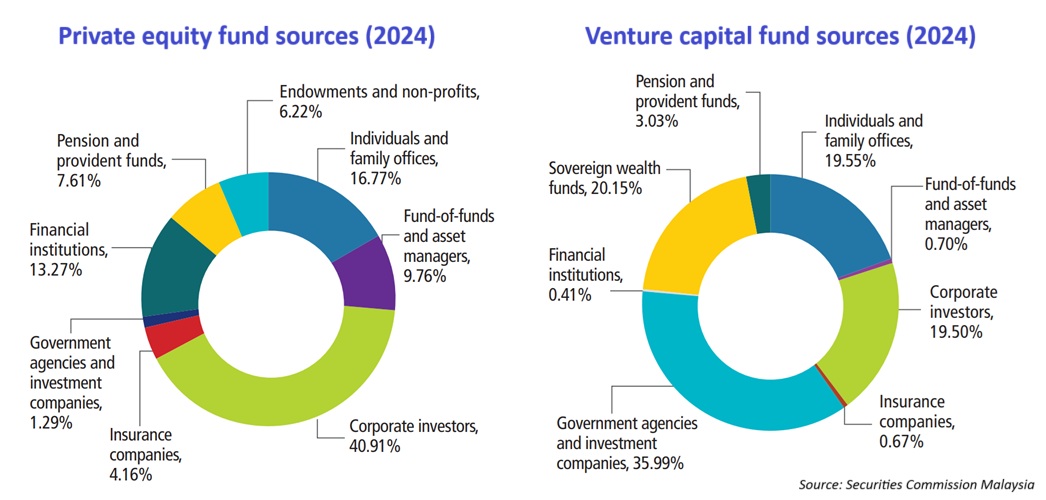

Chart 2: Malaysia’s private equity and venture capital 2024 industry snapshot

Without providing a Shariah split, the SC said private equity fund commitments rose to RM18 billion (US$4.07 billion) in 2024, up from RM11 billion (US$2.49 billion) y-o-y – with commitments sourced from corporate investors (40.91%), individuals and family offices (16.77%) and financial institutions (13.27%).

The overall venture capital sector stood at RM6.7 billion (US$1.51 billion) in 2024, a slight rise from RM6.58 billion (US$1.49 billion) y-o-y – government agencies and investment companies (35.99%), sovereign wealth funds (20.15%) and individuals and family offices (19.55%) made up the top three funding sources.

Reporting a decline of equity crowdfunding campaigns in 2024 to 35 (2023: 51), with a 23% decrease in funds raised of RM97.57 million (US$22.05 million), the SC said Shariah compliant campaigns contributed a mere 4% of the total RM776.15 million (US$175.43 million) across 404 campaigns so far.

P2P financing rose 20% y-o-y in 2024 to RM2.51 billion (US$56.73 million) and Shariah compliant funds made up 20% of the total RM8.49 billion (US$1.92 billion) raised via 120,370 campaigns so far.

Moving forward, SC Executive Chairman Datuk Mohammad Faiz Azmi said a collaboration with Malaysia’s sovereign fund Khazanah Nasional is in the works to introduce later this tokenization of bonds and Sukuk to foster more retail participation in Malaysia’s capital market – subject to regulatory considerations, particularly from Bank Negara Malaysia.