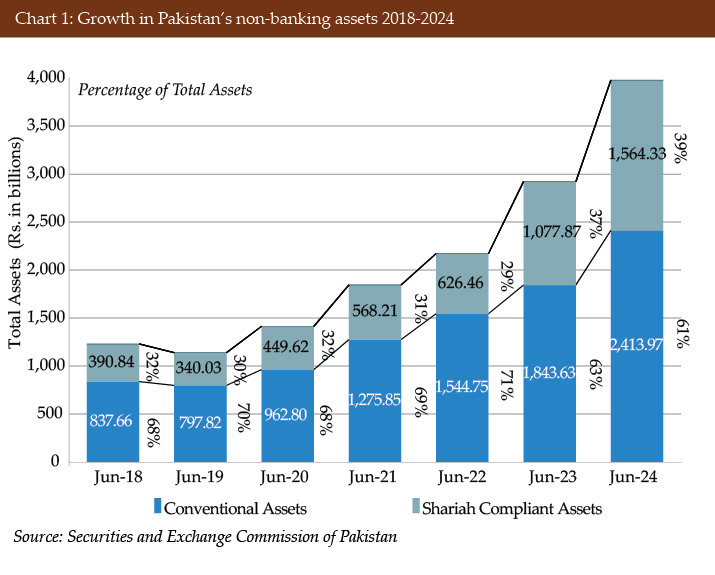

The Securities and Exchange Commission of Pakistan (SECP) has seen the total assets of Shariah compliant funds growing faster than the conventional counterparts, as illustrated in the ‘NBFIs Sector Summary Report June 2024’.

For the PKR1.23 trillion (US$4.41 billion) total non-bank financial assets as at the end of June 2018, the conventional portion (61.2%) was almost double that of the Shariah compliant segment (31.8%). Over six years, the difference between conventional (60.7%) and Shariah compliant segments (39.3%) had narrowed as total assets rose to PKR3.98 trillion (US$14.28 billion) as at the end of June 2024.

Over this six-year period, the compounded annual growth rate (CAGR) for conventional assets was 19.3% and higher at 26% for Shariah compliant assets – which encompass Islamic mutual funds, pension funds, real estate investment trust (REIT) schemes and Mudarabah contracts.

Throughout these six years, the SECP said mutual funds made up the bulk of total assets – rising from a combined PKR678.86 billion (US$2.44 billion) as at June 2018 to PKR2.71 trillion (US$9.72 billion) as at June 2024.

While the conventional fund portion (59.7%) led Shariah compliant assets total (40.3%) as at June 2018, the split was almost equal between conventional (51.6%) and Shariah compliant (48.4%) by June 2024 – as the latter’s CAGR of 29.8% outpaced the conventional funds showing of 22.9%.

The ratio was opposite for pension funds with the Shariah compliant segment (63.5%) almost double that of conventional (36.5%) of the PKR26.83 billion (US$96.32 million) asset total as at June 2018. The split between Shariah compliant funds total (64.6%) and conventional portion (35.4%) stayed when total assets grew to PKR76.11 billion (US$273.23 million) as at June 2024.

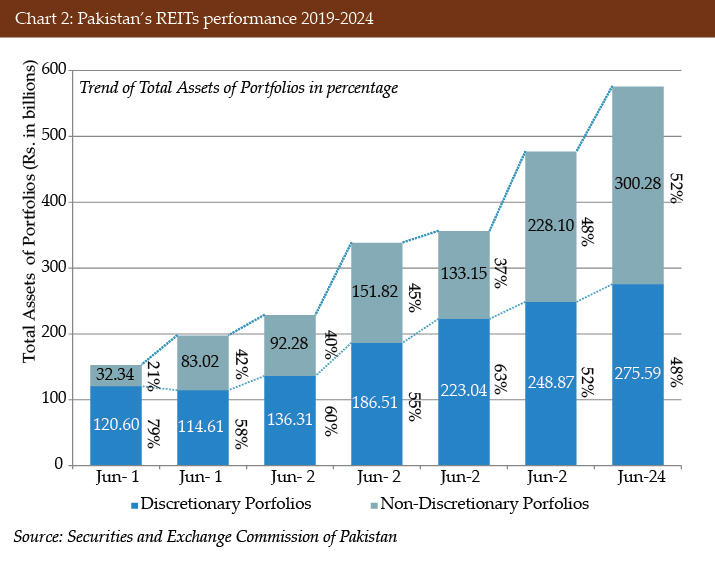

REITS valuations grew steadily in value from June 2019, but there was a spike ahead of SECP issuing its inaugural Shariah compliance certificates in August 2023 to Signature Residency REIT and Rahat Residency REIT, before moderating.

Total valuations of Mudarabah contracts tracked by SECP stayed quite steady, from PKR52.94 billion (US$190.1 million) in June 2018 to PKR49.57 billion (US$177.9 million) as at June 2024.