The SEDCO Capital Global Monthly Distributions Fund aims to tap into multiple Shariah compliant asset classes while receiving regular monthly returns, with a minimum 20% invested in international markets outside Saudi Arabia.

“Asset allocation decisions between different regions and asset classes will reviewed periodically by our portfolio management team with tactical asset allocation expertise,” Bassam Almutairi, the senior vice-president and head of multi-assets and investment solutions at SEDCO Capital, shared with IFN Investor.

Its investments encompass local and international Islamic real estate investment traded funds (REITs), equities including on main and parallel markets in Saudi Arabia, capital markets in GCC countries, IPOs, index funds and Sukuk.

“The fund is designed to be a diversified fund between different asset classes, sectors and regions. We chose a composite benchmark that reflects the fund’s intended diversified strategy,” said Bassam. The benchmark will be calculated internally as the fund manager will not appoint an index provider.

SEDCO Capital Global Monthly Distributions Fund will track three different indices with weightage on Dow Jones Islamic World Total Return Index (DJIMT) at 30%, Dow Jones Sukuk Total Return Index (excluding reinvestment) (DJSUKTXR) at 35% and one-month Saudi Arabian Interbank Bid Rate, or SAIBID, at 35%.

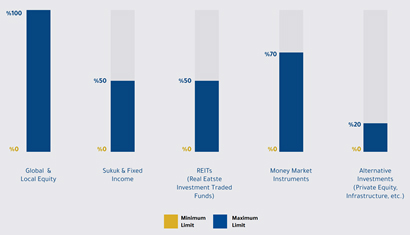

While all of the fund’s asset allocation can be in global and local equities, leeway is given for Sukuk, fixed income and REITs to account for maximum 50% of investments. Money market instruments will be capped at 70% and alternative investments limited to 20%.

Classified as high risk, this fund can invest in multiple jurisdictions in developed and emerging markets such as the US, China, Europe, Japan and the GCC region.

With the initial public offer from the 13th April 2025 and continuing for 20 business days, this open-ended, multi-asset public investment fund will distribute 100% of income and realized capital gains from investments.

The fund’s initial investment will be SAR100 (US$26.67) with subsequent subscriptions at SAR10 (US$2.67). The unit price is set at SAR10.

“As a public fund regulated by the Saudi Capital Market Authority, there are no major restrictions applicable on residents or foreign investors that might prevent them from investing in this fund.”

Chart 1: Fund asset allocation limits

Source:Saudi Economic and Development Securities Company (SEDCO Capital)

*Disclaimer: The opinions and viewpoints expressed in the Fund Profile do not constitute as a recommendation for any funds highlighted. The information presented is not investment advice and should not be treated as such.

| SEDCO Capital Global Monthly Distributions Fund | |

| Fund manager | Saudi Economic and Development Securities Company (SEDCO Capital) |

| Launch date | 13th April 2025 |

| Asset class | Open-ended multi-asset public investment fund |

| Base currency | SAR |

| Initial investment | SAR100 (US$26.67) with additional subscription of SAR10 (US$2.67) |

| Unit price | SAR10 (US$2.67) unit par value |

| Investment objective | The fund aims to distribute regular monthly returns to unitholders by investing in multiple Shariah compliant asset classes |

| Benchmark | 30% Dow Jones Islamic World Total Return Index (DJIMT) 35% Dow Jones Sukuk Total Return Index (excluding reinvestment) (DJSUKTXR) 35% One-month SAIBID |

| Risk profile | High |

| Management fee | 10% of the distribution value |

| Distribution | 100% of the income and realized capital gains from investments |